Toyota (TSE:7203) Valuation Check After New U.S. Battery Plant and Hybrid Expansion Plans

Toyota Motor (TSE:7203) has pushed to fresh 52 week highs after doubling down on U.S. manufacturing, from a new battery plant in North Carolina to a major expansion in hybrid production that reflects cooling pure EV enthusiasm.

See our latest analysis for Toyota Motor.

The latest U.S. battery and hybrid investments have come on top of an already strong run, with the share price up double digits over the past year and multi year total shareholder returns suggesting momentum is still building rather than fading.

If Toyota’s hybrid momentum has you watching autos more closely, this could be a good moment to explore other auto manufacturers that the market might be re rating next.

With the share price near record highs, modest revenue growth, and only a small gap to analyst targets, investors now face a key question: is Toyota still undervalued, or is future growth already fully priced in?

Most Popular Narrative Narrative: 2% Undervalued

With Toyota closing at ¥3,349 against a narrative fair value near ¥3,416, the gap is narrow but leans in favor of further upside.

The analysts have a consensus price target of ¥2995.639 for Toyota Motor based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥3400.0, and the most bearish reporting a price target of just ¥2400.0.

Want to see what justifies a higher fair value than the consensus target? This narrative leans on resilient margins, steady top line growth and a richer future earnings multiple. Curious how those moving parts fit together, and which assumptions really drive the valuation? Dive in to see the full story behind the numbers.

Result: Fair Value of ¥3,416 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside depends on Toyota avoiding major production disruptions and managing intense price competition in key markets such as China and North America.

Find out about the key risks to this Toyota Motor narrative.

Another Angle on Value

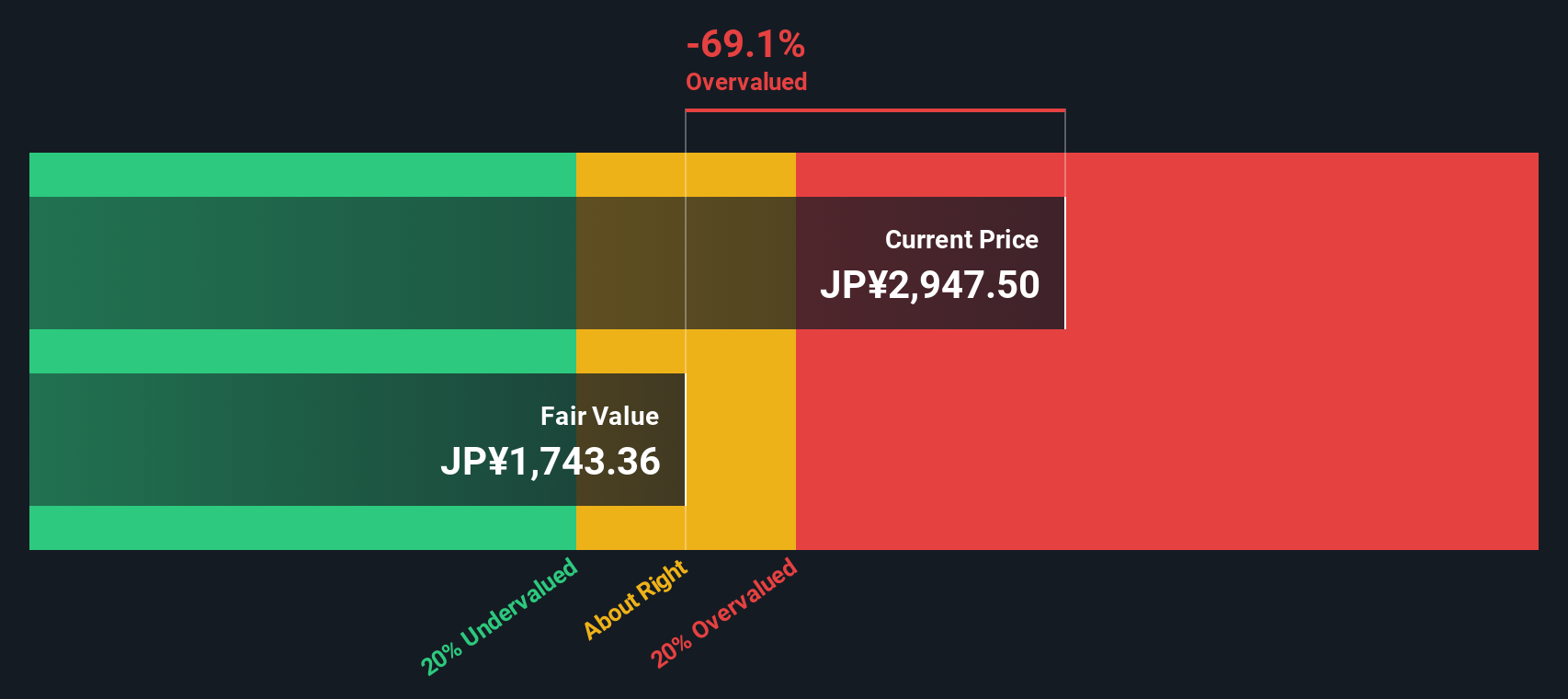

Our SWS DCF model paints a very different picture. On this view, Toyota’s shares trade well above an estimated fair value near ¥1,703, which implies the stock is overvalued despite strong narratives and solid execution. If the cash flows disappoint, how much downside would you accept?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Toyota Motor for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 909 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Toyota Motor Narrative

If you see things differently, or simply prefer to test the assumptions yourself, you can build a complete narrative in under three minutes: Do it your way.

A great starting point for your Toyota Motor research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Toyota has sharpened your appetite for smarter opportunities, do not stop here. Use the Simply Wall St Screener to explore more potential ideas.

- Explore potential high risk, high reward opportunities by assessing these 3636 penny stocks with strong financials that still show solid underlying business momentum.

- Focus on these 26 AI penny stocks that are involved in intelligent software and automation.

- Review these 13 dividend stocks with yields > 3% that may offer income potential through dividend payments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com