Is It Too Late to Consider Pan American Silver After Its 120% Surge in 2025?

- Wondering if Pan American Silver is still worth buying after its big run, or if you have missed the boat? This breakdown will help you make sense of the current price versus underlying value.

- The stock has surged, up 1.0% over the last week, 25.4% over the past month, and 120.0% year to date, with a 118.8% gain over the last year and 217.2% over three years reshaping how the market sees its potential and risk.

- Much of this momentum has been driven by stronger silver prices and renewed investor interest in precious metals as a hedge, especially with ongoing macro uncertainty and shifting interest rate expectations. At the same time, Pan American Silver has been in the spotlight for portfolio optimization moves and asset integration following recent sector consolidation, which together have sharpened the market narrative around its growth profile and operating leverage.

- Right now, Pan American Silver scores a 4/6 on our valuation checks, suggesting the market may not fully be pricing in its fundamentals, but headline multiples never tell the whole story. Next we will walk through DCF, multiples, and asset based perspectives to see how they stack up, then finish with an even more practical way to think about valuation that long term investors can actually use.

Approach 1: Pan American Silver Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting the cash it can generate in the future, then discounting those cash flows back to today to account for risk and the time value of money.

For Pan American Silver, the latest twelve month Free Cash Flow is about $644 Million, and analysts expect this to rise meaningfully over the coming years. Projections used in the 2 Stage Free Cash Flow to Equity model climb into the mid one to two billion dollar range over the next decade, with 2028 Free Cash Flow estimated at roughly $1.86 Billion. Analyst forecasts underpin the first several years, while later years are extrapolated by Simply Wall St based on those trends.

When these future cash flows are discounted back, the model arrives at an intrinsic value of about $105.83 per share, which implies the stock is trading at roughly a 36.0% discount to its estimated fair value. That indicates investors are not fully paying for the cash flow Pan American Silver is expected to generate.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Pan American Silver is undervalued by 36.0%. Track this in your watchlist or portfolio, or discover 909 more undervalued stocks based on cash flows.

Approach 2: Pan American Silver Price vs Earnings

For profitable companies like Pan American Silver, the price to earnings (PE) ratio is a useful way to gauge how much investors are willing to pay today for each dollar of current earnings. A higher PE can be justified when the market expects strong, relatively predictable earnings growth, whereas slower or riskier growth usually warrants a lower, more conservative multiple.

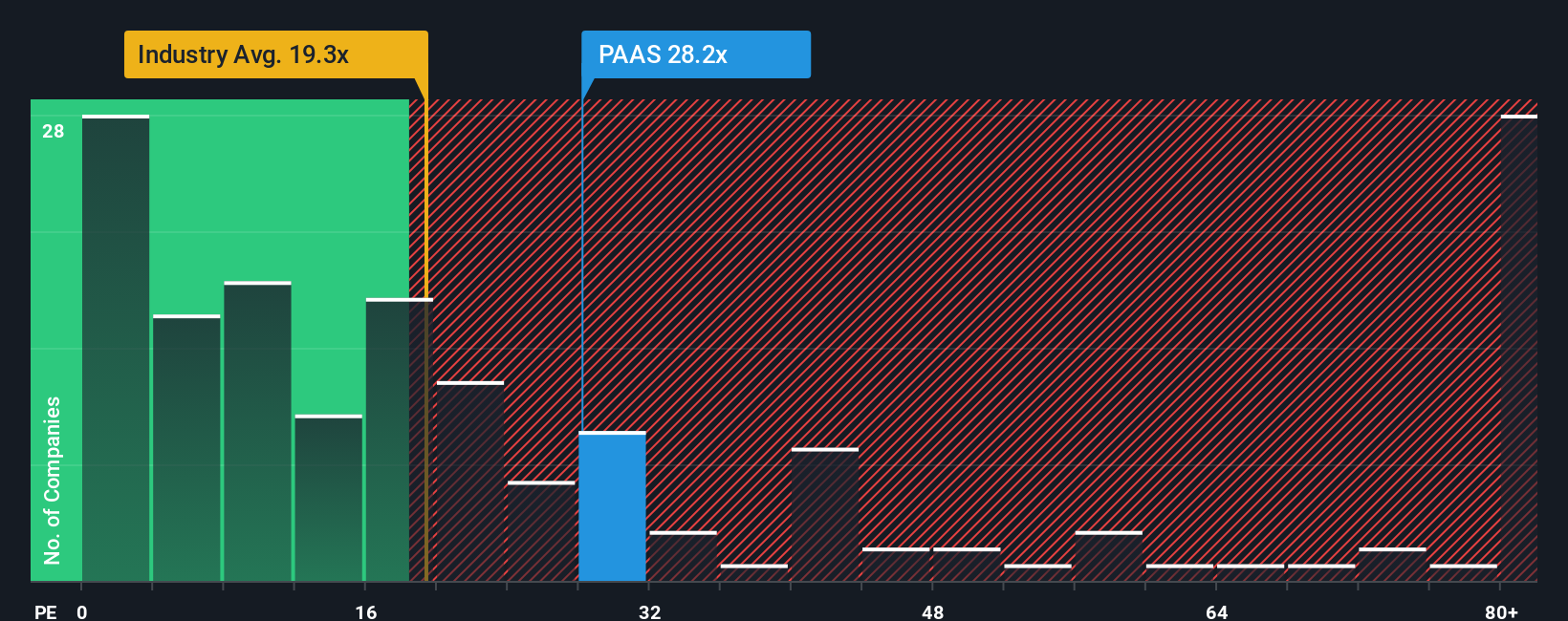

Pan American Silver currently trades on a PE of about 32.8x, which is higher than the broader Metals and Mining industry average of roughly 21.2x, but well below the peer group average of around 63.1x. To move beyond simple comparisons, Simply Wall St calculates a Fair Ratio of 33.9x, which is the PE you might expect given the company’s specific mix of earnings growth prospects, industry dynamics, profit margins, market cap and risk profile. This tailored Fair Ratio is more informative than a basic industry or peer average because it explicitly factors in Pan American Silver’s own fundamentals rather than assuming it should be valued like every other miner.

With the current PE of 32.8x sitting slightly below the Fair Ratio of 33.9x, the stock screens as modestly undervalued on this earnings based view.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1463 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Pan American Silver Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of a company’s story with the numbers behind its future. A Narrative is your own investment storyline for Pan American Silver, where you spell out how you think its production profile, silver prices, costs and strategy will shape future revenue, earnings and margins, and then link that forecast to an estimated fair value. On Simply Wall St’s Community page, used by millions of investors, Narratives are an easy, guided tool that lets you adjust a few key assumptions to create a complete forecast and fair value in minutes. Once you have a Narrative, you can quickly see whether your fair value estimate is above or below today’s share price, helping you assess whether Pan American Silver may be more or less attractive at its current price. Narratives also update dynamically when new information such as quarterly results, guidance changes or major news is released, so your story and numbers stay current. For example, some Pan American Silver Narratives use assumptions that result in a relatively high fair value, while others are much more cautious and embed lower silver prices and profitability.

Do you think there's more to the story for Pan American Silver? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com