Ain Holdings (TSE:9627) Revenue Surge Reinforces Bullish Growth Narrative Despite Thin Margins

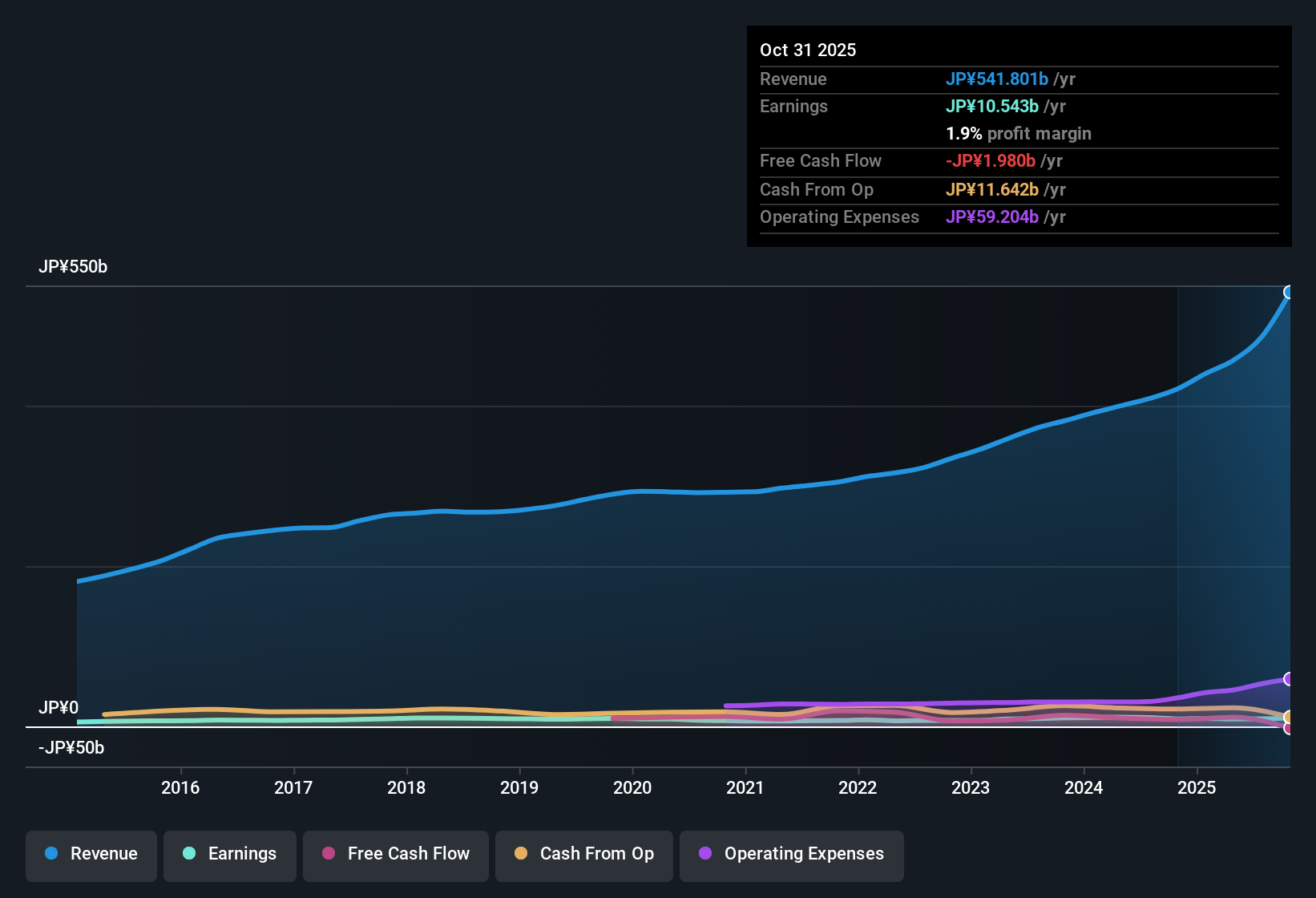

Ain Holdings (TSE:9627) has just posted another set of busy quarter numbers, with Q2 2026 revenue at ¥166.9 billion and basic EPS of ¥73.02, setting the tone for how investors digest the latest move in profitability. The company has seen quarterly revenue climb from ¥111.3 billion in Q2 2025 to ¥166.9 billion in Q2 2026, while basic EPS moved from ¥44.82 to ¥73.02 over the same stretch. On a trailing 12 month view, EPS sits at ¥300.55 on revenue of ¥541.8 billion, leaving investors to weigh the growth in scale against still modest, thin margins.

See our full analysis for Ain Holdings.With the headline results on the table, the next step is to line these numbers up against the prevailing narratives around Ain Holdings to see which stories hold up and which need a rethink.

Curious how numbers become stories that shape markets? Explore Community Narratives

TTM earnings up 12.7 percent but margins stay thin

- Over the last 12 months, net income excluding extra items reached ¥10.5 billion on ¥541.8 billion of revenue, giving a 1.9 percent net margin compared with 2.2 percent a year earlier.

- What stands out for bullish investors is that earnings grew 12.7 percent over the year and have compounded at about 9.6 percent annually over five years. However, this growth is happening on very slim margins that slipped from 2.2 percent to 1.9 percent, which means any cost or pricing pressure can have an outsized impact on profit even while revenue and EPS are moving higher.

- The latest Q2 2026 net income of ¥2.6 billion on ¥166.9 billion of revenue fits this pattern of scale improving faster than margin quality.

- On a trailing basis, ¥10.5 billion of net income on ¥541.8 billion of revenue shows the business is growing but still operating with limited profitability headroom.

Growth forecasts outpace the wider JP market

- Forward looking estimates point to revenue growing around 10.3 percent per year and earnings about 16.4 percent per year, compared with an expected 4.6 percent annual revenue growth rate for the broader JP market.

- Supporters of the bullish view argue that this combination of 12.7 percent trailing earnings growth and double digit forecast growth in both sales and profit signals durable momentum. Yet when set against the current 1.9 percent net margin and the recent drift down from 2.2 percent, the data also highlights that faster growth is being built on a fairly low quality margin base that will need to improve if those forecasts are to translate into stronger bottom line resilience.

- Q2 2026 revenue of ¥166.9 billion, up from ¥111.3 billion in Q2 2025, shows the kind of scale that can support the growth story if operating discipline keeps pace.

- Trailing 12 month EPS of ¥300.55 versus ¥73.02 in the latest quarter underscores that the longer term trend is stronger than any single period and is what those growth forecasts are really anchored to.

P E and DCF paint a mixed value picture

- The trailing P E multiple sits at 21.2 times, above the JP consumer retailing industry average of 13.2 times but below the peer average of 23.8 times, while a DCF fair value of ¥15,036.75 per share is far above the current ¥6,358 share price.

- Critics focus on the bearish side of the story, pointing to the drop in net margin from 2.2 percent to 1.9 percent and the indication that debt is not well covered by operating cash flow. When these are set against a 21.2 times P E multiple that is richer than the wider industry, the valuation looks more demanding unless investors put real weight on that large gap between the share price and the DCF fair value estimate.

- The roughly 57.7 percent discount to the DCF fair value suggests meaningful upside on a cash flow basis but does not address the cash generation strain highlighted in the risk flags.

- With ¥10.5 billion of trailing net income on ¥541.8 billion of revenue, the company is profitable, yet the combination of slim margins and weak debt coverage is exactly what bears use to question how much of that DCF implied upside can actually be realised.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Ain Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Ain Holdings is growing earnings but still runs on very slim, deteriorating margins, with debt not well covered by operating cash flow, raising resilience concerns.

If thin margins and fragile debt coverage make you uneasy, use our solid balance sheet and fundamentals stocks screener (1942 results) today to focus on businesses built on sturdier finances and healthier safety buffers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com