Reassessing American Electric Power (AEP) Valuation After Its Recent Share Price Pullback

American Electric Power Company (AEP) has been drifting lower over the past month even as its year to date return stays comfortably positive, a setup that often makes utilities investors recheck the fundamentals.

See our latest analysis for American Electric Power Company.

That recent 5.55% one month share price pullback to about $114.57 looks more like a pause within a strong year to date share price return of 24.61%, backed by a nearly 29% one year total shareholder return that suggests momentum is still broadly constructive rather than fading.

If AEP’s steady climb has you rethinking how you balance stability and growth, this could be a good moment to explore healthcare stocks as another pocket of resilient opportunities.

With earnings still growing and shares trading about 12% below the average analyst target but slightly above some intrinsic estimates, investors face a familiar dilemma: is AEP a defensive choice today, or has the market already reflected its future growth potential in the current price?

Most Popular Narrative: 10.9% Undervalued

With American Electric Power Company's fair value in the high $120s versus a recent close around $114, the dominant narrative sees meaningful upside still on the table.

The company has a substantial capital investment plan of $54 billion over the next 5 years, with an additional potential of $10 billion, primarily aimed at expanding transmission and distribution, indicating future growth in earnings.

Want to see how that massive spend translates into future profits? The narrative quietly leans on ambitious growth, steady margins, and a richer earnings multiple. Curious which assumptions really drive that fair value jump?

Result: Fair Value of $128.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution risk around AEP’s massive capex plan and shifting state level regulation could quickly challenge those upbeat growth and valuation assumptions.

Find out about the key risks to this American Electric Power Company narrative.

Another Angle on Value

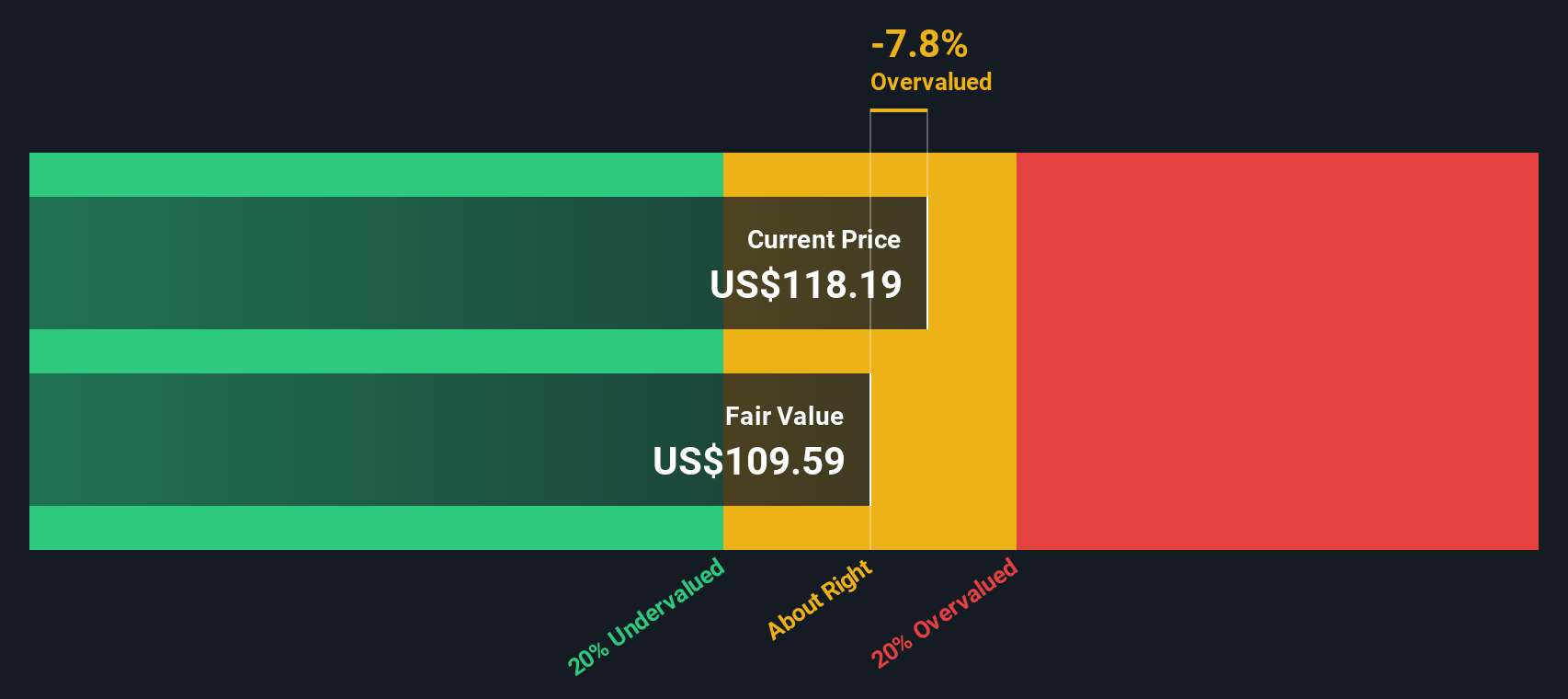

Our SWS DCF model paints a cooler picture than the upbeat fair value narrative, putting AEP’s worth closer to $105.33, below the current $114.57 share price and implying the stock may actually be overvalued instead of cheap. Which story do you trust when the numbers disagree?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out American Electric Power Company for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 909 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own American Electric Power Company Narrative

If you see things differently or would rather dig into the numbers yourself, you can shape a fresh perspective in just minutes: Do it your way.

A great starting point for your American Electric Power Company research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, consider your next move by scanning fresh opportunities on the Simply Wall St Screener, where data backed ideas are updated constantly.

- Look for potential market mispricing by targeting companies trading below their estimated cash flow value through these 909 undervalued stocks based on cash flows before sentiment changes.

- Explore innovation in automation, data analytics, and next generation platforms by focusing on these 26 AI penny stocks that may reshape entire industries.

- Support your portfolio income stream with consistently paying businesses by zeroing in on these 13 dividend stocks with yields > 3% offering yields above 3% and solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com