Truist Financial (TFC): Assessing Valuation After Its Recent Share Price Momentum

Truist Financial (TFC) has been quietly grinding higher, with the stock up around 11% over the past month and 16% over the past year, as investors reassess big regional banks.

See our latest analysis for Truist Financial.

That steady climb in Truist’s share price, capped by a 10.81% 1 month share price return and a 15.59% 1 year total shareholder return, suggests momentum is quietly building as investors warm to its improving earnings profile and perceived risk.

If this kind of renewed confidence in financials has your attention, it could be a good moment to explore fast growing stocks with high insider ownership for other under the radar opportunities.

But with the stock already near analyst targets and trading at a modest intrinsic discount, is Truist still flying under the radar as a value play, or are markets already pricing in its next leg of growth?

Most Popular Narrative: 2.3% Undervalued

With Truist Financial last closing at $49.71 against a narrative fair value near $50.88, the spread is slim but still points to incremental upside.

They note that the updated fair value framework incorporates improving profitability assumptions, suggesting that execution on cost controls and balance sheet optimization is beginning to filter through to valuation metrics.

Want to see what powers that small valuation edge, and how revenue growth, margin gains and future earnings all intersect in one tight forecast? Dive in to unpack the numbers behind this call.

Result: Fair Value of $50.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sizable branch investments and above average commercial real estate exposure could pressure margins and credit quality, challenging the optimistic earnings and valuation narrative.

Find out about the key risks to this Truist Financial narrative.

Another Angle On Valuation

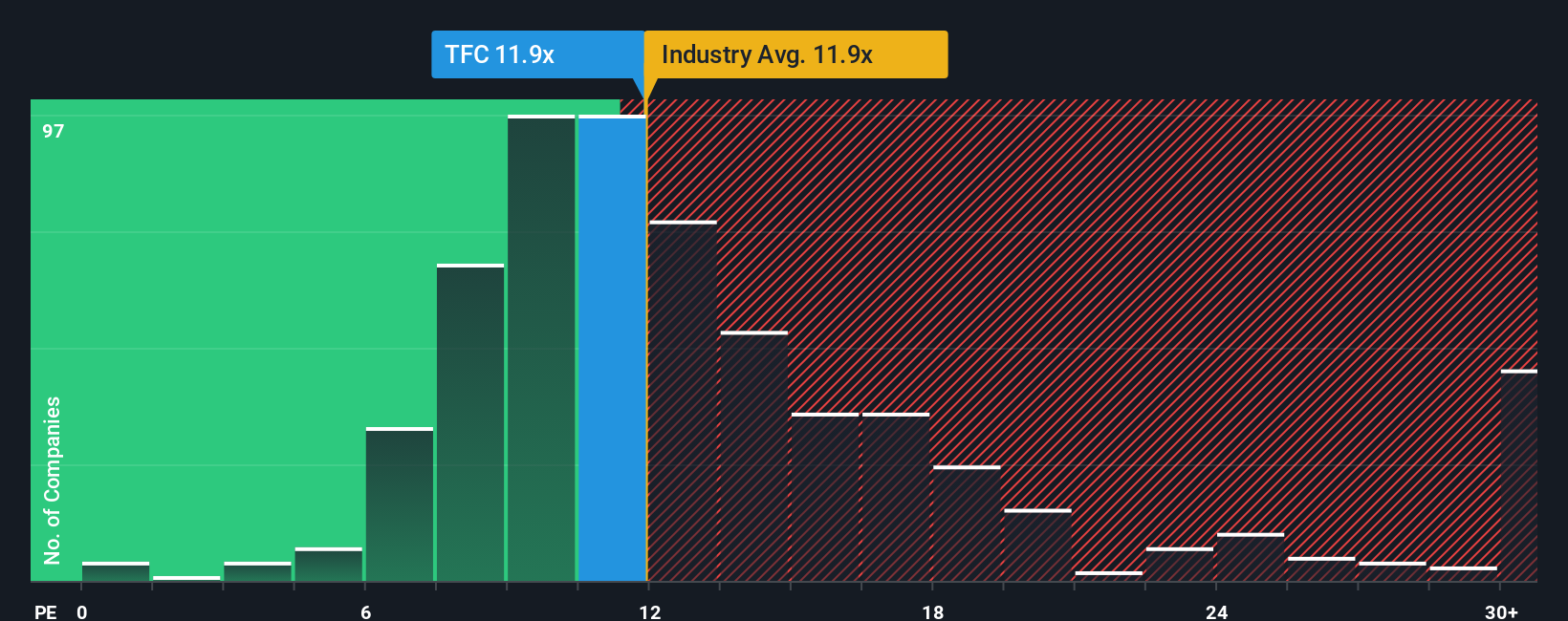

On headline valuation, Truist does not look cheap, with its price to earnings ratio of 12.9 times sitting above the US Banks industry at 12 times, though still below peers at 13.2 times and under a fair ratio of 14.3 times that our models suggest the market could drift toward. Does that mix of modest premium and upside room signal a safety margin or limited rerating potential?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Truist Financial Narrative

If you see the story differently or want to stress test the assumptions with your own inputs, you can build a fresh view in minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Truist Financial.

Ready for your next investing move?

Before you log off, set yourself up for the next big win by scanning fresh opportunities on the Simply Wall St Screener that most investors overlook.

- Capture mispriced opportunities by running through these 909 undervalued stocks based on cash flows that pair solid fundamentals with attractive entry points before sentiment catches up.

- Ride structural growth trends by zeroing in on these 30 healthcare AI stocks transforming diagnostics, treatment, and patient outcomes with data driven innovation.

- Position for asymmetric upside by filtering these 80 cryptocurrency and blockchain stocks shaping the future of digital assets, payments, and blockchain infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com