Nitto Boseki Co., Ltd. (TSE:3110) Shares Slammed 26% But Getting In Cheap Might Be Difficult Regardless

Nitto Boseki Co., Ltd. (TSE:3110) shares have retraced a considerable 26% in the last month, reversing a fair amount of their solid recent performance. Still, a bad month hasn't completely ruined the past year with the stock gaining 72%, which is great even in a bull market.

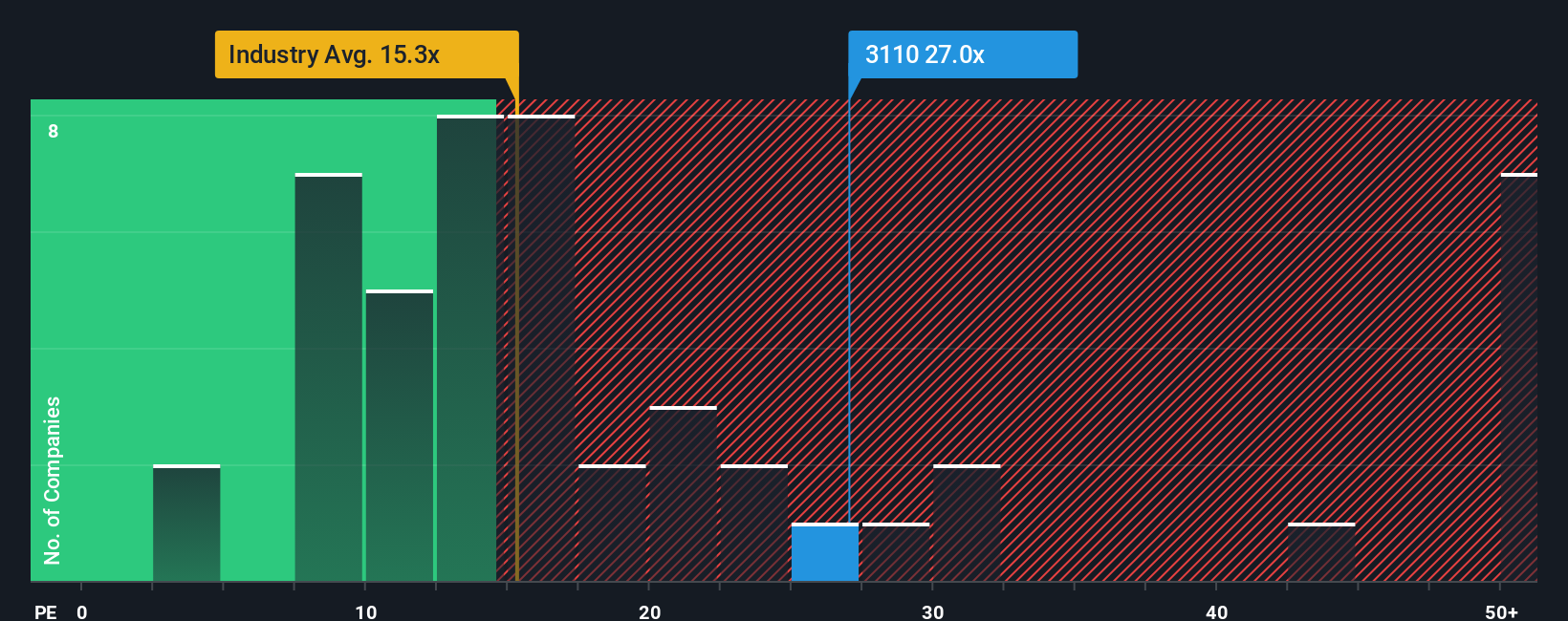

In spite of the heavy fall in price, given close to half the companies in Japan have price-to-earnings ratios (or "P/E's") below 14x, you may still consider Nitto Boseki as a stock to avoid entirely with its 27x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Nitto Boseki certainly has been doing a good job lately as it's been growing earnings more than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Nitto Boseki

How Is Nitto Boseki's Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Nitto Boseki's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 56%. EPS has also lifted 30% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been respectable for the company.

Looking ahead now, EPS is anticipated to climb by 13% per year during the coming three years according to the eight analysts following the company. That's shaping up to be materially higher than the 8.9% per year growth forecast for the broader market.

In light of this, it's understandable that Nitto Boseki's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Nitto Boseki's P/E?

Nitto Boseki's shares may have retreated, but its P/E is still flying high. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Nitto Boseki's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Nitto Boseki you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.