Does Deere’s Precision Agriculture Push Justify Its 2025 Valuation After Recent Share Price Gains?

- Wondering if Deere is still a buy after its big multi year run, or if most of the easy money has already been made? This breakdown will walk through what the current price is really baking in.

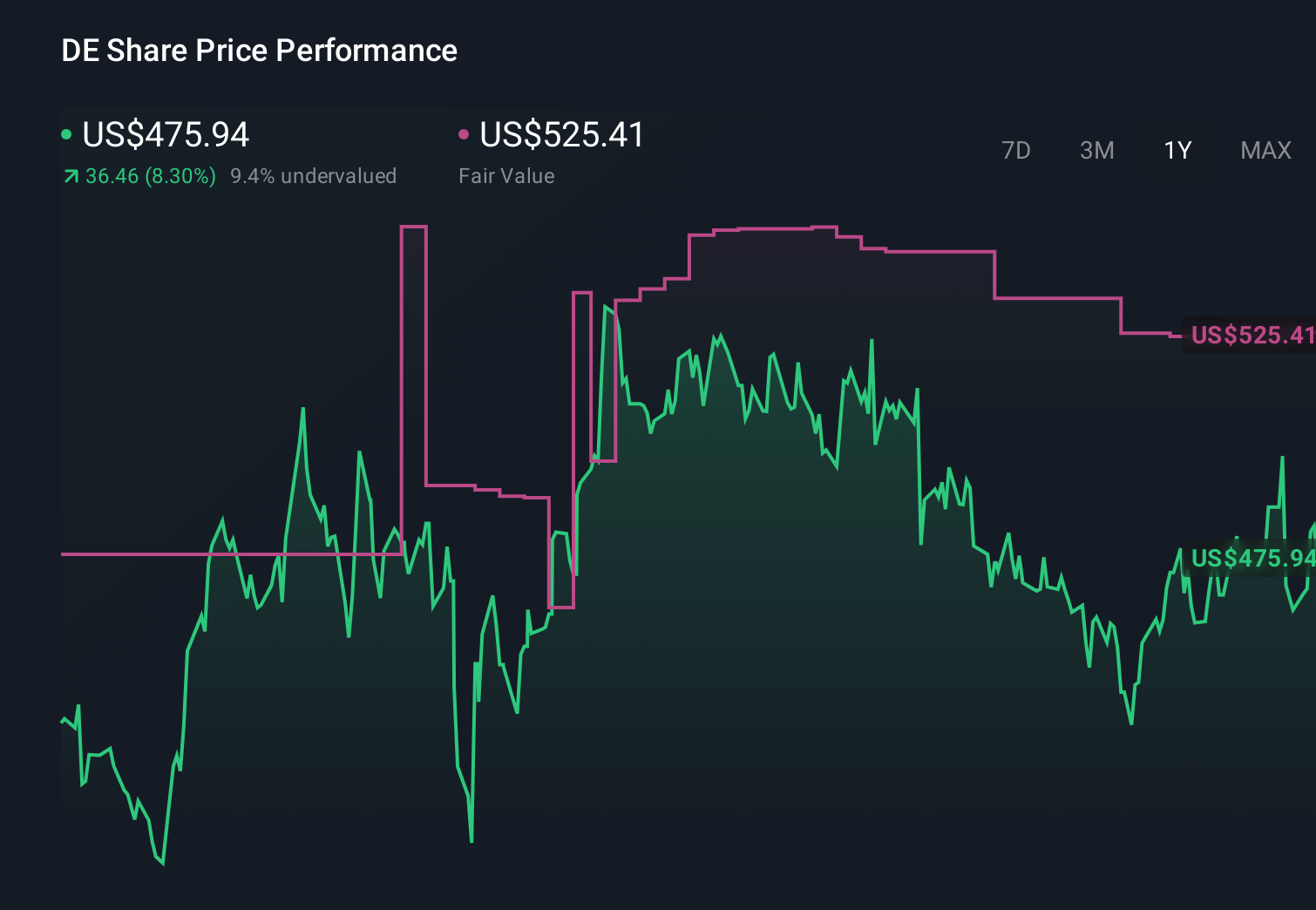

- With the stock at around $485 and up 4.9% over the last week, 1.9% over the last month, and 16.1% year to date, investors are clearly still willing to pay up for Deere's long term story despite only modest 11.0% 1 year and stronger 92.3% 5 year returns.

- Recent headlines have focused on Deere doubling down on precision agriculture and automation, including ongoing investments in smart farming tech and autonomous equipment that are meant to boost farmer productivity and lock in long term demand. At the same time, analysts and industry watchers have been debating how cyclical pressures in agriculture and construction might balance against this innovation push, which helps explain some of the tug of war in the share price.

- On our framework, Deere currently scores a 3 out of 6 valuation checks, suggesting it looks undervalued on several metrics but not across the board. Next we will unpack what those different valuation lenses say, before ending with a more powerful way to think about what Deere is truly worth.

Find out why Deere's 11.0% return over the last year is lagging behind its peers.

Approach 1: Deere Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a business is worth by projecting its future cash flows and then discounting them back to today to reflect risk and the time value of money.

For Deere, the model starts with last twelve month Free Cash Flow of about $3.6 billion. It then uses analyst forecasts and longer term extrapolations to estimate how this could grow. By 2030, annual Free Cash Flow is projected to reach roughly $12.4 billion, with additional growth assumed beyond that based on Simply Wall St estimates.

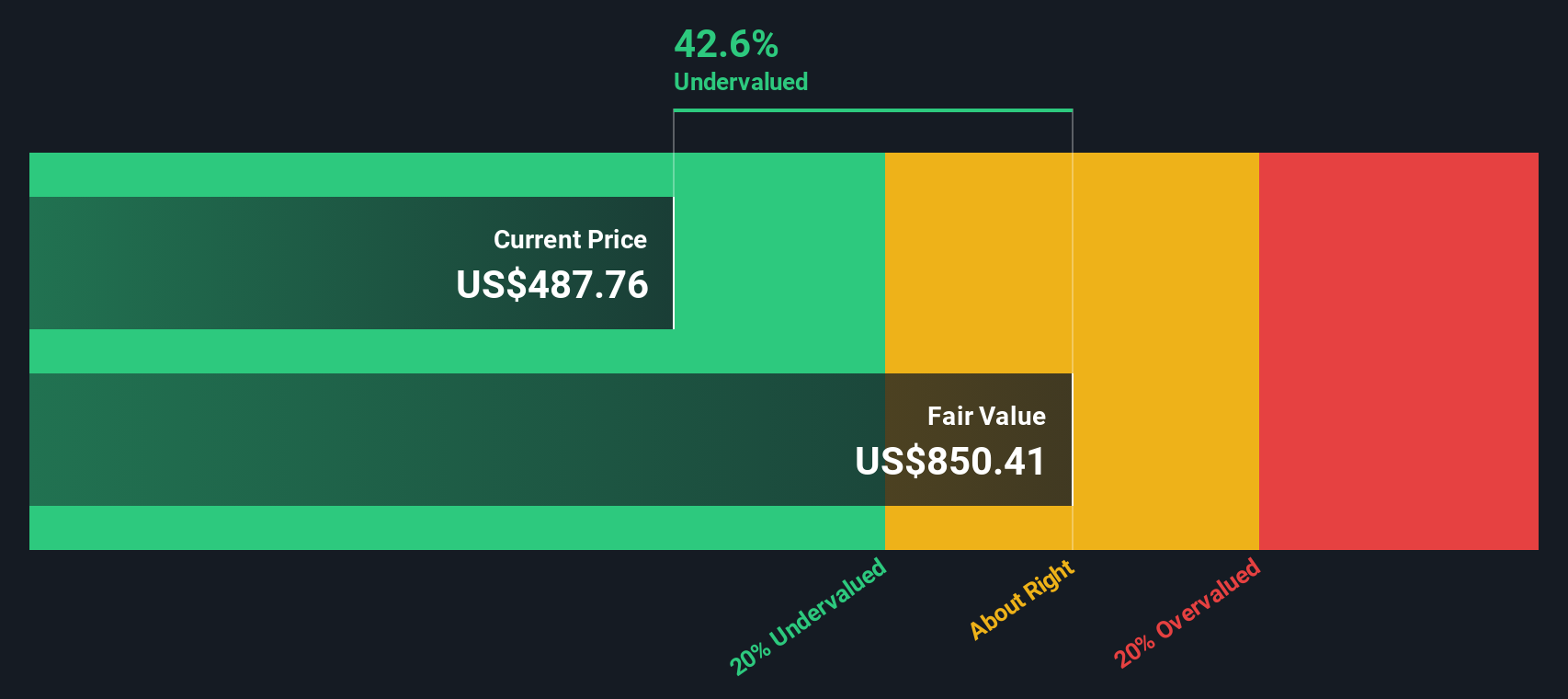

Adding up those future cash flows and discounting them back to today gives an estimated intrinsic value of about $635.85 per share. Compared to the current share price around $485, the DCF suggests the stock is roughly 23.7% undervalued, indicating that the market may be underestimating Deere's long term cash generation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Deere is undervalued by 23.7%. Track this in your watchlist or portfolio, or discover 910 more undervalued stocks based on cash flows.

Approach 2: Deere Price vs Earnings

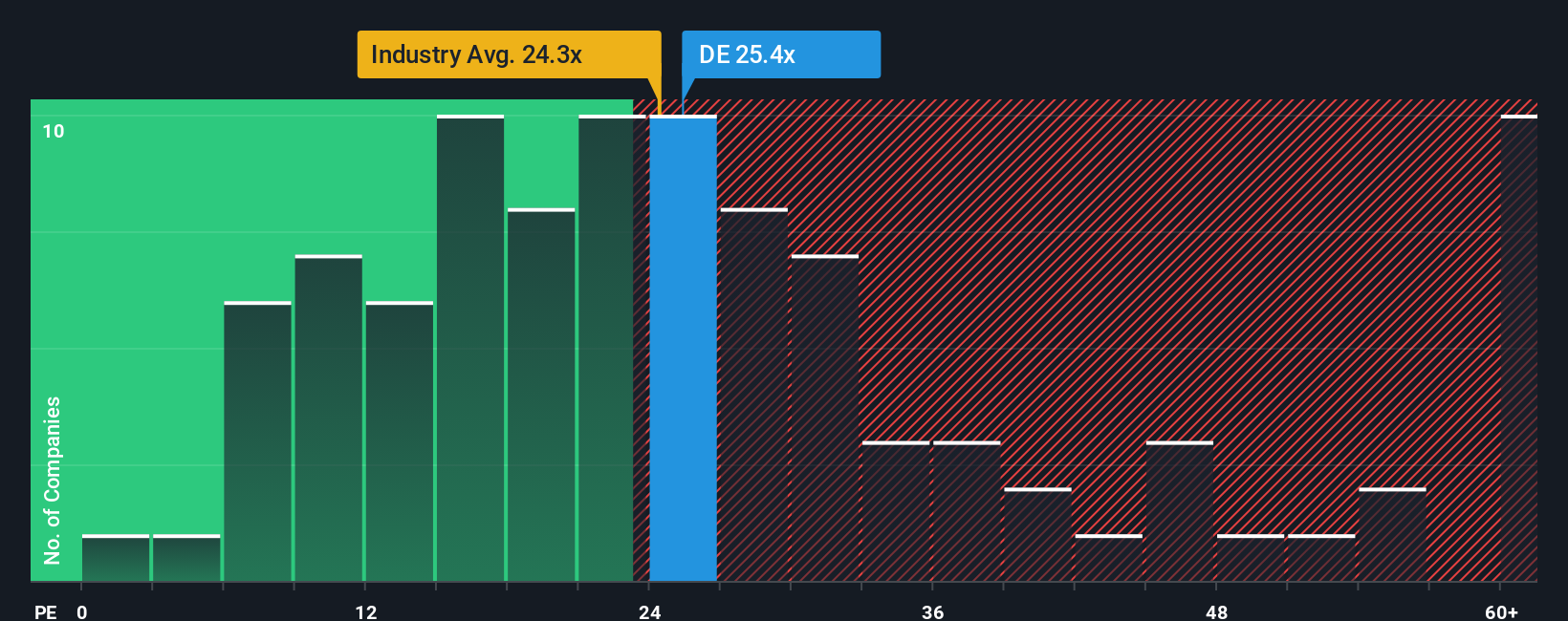

For a profitable, mature business like Deere, the price to earnings, or PE, ratio is a practical way to judge whether investors are paying a reasonable price for each dollar of profit. In general, faster growth and lower risk justify a higher PE, while slower growth or more uncertainty usually mean the multiple should sit closer to, or below, the market and industry average.

Deere currently trades on a PE of about 26.1x. This is slightly above the Machinery industry average of around 25.6x and meaningfully above its peer group average of roughly 23.2x. At first glance, that might suggest the shares are a bit expensive relative to similar companies.

However, Simply Wall St also calculates a Fair Ratio, a proprietary PE estimate of what investors should be willing to pay given Deere's earnings growth outlook, profitability, size, industry and specific risks. This makes it more targeted than a simple comparison to peers or the sector, which can mask important differences in quality and growth. Deere's Fair Ratio is estimated at about 34.6x, comfortably above the current 26.1x. This implies the market is not fully pricing in its fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1463 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Deere Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a simple way to turn your view of Deere into a structured story that links its business drivers to a financial forecast and then to a Fair Value estimate, all within the Simply Wall St Community page used by millions of investors. You can see, for example, one Narrative that assumes precision agriculture subscriptions and margin expansion justify a Fair Value closer to the high end of analyst targets near $724. Another, more cautious Narrative leans into cyclical risk, lower revenue growth, and compressed margins to arrive nearer the low end around $460. As new news, earnings, and guidance arrive, these Narratives update automatically, allowing you to continuously compare each Fair Value to the current share price and decide whether, based on the story you believe, Deere looks like a buy, hold, or sell.

Do you think there's more to the story for Deere? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com