Is Lloyds Still Attractive After Its 225.6% Five Year Rally and Digital Banking Push?

- Wondering if Lloyds Banking Group is still a bargain after its big run up, or if you have missed the boat? This breakdown will help you separate genuine value from momentum hype.

- With the share price recently closing at £0.9594 and delivering 1.2% over the last week, 5.6% over 30 days, 74.3% year to date, 83.8% over 1 year, 142.5% over 3 years and 225.6% over 5 years, investors are clearly re rating the stock.

- Recent headlines have focused on Lloyds ongoing push into digital banking and efficiency gains across its UK retail and commercial franchises. These developments help explain why sentiment has improved so sharply. At the same time, a steadier interest rate outlook and continued focus on capital returns have kept Lloyds firmly on the radar of income and value focused investors.

- Despite that backdrop, Lloyds only scores 2 out of 6 on our valuation checks. The story is therefore more nuanced than a simple cheap or expensive label, and we will walk through those methods before finishing with an even more intuitive way to think about its true value.

Lloyds Banking Group scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Lloyds Banking Group Excess Returns Analysis

The Excess Returns model looks at how much profit Lloyds can generate over and above the return that investors demand on its equity, and then capitalises those surplus profits into a per share value.

For Lloyds, the foundation is a Book Value of £0.77 per share and a Stable EPS of £0.10 per share, based on weighted future Return on Equity estimates from 14 analysts. With an Average Return on Equity of 13.26% and a Cost of Equity of about 6%, the bank is expected to earn an Excess Return of roughly £0.04 per share each year. The Stable Book Value is also estimated at £0.77 per share, using forecasts from 9 analysts.

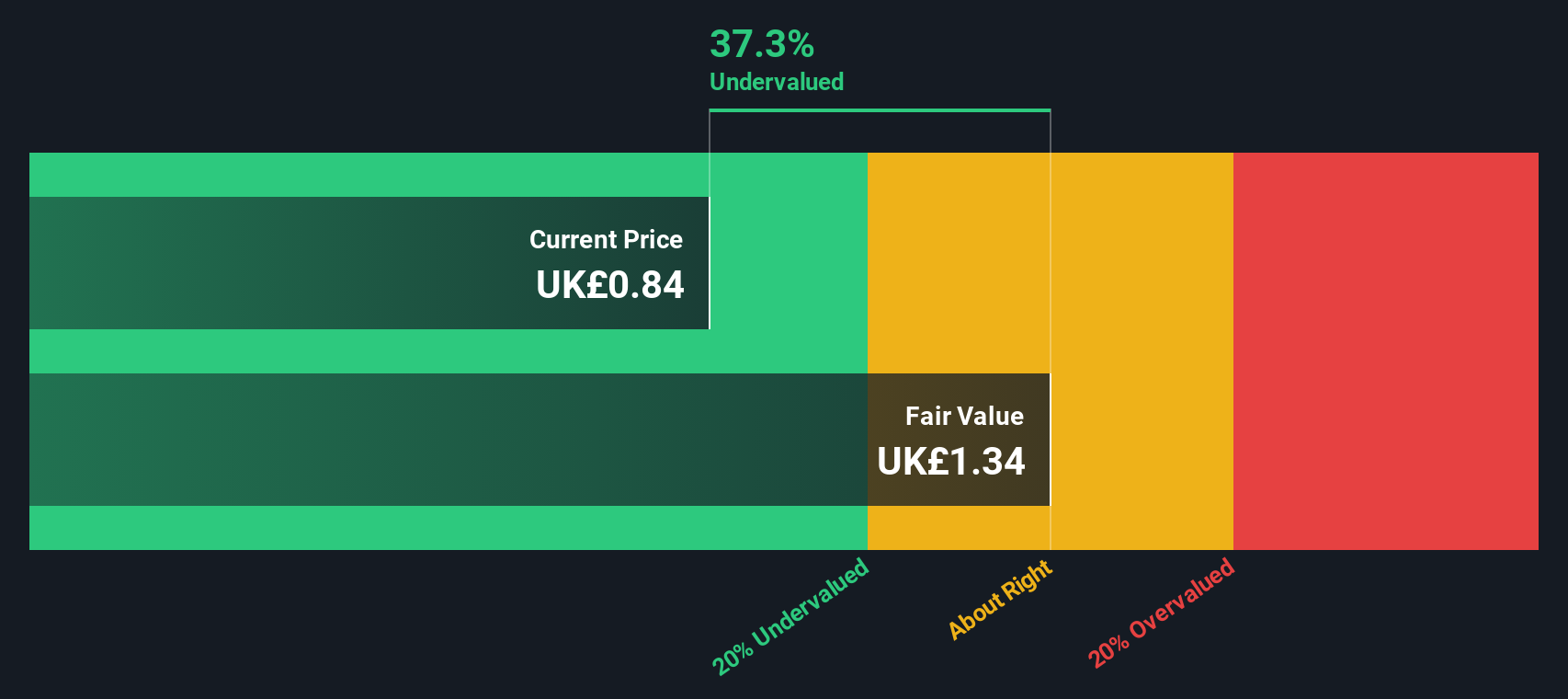

By projecting these excess returns into the future and discounting them back, the model arrives at an intrinsic value of roughly £1.45 per share. Compared with the recent share price of about £0.96, this suggests the stock is around 33.9% undervalued according to this model.

Result: UNDERVALUED

Our Excess Returns analysis suggests Lloyds Banking Group is undervalued by 33.9%. Track this in your watchlist or portfolio, or discover 910 more undervalued stocks based on cash flows.

Approach 2: Lloyds Banking Group Price vs Earnings

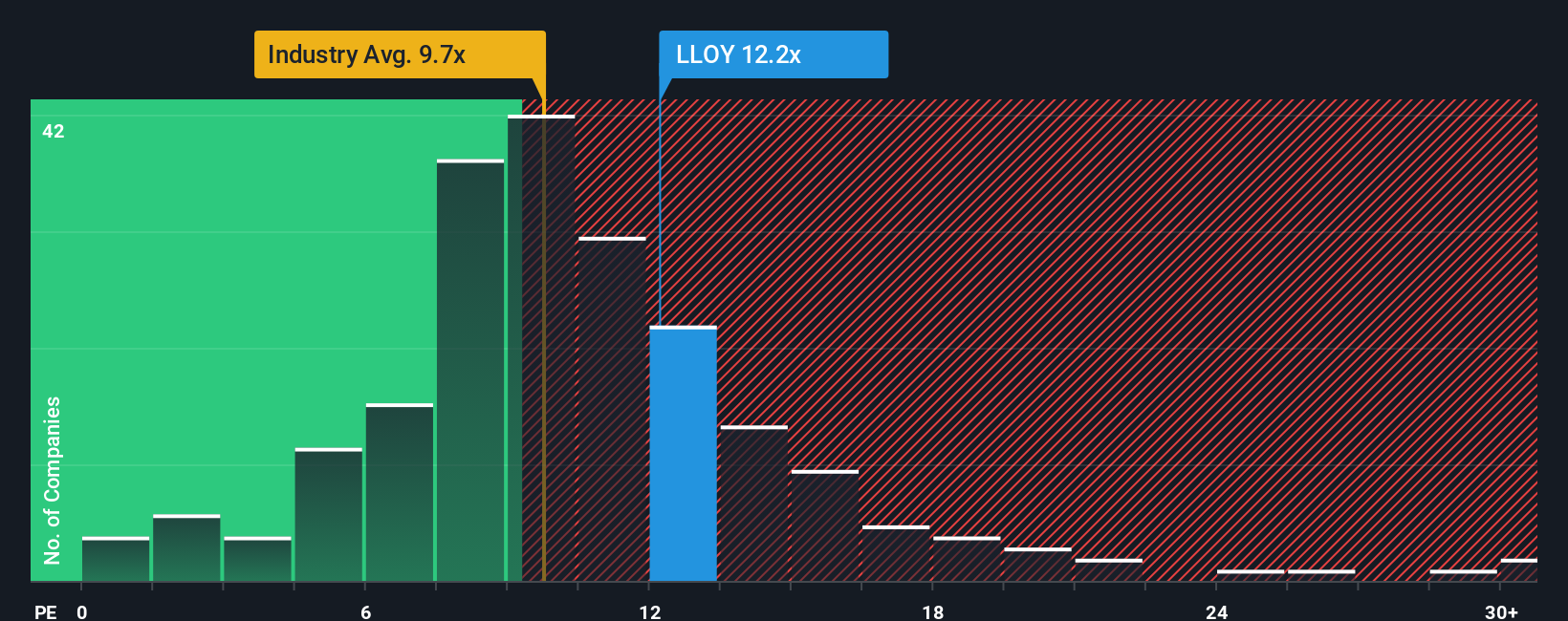

For a consistently profitable bank like Lloyds, the price to earnings ratio is a practical way to gauge whether investors are paying a sensible price for each pound of current earnings. In general, faster growth and lower risk justify a higher PE, while slower growth or higher risk should translate into a lower, more cautious multiple.

Lloyds currently trades on a PE of about 16.30x, which is noticeably higher than both the UK banks industry average of roughly 10.83x and the broader peer group average of around 11.94x. Simply Wall St’s Fair Ratio for Lloyds, however, is a lower 9.96x. This Fair Ratio is a proprietary estimate of what the PE should be, given Lloyds specific mix of earnings growth, profitability, risk profile, industry positioning and market cap.

Because it incorporates these fundamentals directly, the Fair Ratio is a more nuanced yardstick than a simple comparison with peers or the sector, which can be distorted by short term sentiment or company specific issues. With Lloyds actual PE sitting well above its Fair Ratio, the shares appear somewhat expensive on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1463 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Lloyds Banking Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. These are simply your story about a company, linked directly to your own numbers from revenue growth and margins through to a fair value estimate. On Simply Wall St’s Community page you can quickly see how your view compares with others, track how that view changes as news or earnings updates roll in, and decide when to buy or sell by comparing your Fair Value to today’s Price. For example, one Lloyds investor might build a bullish Narrative around accelerating digital efficiency, expanding wealth and fee income, and rising buybacks that justifies a fair value near the top of the current analyst range at about £1.03 per share. Another might focus on UK macro risk, margin pressure, and regulation, leading to a far more cautious Narrative and a fair value closer to the low end, around £0.53. This shows how the same set of facts can support very different, but clearly quantified, investment decisions.

Do you think there's more to the story for Lloyds Banking Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com