Is Mercedes-Benz Still Attractively Priced After Its Strong 5 Year Share Price Run?

- If you are wondering whether Mercedes-Benz Group is still a value play after its strong run, or if the easy money has already been made, this overview can help you sanity-check the current price against fundamentals.

- The stock has slipped 1.3% over the last week but is still up 2.4% over the past month, 13.3% year to date and 20.7% over the last year, with a 70.3% gain over five years hinting at a longer term rerating story.

- Recent headlines have focused on Mercedes-Benz doubling down on premium EVs while keeping profitable combustion models in the mix, as well as continued investment in software and autonomous driving partnerships. At the same time, investors are digesting macro worries around European demand and higher for longer interest rates, which can both weigh on cyclicals and open up selective value opportunities.

- Even after that performance, our valuation framework gives Mercedes-Benz Group a 4 out of 6 score for being undervalued across key checks. This suggests there may still be upside on the table. In the rest of this article we break down what different valuation approaches say about the stock, and finish with a more holistic way to think about its worth that goes beyond any single model.

Approach 1: Mercedes-Benz Group Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting its future cash flows and discounting them back to their present value. For Mercedes-Benz Group, this approach focuses on the free cash the company can return to shareholders after investments.

The latest twelve month free cash flow is about €13.0 billion, reflecting the strong profitability of the core Mercedes-Benz franchise. Analysts provide detailed forecasts for the next few years, and Simply Wall St then extrapolates these out to 10 years. Under this 2 Stage Free Cash Flow to Equity model, free cash flow is expected to gradually trend toward roughly €7.1 billion by 2035 as growth moderates.

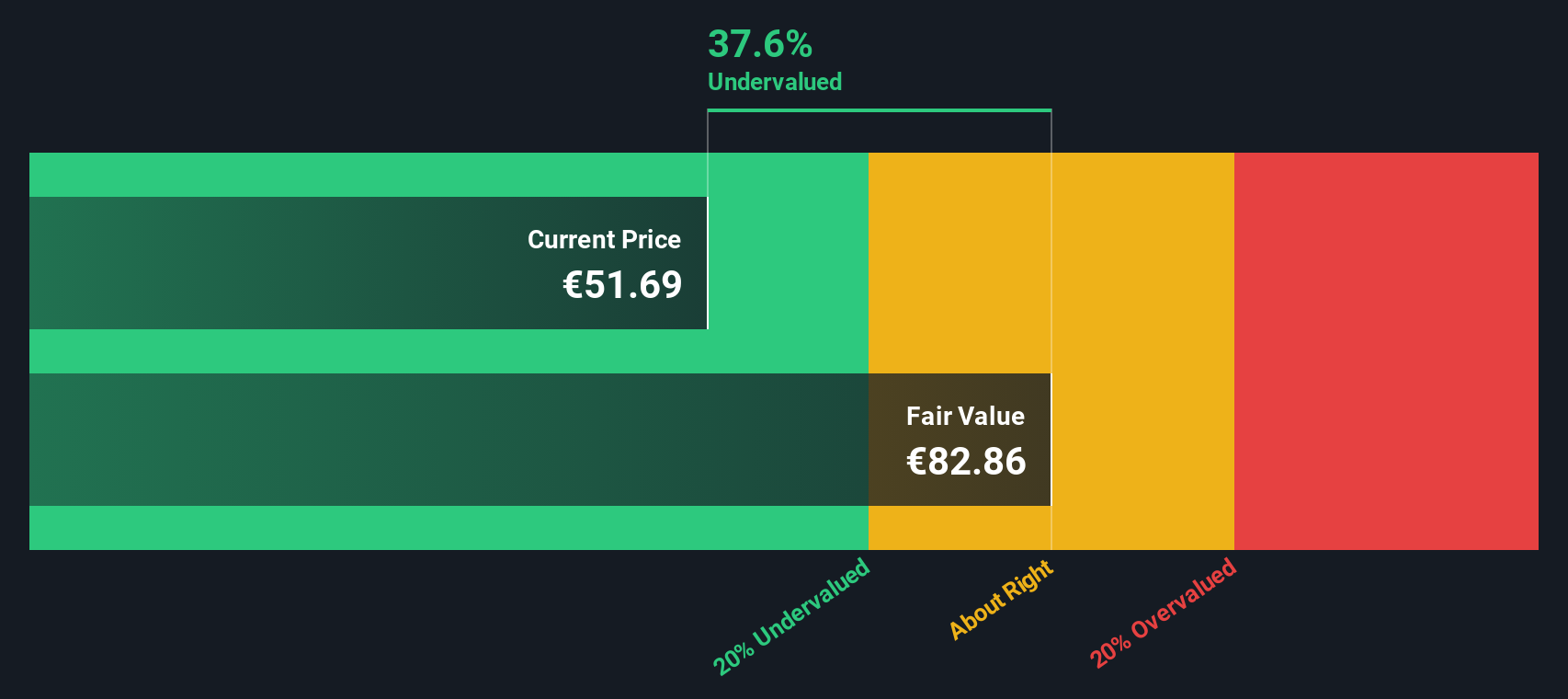

Discounting these projected cash flows back to today results in an estimated intrinsic value of about €73.58 per share. Compared with the current market price, this implies the stock is trading at roughly an 18.6% discount, which indicates that investors may not be fully pricing in Mercedes-Benz Group's future cash generation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Mercedes-Benz Group is undervalued by 18.6%. Track this in your watchlist or portfolio, or discover 910 more undervalued stocks based on cash flows.

Approach 2: Mercedes-Benz Group Price vs Earnings

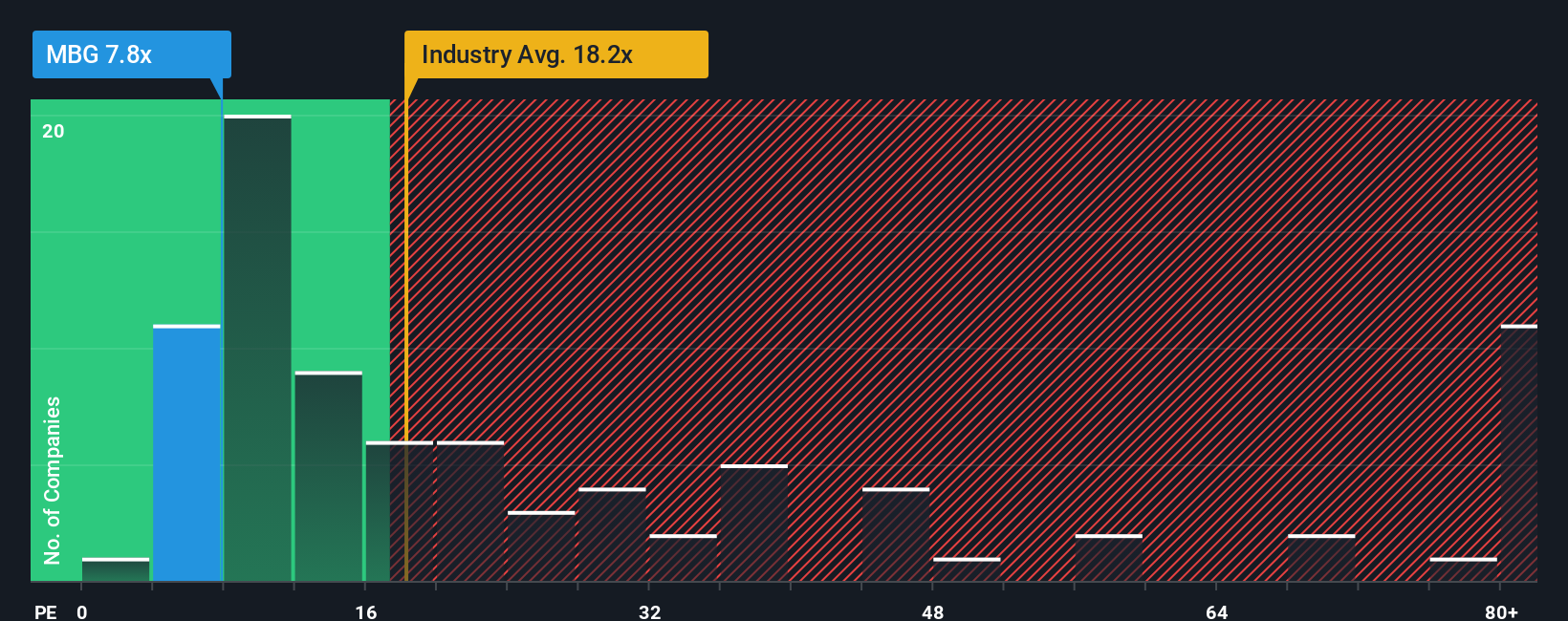

For a mature, consistently profitable manufacturer like Mercedes-Benz Group, the price to earnings ratio is a useful yardstick because it ties the share price directly to the profits the business is generating today. In general, companies with stronger, more reliable growth and lower risk tend to justify higher PE ratios, while slower growing or riskier firms should trade on lower multiples.

Mercedes-Benz Group currently trades on a PE of about 9.2x, which is well below both the Auto industry average of around 18.4x and a broader peer group that sits near 19.0x. That relative discount hints at pessimistic expectations, but simple peer comparisons can be misleading because they ignore differences in growth prospects, margins, balance sheet strength and overall risk.

To address this, Simply Wall St uses a Fair Ratio. This estimates what a reasonable PE should be after adjusting for factors such as Mercedes-Benz Group's earnings growth outlook, profitability, industry positioning, market cap and risk profile. On that basis, the Fair Ratio comes out at roughly 12.8x, meaning the stock trades at a meaningful discount to what these fundamentals would typically justify. This suggests the market may be underestimating the company rather than pricing it aggressively.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1463 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Mercedes-Benz Group Narrative

Earlier we mentioned that there is an even better way to understand valuation. So let's introduce you to Narratives, which are simple stories you create about a company that link your view of its strategy and risks to a set of revenue, earnings and margin forecasts, and then to a fair value. On Simply Wall St's Community page, millions of investors use these Narratives as an easy, interactive tool to compare their Fair Value with the current share price to decide whether to buy, hold or sell. Each Narrative updates automatically as new news or earnings arrive. For Mercedes-Benz Group, one investor might build a bullish Narrative around premium EV expansion, software-driven margins and a fair value near the optimistic €83 analyst target, while another focuses on China softness, tariffs and BEV execution risk and lands closer to the €40 bear case. This shows how different perspectives on the same facts translate into different forecasts and price targets that you can transparently track over time.

Do you think there's more to the story for Mercedes-Benz Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com