Hillenbrand (HI): Is the Recent 25% 90-Day Climb Justified by Its Valuation?

Hillenbrand (HI) has quietly ground higher this past quarter, leaving some investors wondering what is driving the move and whether the current price still reflects a reasonable entry point.

See our latest analysis for Hillenbrand.

At around $31.70, the recent 90 day share price return of roughly 25 percent suggests sentiment has turned more constructive, even though the longer term total shareholder returns have been negative.

If Hillenbrand has you rethinking where the next leg of industrial growth might come from, it could be worth scanning fast growing stocks with high insider ownership for other under the radar ideas.

With shares now hovering just below analyst targets, yet still trading at a sizable discount to some intrinsic value estimates, is Hillenbrand an overlooked value play or a stock already pricing in its next growth wave?

Most Popular Narrative Narrative: 3.9% Undervalued

Compared with Hillenbrand’s last close, the most widely followed narrative points to only a modest gap between market price and long term fair value.

Accelerating industry demand for factory automation and digital manufacturing solutions aligns with Hillenbrand's increased investment in R&D and digital service offerings (automation, remote monitoring, predictive maintenance). This supports growth in recurring, higher-margin aftermarket and service revenue streams.

Want to see the math behind that premium automation story? This narrative leans heavily on profit expansion, a shrinking top line, and a surprisingly restrained earnings multiple. Curious how those moving parts still point to upside?

Result: Fair Value of $33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering macro uncertainty and integration challenges could delay order recovery and margin gains, which could quickly undermine the case for a smooth earnings rebound.

Find out about the key risks to this Hillenbrand narrative.

Another Lens On Value

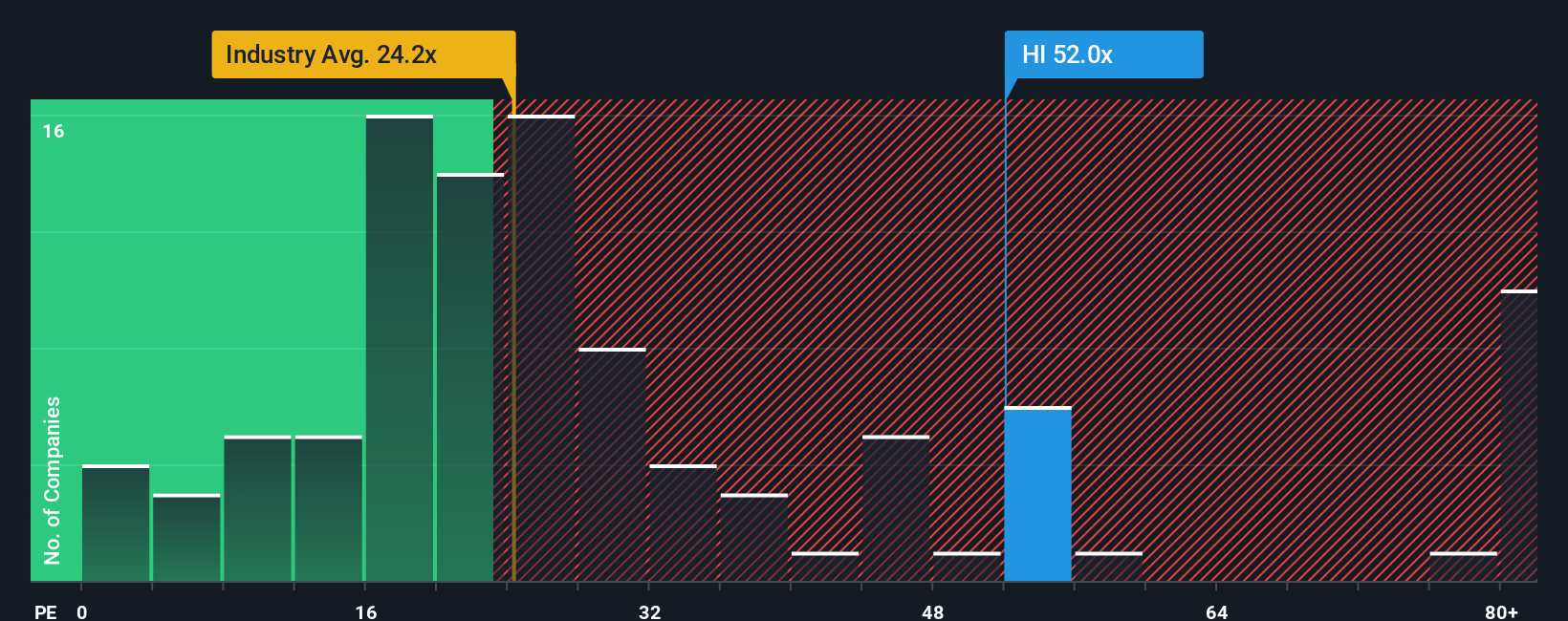

Zooming out from that narrative fair value, the market is sending a very different signal. At roughly 51.9 times earnings, Hillenbrand trades at a hefty premium to both the US Machinery industry on 25.6 times and peers on 32.8 times. Is this really a value name, or a rerating already in motion?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hillenbrand Narrative

If this framing does not quite match your view, or you would rather interrogate the numbers yourself, you can build a fresh take in minutes, Do it your way.

A great starting point for your Hillenbrand research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Do not stop at Hillenbrand alone. Use the Simply Wall Street Screener to uncover focused opportunities that match your style before the market catches up.

- Secure growing income streams by targeting businesses with reliable payouts through these 12 dividend stocks with yields > 3% offering attractive yields backed by resilient cash flows.

- Position yourself ahead of the next technology shift by filtering for innovators in automation, software, and infrastructure via these 26 AI penny stocks.

- Capitalize on mispriced opportunities by zeroing in on companies trading below their estimated cash flow value using these 913 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com