Worthington Enterprises (WOR) Margin Rebound Supports Bullish Re‑Rating Narrative After Q2 2026 Results

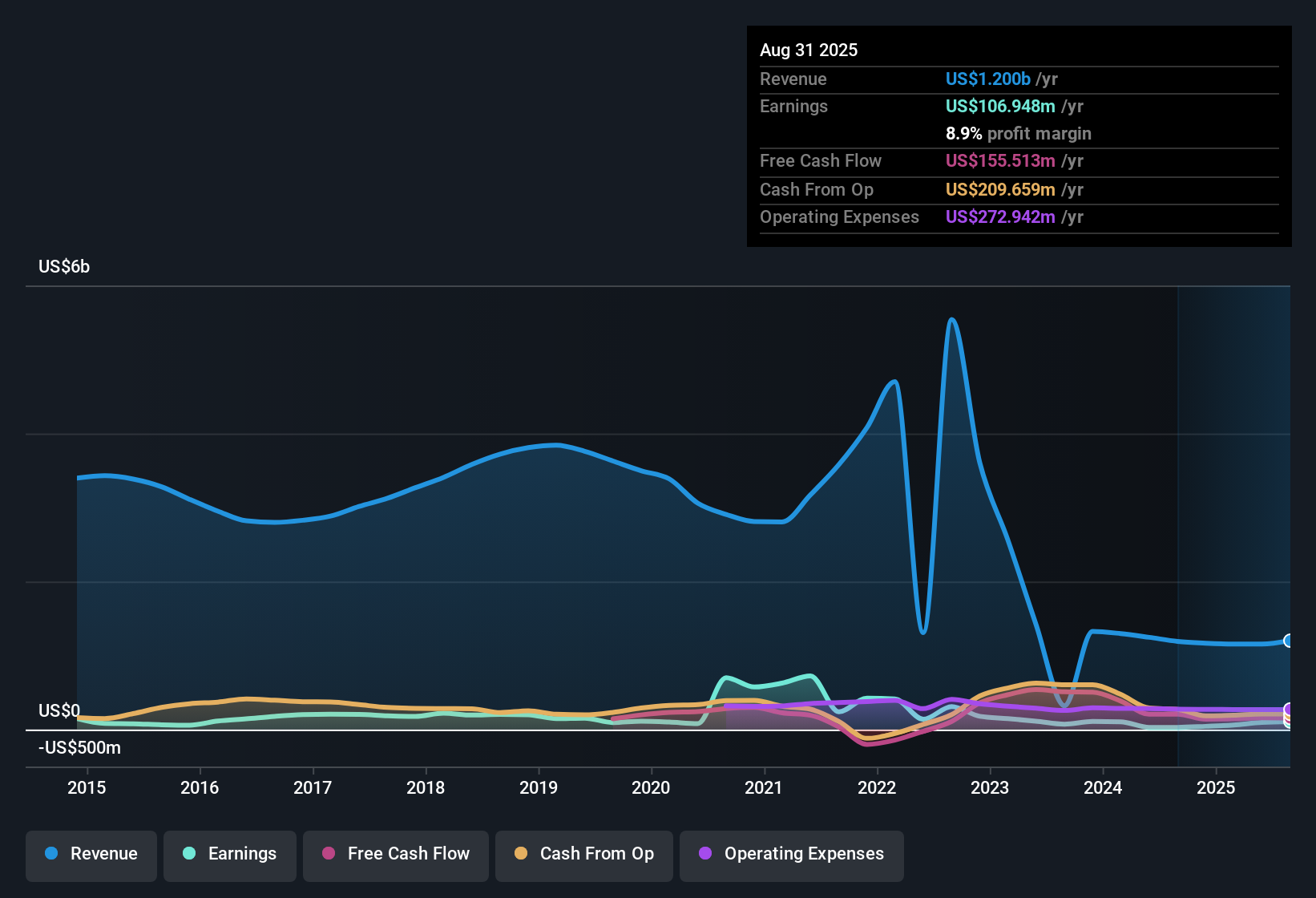

Worthington Enterprises (WOR) has just posted Q2 2026 results with revenue of about $327 million and EPS of $0.56, setting the stage against a year in which trailing 12 month revenue reached roughly $1.25 billion and EPS came in at $2.15. The company has seen quarterly revenue move from about $274 million in Q2 2025 to $327 million in Q2 2026, while EPS has shifted from $0.57 to $0.56 over the same period, as wider trailing margins now frame how investors will parse this latest print. Overall, profitability trends look more like steady margin rebuilding than headline grabbing growth, which is exactly what the market will be weighing in this update.

See our full analysis for Worthington Enterprises.With the headline numbers on the table, the next step is to see how they line up against the key narratives around Worthington Enterprises, and where the data might quietly support or contradict what investors have been assuming.

See what the community is saying about Worthington Enterprises

Margins Rebuild Despite $66.3M Hit

- Net profit margin on a trailing 12 month basis sits at 8.5 percent, up from 3.7 percent a year earlier even though the period includes a $66.3 million one off loss.

- Consensus narrative expects operational efficiencies and acquisitions to lift margins further over time, which lines up with the move from 3.7 percent to 8.5 percent, but

- that same narrative has to account for the fact that such a large $66.3 million loss is still flowing through reported numbers, making the quality of the 146.6 percent earnings growth harder to read at a glance.

- the five year record of earnings declining about 49.6 percent per year shows margin rebuilding is relatively recent compared with the longer history that consensus is assuming will stay behind the company.

Revenue Growth Slower Than EPS Rebound

- On a trailing 12 month basis, revenue is about $1.25 billion, up only modestly from roughly $1.17 billion a year ago, while earnings over that span climbed 146.6 percent.

- Analysts consensus view leans on new products and partnerships to drive revenue expansion, yet

- current forecasts call for revenue growth of about 5.3 percent per year, which is slower than the roughly 15.5 percent annual earnings growth they are expecting from the same business.

- that gap suggests the consensus is counting on margin improvement and integration of deals like Ragasco to do more work than top line acceleration alone has done over the last year.

Valuation Discount Versus Mixed Track Record

- With the stock at $54.86, the DCF fair value of about $92.69 implies roughly a 40.8 percent discount, while the 25.7 times price to earnings multiple is below the 40.4 times peer average and close to the 25.6 times industry level.

- What stands out in the consensus narrative is the focus on future upside against a more challenging history, because

- earnings are forecast to grow around 15.5 percent a year with margins rising from about 8.3 percent to 14.9 percent, yet over the past five years earnings have compounded down at roughly 49.6 percent per year.

- the current share price sitting below both the DCF fair value of $92.69 and an analyst target of 68.20 means the market is not yet fully buying into those longer term margin and growth assumptions.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Worthington Enterprises on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers through a different lens? Take a few minutes to turn that view into a concise narrative investors can follow: Do it your way.

A great starting point for your Worthington Enterprises research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Worthington Enterprises is rebuilding margins and looks optically cheap, but its long term earnings decline and modest revenue growth leave the story unproven.

If that mixed trajectory makes you uneasy, use our stable growth stocks screener (2093 results) to quickly shift your focus toward companies with more consistent revenue, steadier earnings and clearer performance trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com