Assessing NuScale Power’s Premium Valuation After Recent Share Price Slide

- Wondering if NuScale Power at around $15.73 is a bargain or a value trap? This article will walk through what the numbers are really saying about the stock.

- The share price has been under pressure recently, down 22.6% over the last week and 25.3% over the past month. However, it is still up 53.5% over 3 years and 52.0% over 5 years, hinting at a volatile but resilient story.

- Much of the recent move has been shaped by shifting sentiment around small modular reactors, including policy support for advanced nuclear and utility interest in cleaner baseload options, which tend to swing expectations quickly. At the same time, NuScale's progress on securing long lead-time projects and navigating regulatory milestones has kept the company in the spotlight for investors who are comfortable with long duration infrastructure plays.

- Right now, NuScale Power only scores 1 out of 6 on our valuation checks for being undervalued, so we will dig into what that means across different valuation methods and, later on, look at an even better way to make sense of what the market might be missing.

NuScale Power scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: NuScale Power Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting its future cash flows and then discounting those back to the present using a required rate of return.

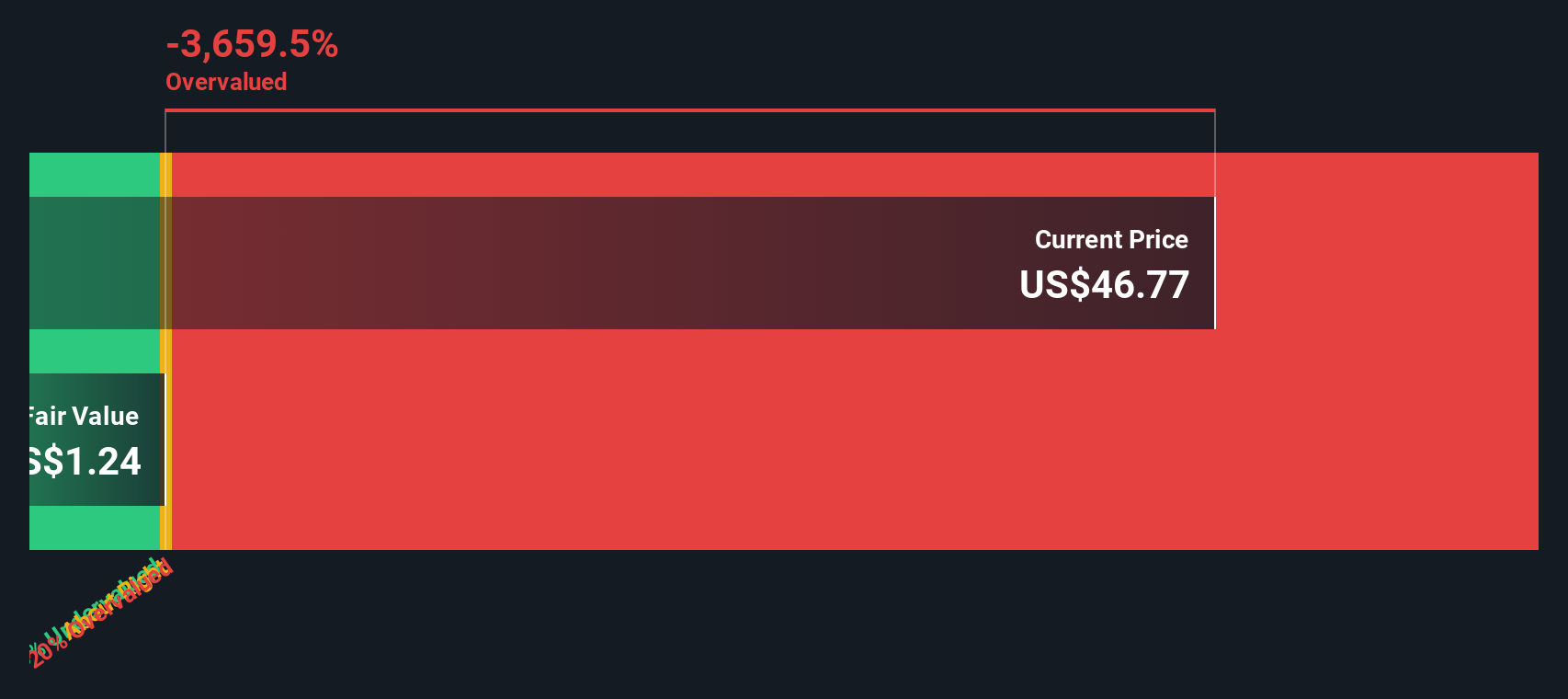

For NuScale Power, the latest twelve month Free Cash Flow is about $284 million outflow, and analyst expectations point to continued negative cash flows through 2028, with $424.95 million outflow projected in 2026 and $39.53 million outflow in 2028. The first positive Free Cash Flow appears in 2029 at around $27.38 million, with Simply Wall St extrapolating further growth out to 2035 as the company scales its projects.

When these projected cash flows are discounted back using a 2 Stage Free Cash Flow to Equity model, the intrinsic value for NuScale is estimated at roughly $3.25 per share. Compared with the current price near $15.73, the DCF implies the stock is about 384.7% above this estimated value, indicating that the market price reflects a substantial premium for long term potential that remains highly uncertain.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests NuScale Power may be overvalued by 384.7%. Discover 911 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: NuScale Power Price vs Book

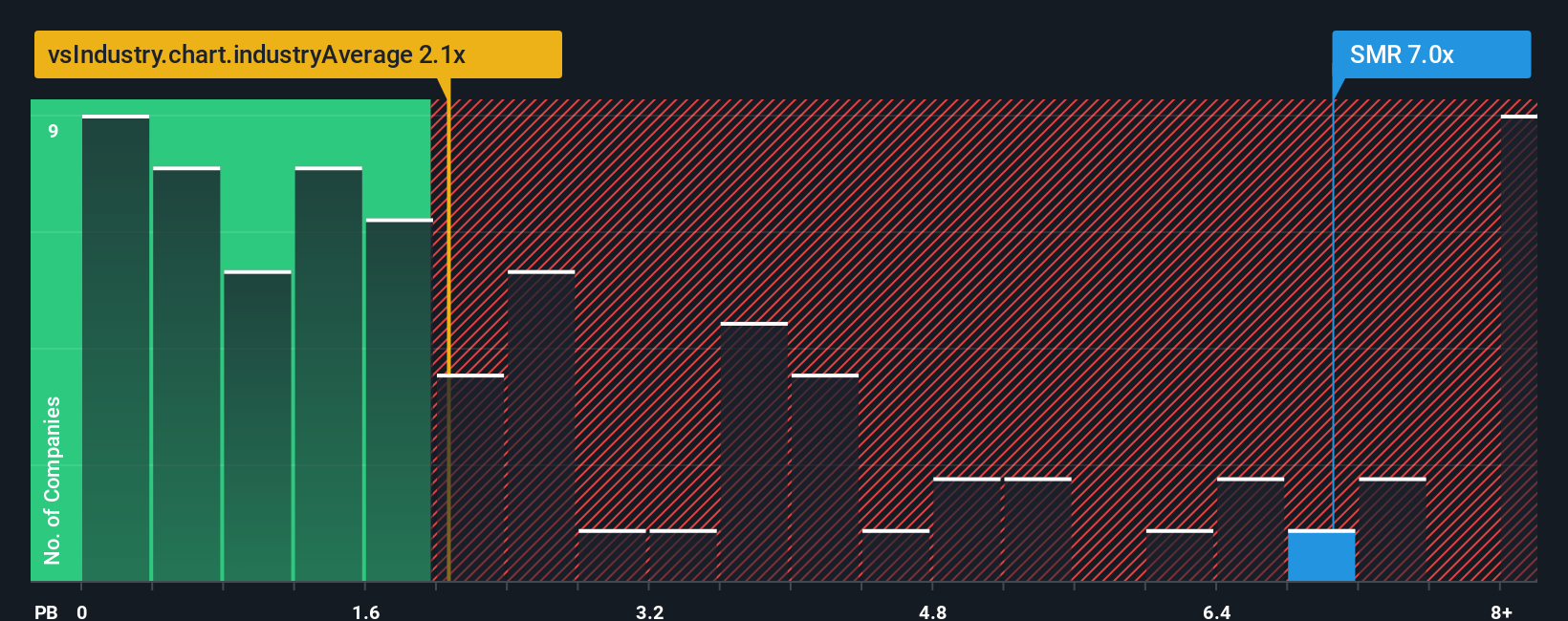

For companies that are still working toward sustainable profitability, the price to book ratio is often a more grounded way to think about value, because it anchors the share price to the net assets backing the business rather than earnings that may be volatile or negative.

In theory, faster growth and lower risk justify investors paying a higher multiple of book value, while slower growth and higher execution or regulatory risk should keep the normal range closer to, or even below, the value of the underlying assets. NuScale currently trades at about 5.37x book value, compared with an Electrical industry average of roughly 2.47x and a peer group average near 13.28x. This puts it at a premium to the sector but below some of the more aggressively priced names.

Simply Wall St also uses a proprietary Fair Ratio framework to estimate what a reasonable price to book multiple should be after adjusting for the company’s specific earnings growth outlook, industry dynamics, profit margins, market capitalization and risk profile. This tailored approach is more informative than a simple peer or industry comparison, because it directly ties the expected multiple to NuScale’s unique fundamentals. In NuScale’s case, the current 5.37x multiple sits well above this Fair Ratio estimate, indicating that the shares are still pricing in more optimism than the underlying fundamentals support.

Result: OVERVALUED

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1463 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your NuScale Power Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple tool on Simply Wall St’s Community page that lets you write the story behind your numbers by connecting your assumptions about NuScale Power’s future revenue, earnings and margins to a forecast and Fair Value. You can then compare that to the current share price to consider whether to buy, hold or sell. The platform keeps your view dynamically updated as new news or earnings arrive. One investor might build a bullish NuScale Narrative around rapid SMR deployment and a Fair Value closer to the high end of recent targets near $38 per share. Another may create a more cautious Narrative anchored nearer $17, illustrating how different perspectives on the same company can coexist and be tracked side by side.

Do you think there's more to the story for NuScale Power? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com