Syndax Pharmaceuticals (SNDX): Assessing Valuation After Key ASH Data on Revuforj and Niktimvo

Syndax Pharmaceuticals (SNDX) is back on traders radar after showcasing fresh data on its FDA approved cancer drugs Revuforj and Niktimvo at the high profile ASH hematology meeting in Orlando.

See our latest analysis for Syndax Pharmaceuticals.

The momentum around these ASH updates lines up with a strong run in the stock, with Syndax delivering a roughly 44% year to date share price return and a 59% total shareholder return over the last year, even as multi year total shareholder returns remain negative.

If this kind of event driven move has you wondering what else is setting up for potential upside, it could be worth exploring healthcare stocks as your next research stop.

With shares still trading at a steep discount to Wall Street targets despite accelerating revenue growth and two newly approved drugs, investors now face a pivotal question: Is Syndax undervalued or already pricing in its future growth?

Most Popular Narrative: 48.2% Undervalued

With Syndax last closing at $20.37 against a narrative fair value of about $39, the valuation story leans aggressively toward upside and demands closer inspection.

Fixed operating expense base, together with expanding product sales and cash flow contributions from both franchises, is positioned to drive significant operating leverage, boosting net margins and accelerating the pathway to profitability. Late-stage pipeline advancements (including frontline trials, lifecycle management, and expansion into new indications like IPF for Niktimvo), coupled with strong clinical data and market-leading positions in precision oncology, provide robust long-term growth avenues aligned with surging demand for innovative, targeted therapies, supporting sustained multi-year earnings momentum.

Want to see how rapid revenue expansion, shifting margins, and a rich future earnings multiple combine into that upside case? The narrative unpacks every assumption behind that valuation.

Result: Fair Value of $39.31 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside case still hinges on successful label expansions and sustained Revuforj uptake, as regulatory delays or safety driven prescribing hesitancy could derail expectations.

Find out about the key risks to this Syndax Pharmaceuticals narrative.

Another View: Rich On Sales, Cheap On Story

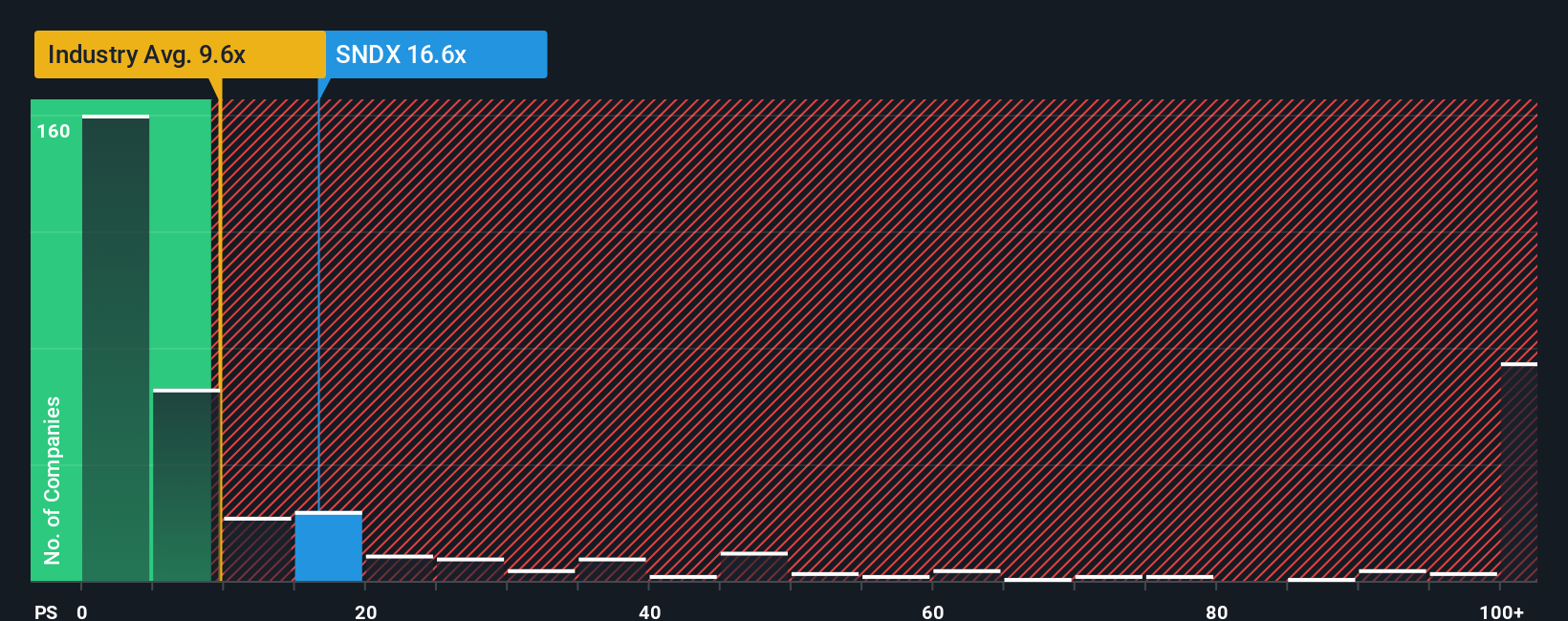

Overlaying this upbeat narrative with a simpler price to sales lens paints a tougher picture. SNDX trades at about 15.9 times sales, well above the US biotech peer average of 12.3 times and a fair ratio closer to 1.3 times. That kind of gap suggests real valuation risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Syndax Pharmaceuticals Narrative

If you see the story playing out differently or prefer building your own view from the numbers, you can craft a custom narrative in minutes, Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Syndax Pharmaceuticals.

Ready for your next investment move?

Before you log off, lock in your edge by scanning fresh opportunities on the Simply Wall Street Screener so you are not late to the next breakout.

- Look for mispriced potential by targeting these 913 undervalued stocks based on cash flows that combine solid fundamentals with cash flow profiles you find attractive.

- Explore the technology theme by focusing on these 26 AI penny stocks that are involved in real world artificial intelligence applications.

- Review your income strategy by pinpointing these 13 dividend stocks with yields > 3% that offer reliable, above average payouts consistent with your goals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com