Forbo Holding AG's (VTX:FORN) Shares Bounce 26% But Its Business Still Trails The Market

Forbo Holding AG (VTX:FORN) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Looking further back, the 16% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

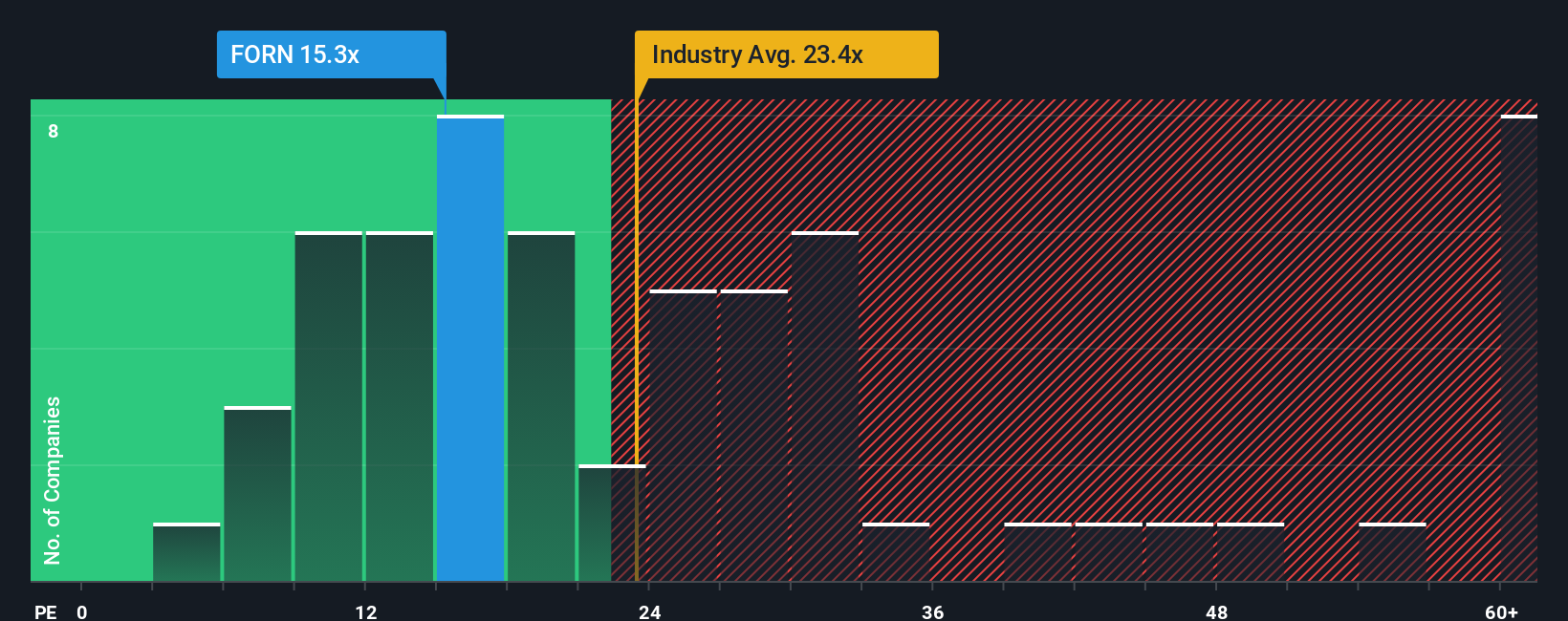

In spite of the firm bounce in price, Forbo Holding's price-to-earnings (or "P/E") ratio of 15.3x might still make it look like a buy right now compared to the market in Switzerland, where around half of the companies have P/E ratios above 21x and even P/E's above 29x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Forbo Holding hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Check out our latest analysis for Forbo Holding

Does Growth Match The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Forbo Holding's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 14% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 40% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 6.2% per annum as estimated by the three analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 11% each year, which is noticeably more attractive.

In light of this, it's understandable that Forbo Holding's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Forbo Holding's P/E?

Despite Forbo Holding's shares building up a head of steam, its P/E still lags most other companies. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Forbo Holding maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Forbo Holding with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on Forbo Holding, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.