European Growth Companies With High Insider Ownership December 2025

As European markets navigate a mixed landscape with the pan-European STOXX Europe 600 Index ending slightly lower and major indexes showing varied performance, investors are keenly observing the European Central Bank's next policy moves amid growth and inflation risks. In this environment, growth companies with high insider ownership can be particularly appealing as they often signal strong confidence from those closest to the business, potentially aligning well with market resilience and strategic economic positioning.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Warimpex Finanz- und Beteiligungs (WBAG:WXF) | 25.9% | 100.6% |

| S.M.A.I.O (ENXTPA:ALSMA) | 16.1% | 72.8% |

| Skolon (OM:SKOLON) | 38.3% | 126.5% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| DNO (OB:DNO) | 13.5% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 66.1% |

| CD Projekt (WSE:CDR) | 29.7% | 51.8% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 49.6% |

Below we spotlight a couple of our favorites from our exclusive screener.

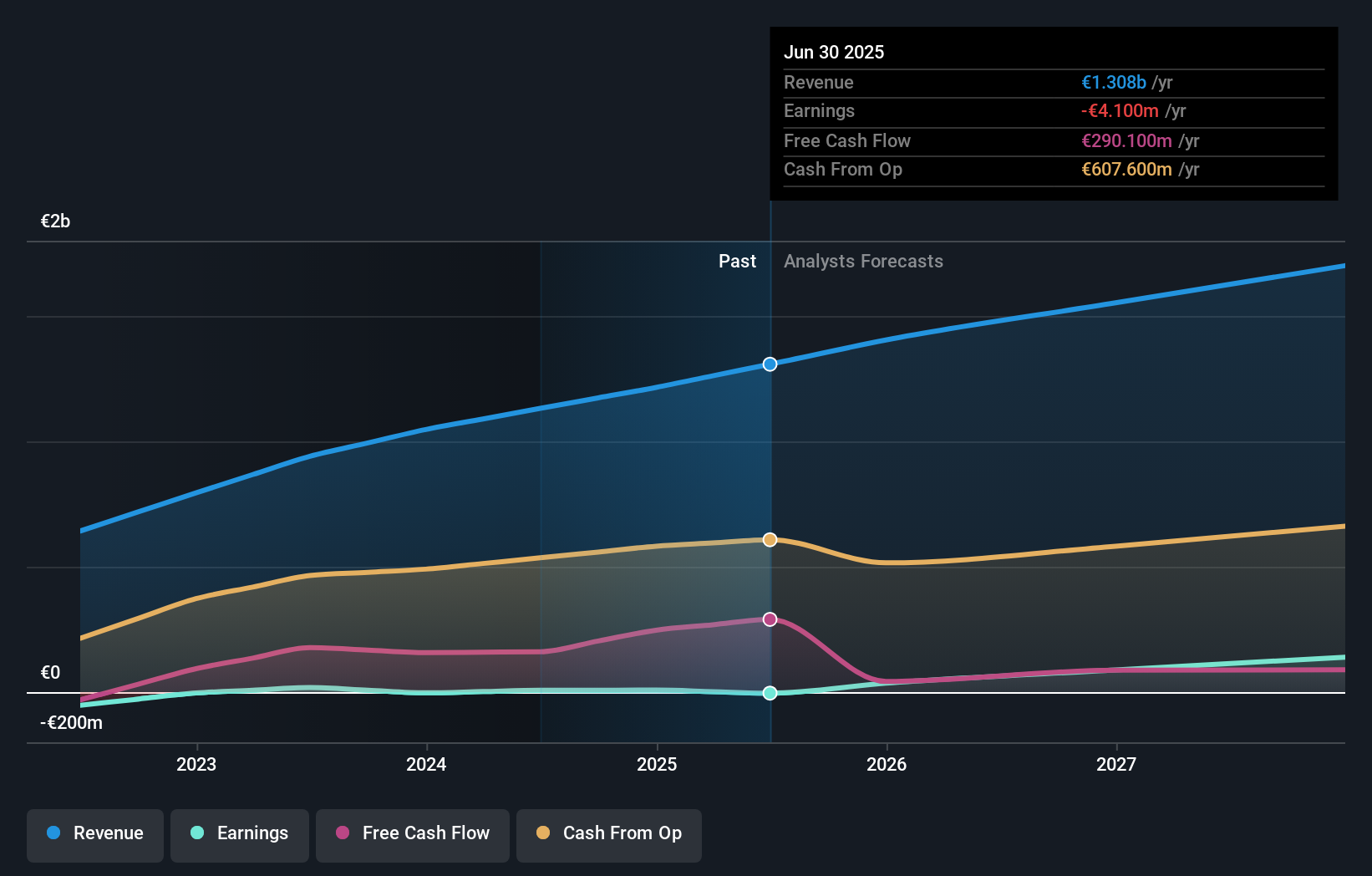

Basic-Fit (ENXTAM:BFIT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Basic-Fit N.V., along with its subsidiaries, operates fitness clubs and has a market capitalization of approximately €1.88 billion.

Operations: The company's revenue is derived from its operations in the Benelux region, which contributed €541.70 million, and from France, Spain, and Germany, which collectively generated €766 million.

Insider Ownership: 12.1%

Basic-Fit is poised for growth with earnings forecasted to increase by 46.77% annually and revenue expected to grow faster than the Dutch market at 9.9% per year. Despite a highly volatile share price, the company is on track to meet its revenue guidance of €1.375 billion to €1.425 billion for 2025, having already reported a significant 60% revenue increase over last year for the first nine months of 2025.

- Click here to discover the nuances of Basic-Fit with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Basic-Fit's share price might be too pessimistic.

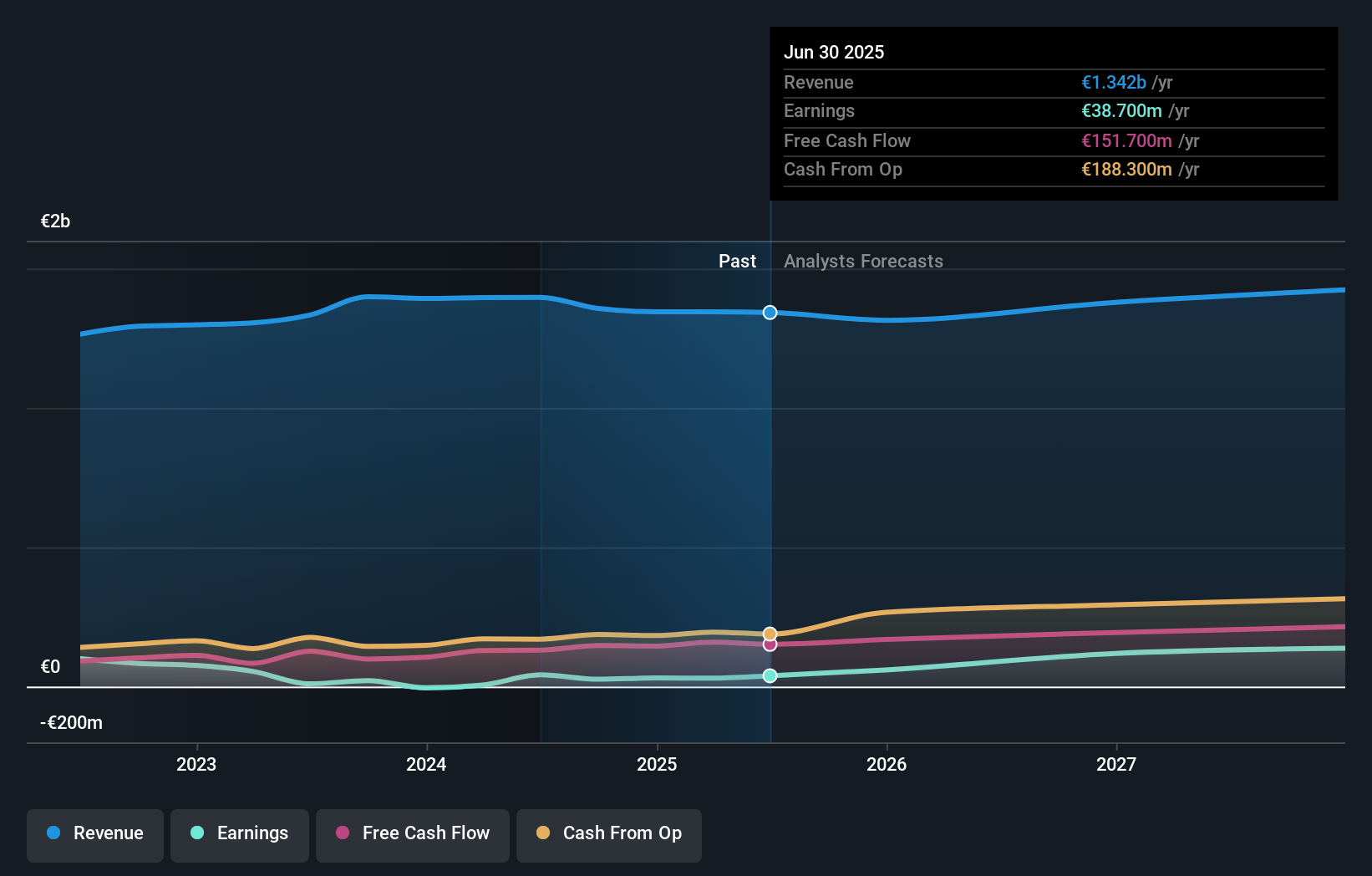

Sanoma Oyj (HLSE:SANOMA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sanoma Oyj is a media and learning company with operations in Finland, the Netherlands, Poland, Spain, Belgium, and internationally; it has a market cap of €1.48 billion.

Operations: The company's revenue is primarily generated from its Learning segment, which accounts for €754 million, and the Media Finland segment, contributing €564.30 million.

Insider Ownership: 16.7%

Sanoma Oyj is positioned for significant growth, with earnings expected to rise 60.98% annually, outpacing the Finnish market. However, revenue growth at 2.2% per year lags behind market expectations. The company recently secured a €220 million loan to refinance existing debt and pursue acquisitions in the K-12 content sector, aiming to enhance scale and shareholder returns. Despite these initiatives, profit margins have declined from last year due to large one-off items impacting results.

- Get an in-depth perspective on Sanoma Oyj's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Sanoma Oyj's shares may be trading at a discount.

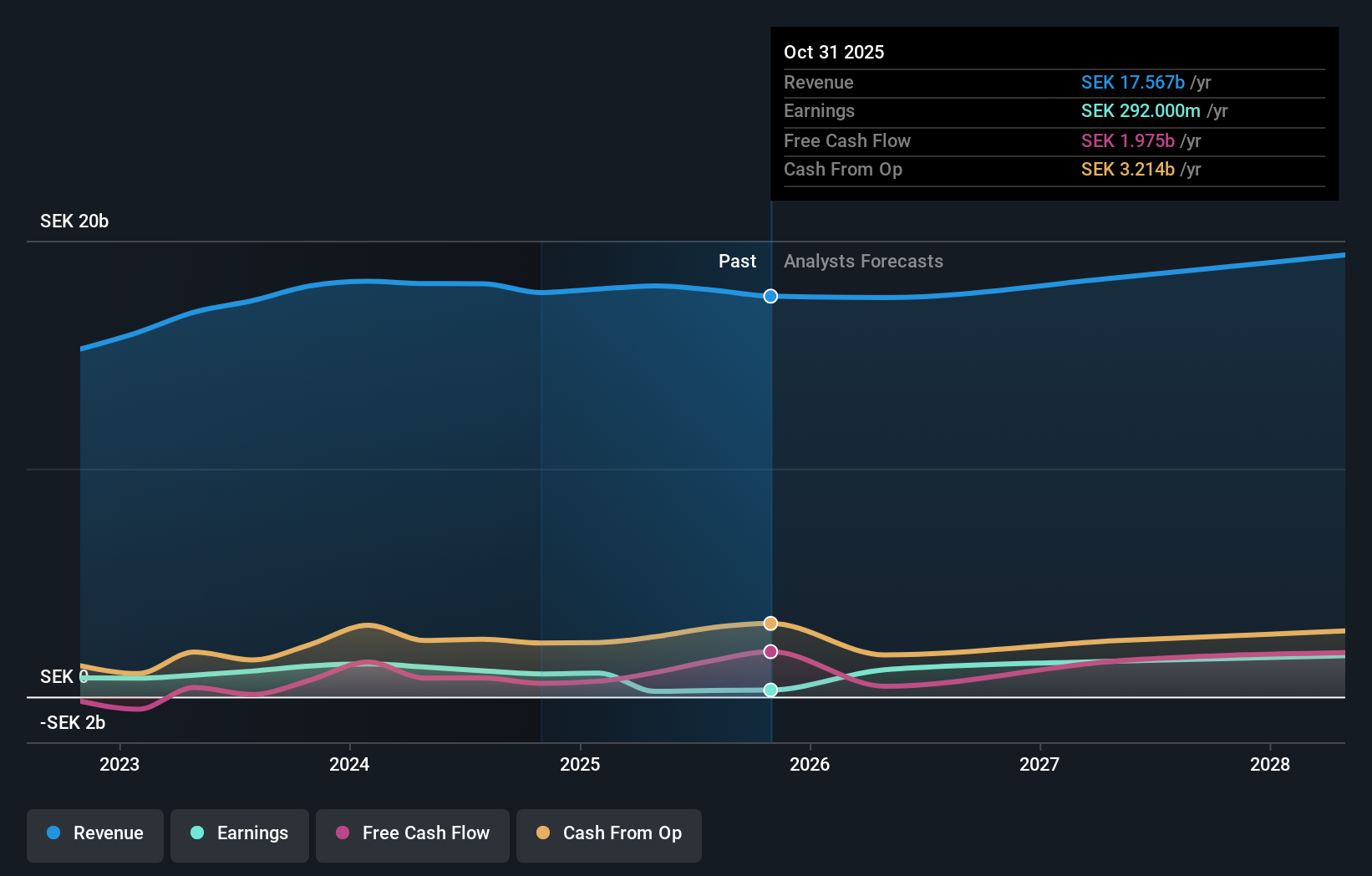

Elekta (OM:EKTA B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Elekta AB (publ) is a medical technology company specializing in clinical solutions for treating cancer and brain disorders across various global regions, with a market cap of approximately SEK21.57 billion.

Operations: The company's revenue is derived from three main segments: SEK5.93 billion from Asia Pacific, SEK4.83 billion from the Americas, and SEK6.81 billion from Europe, the Middle East, and Africa (EMEA).

Insider Ownership: 17.9%

Elekta is poised for robust earnings growth of 28.5% annually, surpassing the Swedish market's average. Despite this, revenue growth remains moderate at 5.6% per year and profit margins have shrunk from last year due to significant one-off items. Insider activity shows more buying than selling recently, although not in large volumes. The company trades significantly below its estimated fair value but faces challenges with a high debt level and unsustainable dividend coverage by earnings.

- Delve into the full analysis future growth report here for a deeper understanding of Elekta.

- Our expertly prepared valuation report Elekta implies its share price may be too high.

Key Takeaways

- Access the full spectrum of 212 Fast Growing European Companies With High Insider Ownership by clicking on this link.

- Ready To Venture Into Other Investment Styles? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com