3 European Penny Stocks With Market Caps Under €300M To Consider

The European stock market has shown mixed performance recently, with indices such as Germany's DAX gaining slightly while others like France's CAC 40 have seen declines. Despite these fluctuations, the concept of penny stocks remains relevant for investors seeking opportunities in smaller or newer companies. While the term may seem outdated, it highlights a segment of the market where strong financials can lead to significant potential returns.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €4.45 | €1.54B | ✅ 4 ⚠️ 2 View Analysis > |

| Orthex Oyj (HLSE:ORTHEX) | €4.72 | €83.82M | ✅ 4 ⚠️ 1 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €1.00 | €14.86M | ✅ 4 ⚠️ 5 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €223.46M | ✅ 3 ⚠️ 3 View Analysis > |

| Libertas 7 (BME:LIB) | €3.14 | €66.6M | ✅ 3 ⚠️ 3 View Analysis > |

| Hultstrom Group (OM:HULT B) | SEK3.12 | SEK189.82M | ✅ 2 ⚠️ 2 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.295 | €379.61M | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.265 | €313.07M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.772 | €25.85M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 291 stocks from our European Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Oriola Oyj (HLSE:ORIOLA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Oriola Oyj is involved in the wholesale of pharmaceuticals and health products across Sweden, Finland, and internationally, with a market cap of €202.29 million.

Operations: The company's revenue is primarily derived from its Distribution segment, which accounts for €1.49 billion, followed by the Wholesale segment at €354 million.

Market Cap: €202.29M

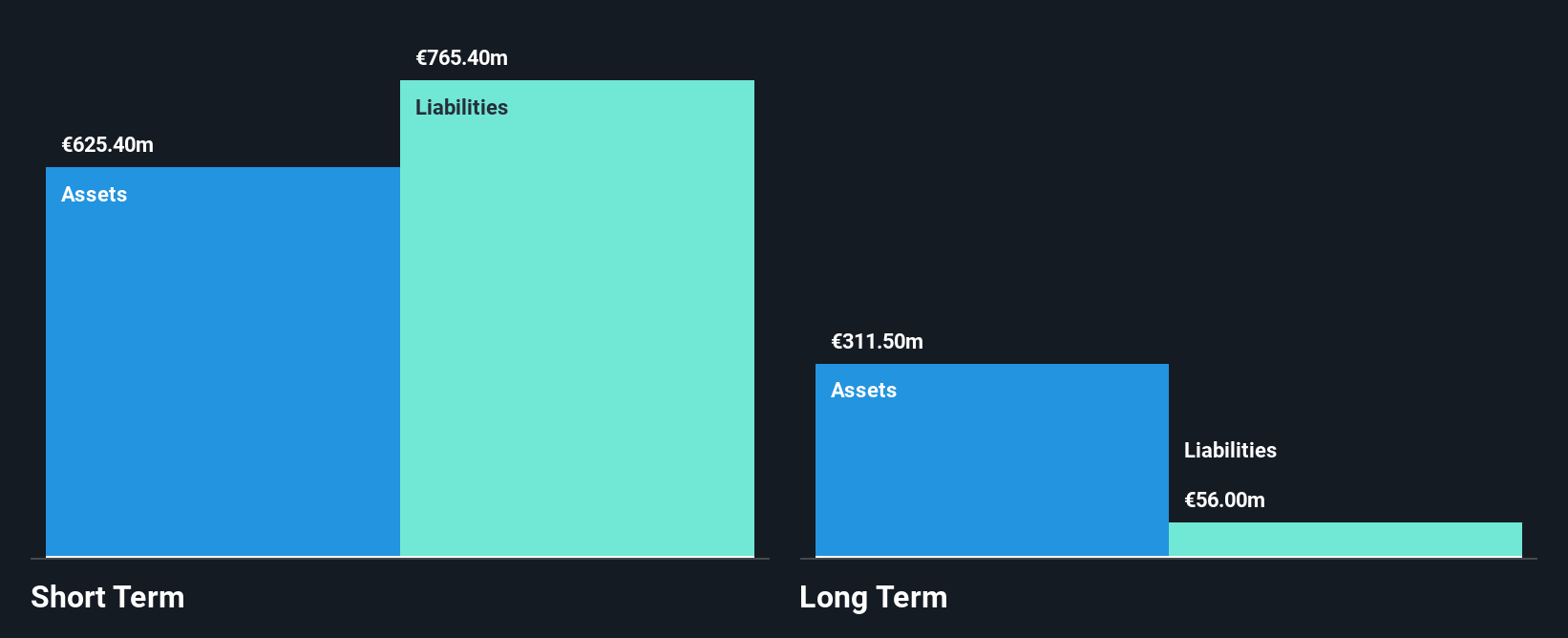

Oriola Oyj, with a market cap of €202.29 million, is navigating through strategic changes to bolster its logistics capabilities by planning a new distribution centre in Järvenpää, Finland. Despite being unprofitable and facing challenges with short-term liabilities exceeding assets, the company has managed to decrease its debt-to-equity ratio significantly over five years. Oriola's earnings are forecasted to grow substantially at 91.6% annually, although it currently trades well below estimated fair value and offers a dividend not covered by earnings. Recent management changes aim to enhance operational efficiency and support long-term growth strategies.

- Click to explore a detailed breakdown of our findings in Oriola Oyj's financial health report.

- Review our growth performance report to gain insights into Oriola Oyj's future.

BrainCool (OM:BRAIN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: BrainCool AB (publ) is a medical device company that develops, markets, and sells medical cooling systems for the healthcare sector in Sweden with a market cap of SEK141.90 million.

Operations: The company generates revenue of SEK46.13 million from its medical products segment.

Market Cap: SEK141.9M

BrainCool AB, with a market cap of SEK141.90 million, is navigating financial challenges despite some revenue generation from its medical products segment. The company remains unprofitable with increasing losses over the past five years and a negative return on equity of -31.43%. While debt-free and trading significantly below estimated fair value, BrainCool's high volatility and short cash runway present risks typical for penny stocks. Recent strategic moves include amending share capital limits and planning a rights issue to bolster finances, reflecting efforts to stabilize operations amid ongoing financial restructuring efforts in the competitive medical device sector.

- Click here and access our complete financial health analysis report to understand the dynamics of BrainCool.

- Learn about BrainCool's future growth trajectory here.

Rank Progress (WSE:RNK)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Rank Progress S.A. is a company that invests in, develops, rents, and sells commercial real estate properties both in Poland and internationally, with a market capitalization of PLN176.87 million.

Operations: The company's revenue is primarily derived from the lease of property at PLN61.74 million, followed by construction services at PLN6.84 million, and the sale of real estate at PLN0.83 million.

Market Cap: PLN176.87M

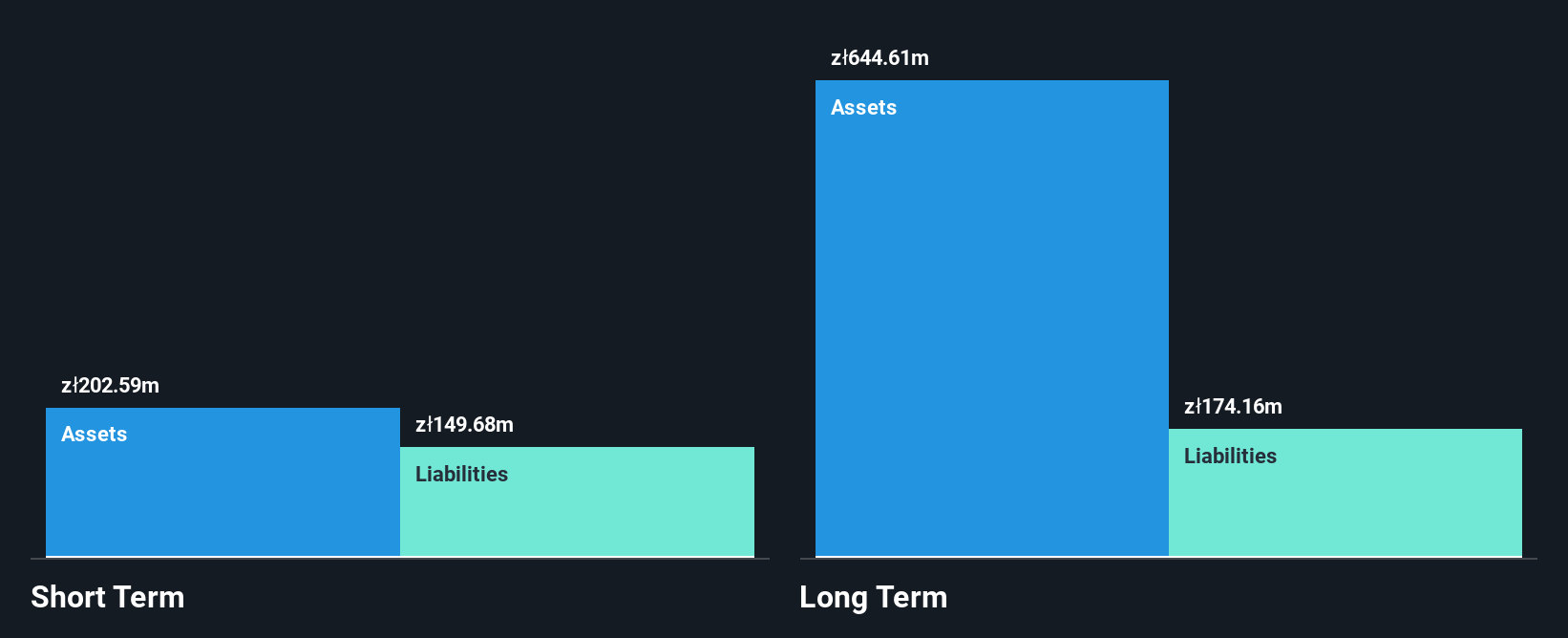

Rank Progress S.A., with a market cap of PLN176.87 million, demonstrates mixed financial performance typical for penny stocks. Despite reporting high-quality earnings and stable weekly volatility, the company's earnings have declined by 14.5% annually over five years, and its return on equity remains low at 1%. Recent results show improved quarterly net income of PLN16.22 million from a previous loss, yet nine-month sales dropped significantly to PLN48.69 million from PLN139.35 million year-on-year. While debt levels are satisfactory with interest well-covered by EBIT, operating cash flow inadequately covers debt obligations, highlighting ongoing liquidity challenges in its real estate operations.

- Navigate through the intricacies of Rank Progress with our comprehensive balance sheet health report here.

- Understand Rank Progress' track record by examining our performance history report.

Taking Advantage

- Investigate our full lineup of 291 European Penny Stocks right here.

- Want To Explore Some Alternatives? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com