Ligand Pharmaceuticals (LGND) Valuation After Its 2026 Royalty-Focused Earnings Outlook Drives Investor Interest

Ligand Pharmaceuticals (LGND) just put numbers around its 2026 outlook, projecting total revenue between $245 million and $285 million, with the bulk expected from royalty streams rather than product or contract sales.

See our latest analysis for Ligand Pharmaceuticals.

That forward look seems to be resonating with investors, with the share price now at $194.59 and a strong year to date share price return of 79.48 percent alongside a hefty 3 year total shareholder return of 190.30 percent, suggesting momentum is still firmly on the upside.

If this kind of guidance driven move has your attention, it might be worth exploring other healthcare stocks that could be setting up for their next leg higher.

With shares already up sharply and trading at a discount to analyst targets and some estimates of intrinsic value, the key question is whether Ligand remains mispriced or if the market has already factored in that future growth.

Most Popular Narrative: 18.1% Undervalued

With the narrative fair value sitting well above Ligand Pharmaceuticals last close of $194.59, the implied upside rests on ambitious but specific growth targets.

Strong revenue and earnings growth are expected as Ligand broadens its high-margin royalty portfolio, with multiple partnered drugs (such as O2vir, Filspari, Qarziba, and Zelsuvmi) in various stages of commercialization or late-stage development. This expanding royalty base enhances recurring revenue, earnings visibility, and long-term cash flow predictability.

Curious how recurring royalties, rising margins, and a richer earnings mix combine into that upside case? Want to see the exact assumptions powering this valuation engine?

Result: Fair Value of $237.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concentrated reliance on a handful of royalty assets, along with mounting drug pricing pressure, could quickly challenge those upbeat growth and valuation assumptions.

Find out about the key risks to this Ligand Pharmaceuticals narrative.

Another Lens on Value

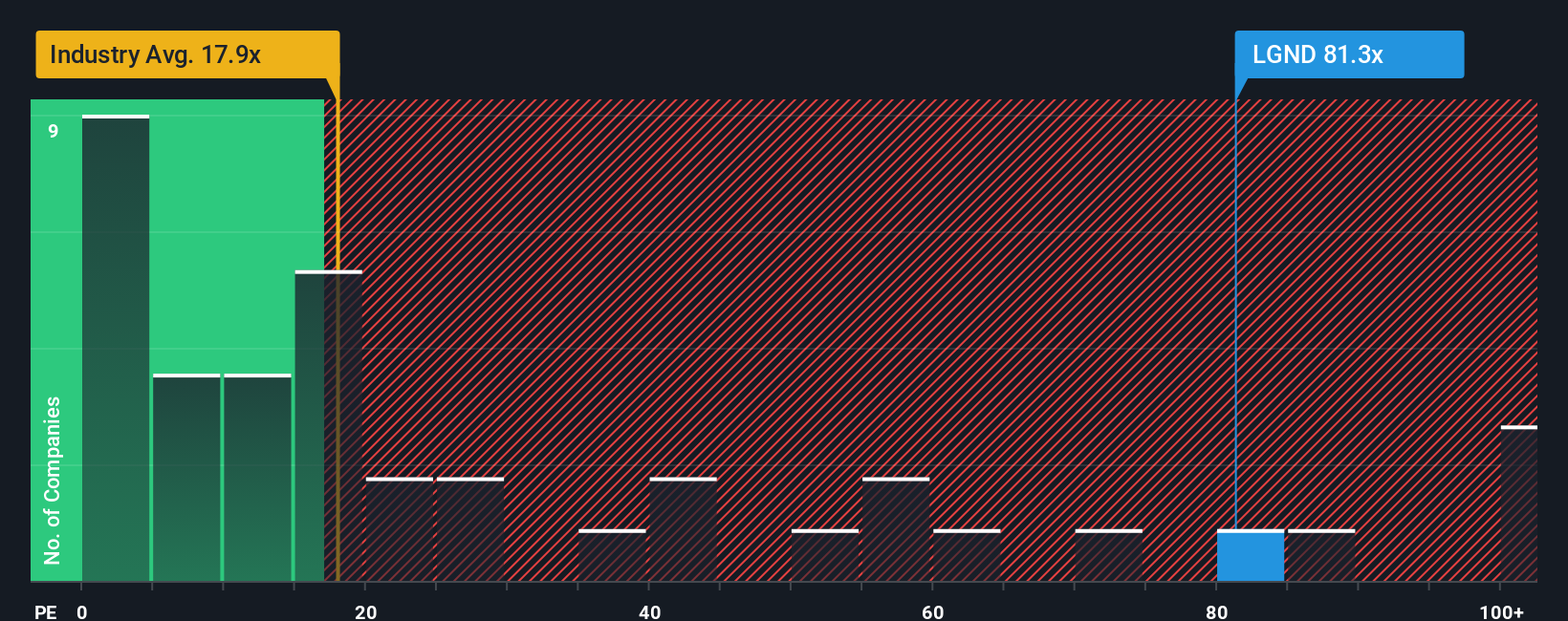

Step away from fair value estimates and the current price tells a different story. At about 78.8 times earnings, Ligand trades well above the US pharma average of 20.1 times and a fair ratio of 22.2 times, which hints at real multiple risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ligand Pharmaceuticals Narrative

If you see the story differently or want to dig into the numbers yourself, you can shape a custom view in minutes: Do it your way.

A great starting point for your Ligand Pharmaceuticals research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunity by using the Simply Wall St Screener to uncover focused ideas you will not want to overlook.

- Target potential big movers by scanning these 3642 penny stocks with strong financials that already show financial strength instead of just hype.

- Ride structural growth trends by zeroing in on these 26 AI penny stocks positioned at the forefront of intelligent automation.

- Secure value oriented ideas by filtering for these 13 dividend stocks with yields > 3% that can support both income and stability in your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com