Assessing Postal Savings Bank of China (SEHK:1658) Valuation After Its Governance Overhaul and Oversight Restructuring

Postal Savings Bank of China (SEHK:1658) just pushed through a sweeping governance overhaul, dissolving its Board of Supervisors and shifting those oversight powers to an empowered Audit Committee along with refreshed board committee mandates.

See our latest analysis for Postal Savings Bank of China.

The governance revamp lands after a solid run, with the share price at HK$5.16 and a year to date share price return of 14.41%. The 1 year total shareholder return of 21.25% and 5 year total shareholder return of 64.89% suggest long term momentum is still building.

If this governance reset has you thinking about where else capital and control are aligned, it might be worth exploring fast growing stocks with high insider ownership as your next discovery step.

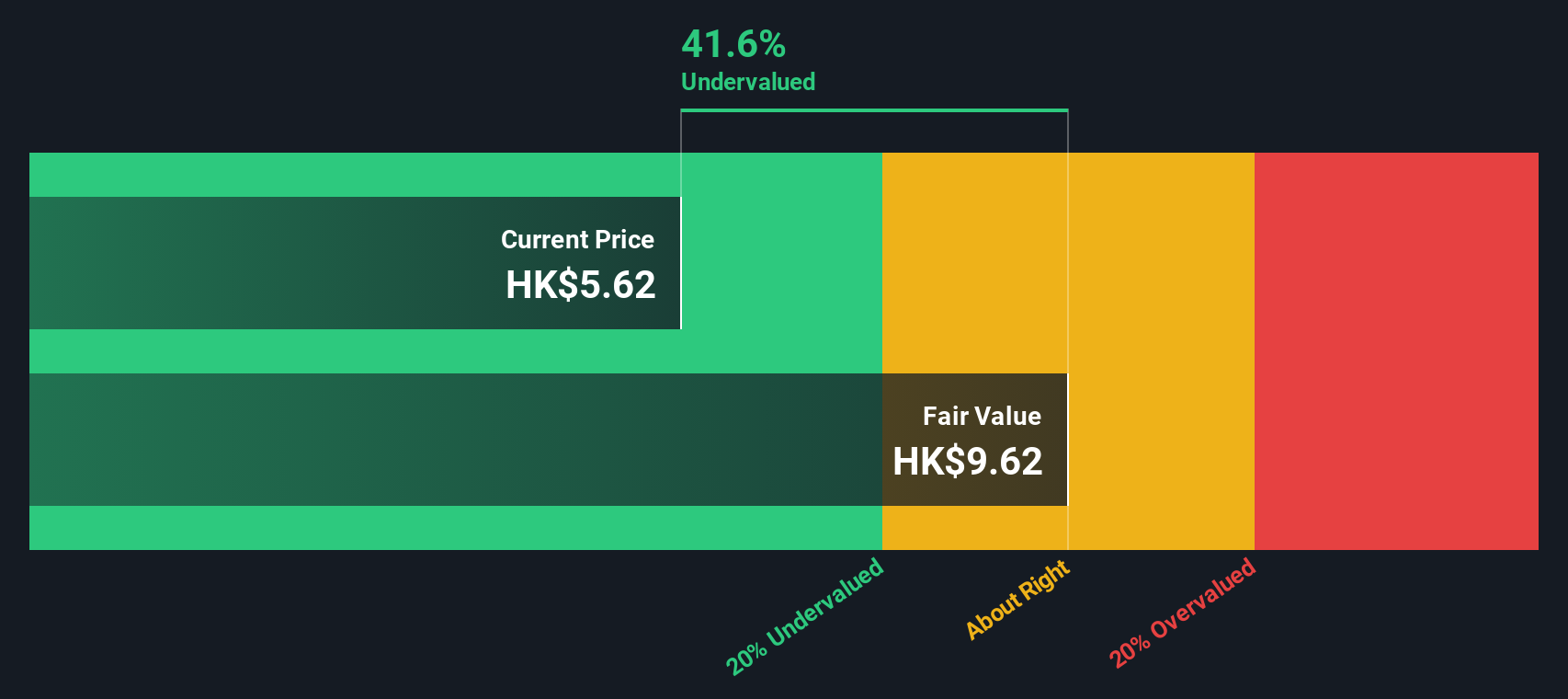

With earnings still growing, analysts seeing upside to the current price, and the shares trading at a hefty estimated intrinsic discount, the question now is simple: is this a buying opportunity, or is the market already pricing in that future growth?

Price-to-Earnings of 6.9x: Is it justified?

On a headline basis, Postal Savings Bank of China trades on a 6.9x price-to-earnings multiple at HK$5.16, which looks modest but not obviously cheap versus key benchmarks.

The price-to-earnings ratio compares the current share price with the company’s earnings per share. It is a core yardstick for valuing profitable banks. For Postal Savings Bank of China, earnings have grown around 5% per year over five years and are forecast to keep rising, but only in the mid single digit range. This implies the market is not paying up for aggressive profit acceleration.

Relative comparisons tell a more nuanced story. The 6.9x multiple sits above the Hong Kong banks industry average of 5.6x, suggesting the stock commands a premium to local peers. It still trades well below a broader peer average closer to 10x and roughly in line with its own estimated fair price-to-earnings ratio. That combination signals investors may already be pricing in steadier earnings quality and slightly faster top line growth than the market, while still leaving room for rerating if sentiment toward Chinese financials improves.

Explore the SWS fair ratio for Postal Savings Bank of China

Result: Price-to-Earnings of 6.9x (ABOUT RIGHT)

However, lingering concerns around China’s macro backdrop and tighter regulatory scrutiny on state controlled lenders could easily cap valuation upside, despite steady earnings progress.

Find out about the key risks to this Postal Savings Bank of China narrative.

Another View on Value

While the 6.9x earnings multiple feels roughly in line with expectations, our DCF model paints a sharper picture, suggesting fair value closer to HK$9.82, around 47% above today’s HK$5.16. Is the market overlooking steady compounding, or are the cash flow assumptions too generous?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Postal Savings Bank of China for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 912 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Postal Savings Bank of China Narrative

If you see things differently, or would rather dig into the numbers yourself, you can quickly craft a personalised view in just a few minutes, Do it your way.

A great starting point for your Postal Savings Bank of China research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next moves with targeted stock ideas from the Simply Wall St Screener so you are not leaving opportunities on the table.

- Capture potential price rebounds by scanning these 912 undervalued stocks based on cash flows that may be trading below what their cash flows suggest they are worth.

- Ride the next wave of innovation by focusing on these 26 AI penny stocks positioned at the heart of the artificial intelligence boom.

- Strengthen your portfolio’s income engine with these 13 dividend stocks with yields > 3% that can help you target reliable cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com