The Bull Case For Dassault Aviation (ENXTPA:AM) Could Change Following Expanded Falcon 6X Fuselage Production In India

- On 5 December 2025, Dynamatic Technologies Limited announced an expanded agreement with Dassault Aviation to manufacture and assemble the complete rear fuselage (Section 5) of the Falcon 6X, building on its earlier work industrialising the rear fuel tank already in commercial production.

- This deeper manufacturing role not only strengthens Dassault Aviation’s supply chain for the Falcon 6X, but also broadens its industrial footprint in India under the Make in India policy, potentially supporting production resilience and local aerospace know-how.

- We’ll now explore how expanding Falcon 6X rear fuselage production in India could influence Dassault Aviation’s investment narrative and long-term positioning.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Dassault Aviation société anonyme Investment Narrative Recap

To own Dassault Aviation, you need to believe in the twin engines of Rafale defense demand and a successful Falcon business jet refresh, particularly the 6X and 10X. The Dynamatic agreement modestly supports the near term Falcon 6X ramp up by adding redundancy in a supply chain that remains one of the key operational risks, while demand softness or slower-than-hoped Falcon adoption still looks like the most important short term swing factor.

The June 2025 production transfer agreements with Tata Advanced Systems for Rafale fuselage sections and the creation of an Indian Falcon Center of Excellence tie directly into this newer Falcon 6X fuselage work with Dynamatic. Together, they underline Dassault’s push to embed production capacity in India, which could incrementally ease supply bottlenecks and support its delivery targets if execution stays on track.

Yet while this deepening India footprint can help diversify production, investors should also be aware of the risk that persistent supplier delays could still...

Read the full narrative on Dassault Aviation société anonyme (it's free!)

Dassault Aviation société anonyme's narrative projects €10.6 billion revenue and €1.6 billion earnings by 2028. This requires 16.4% yearly revenue growth and about a €0.8 billion earnings increase from €782.1 million today.

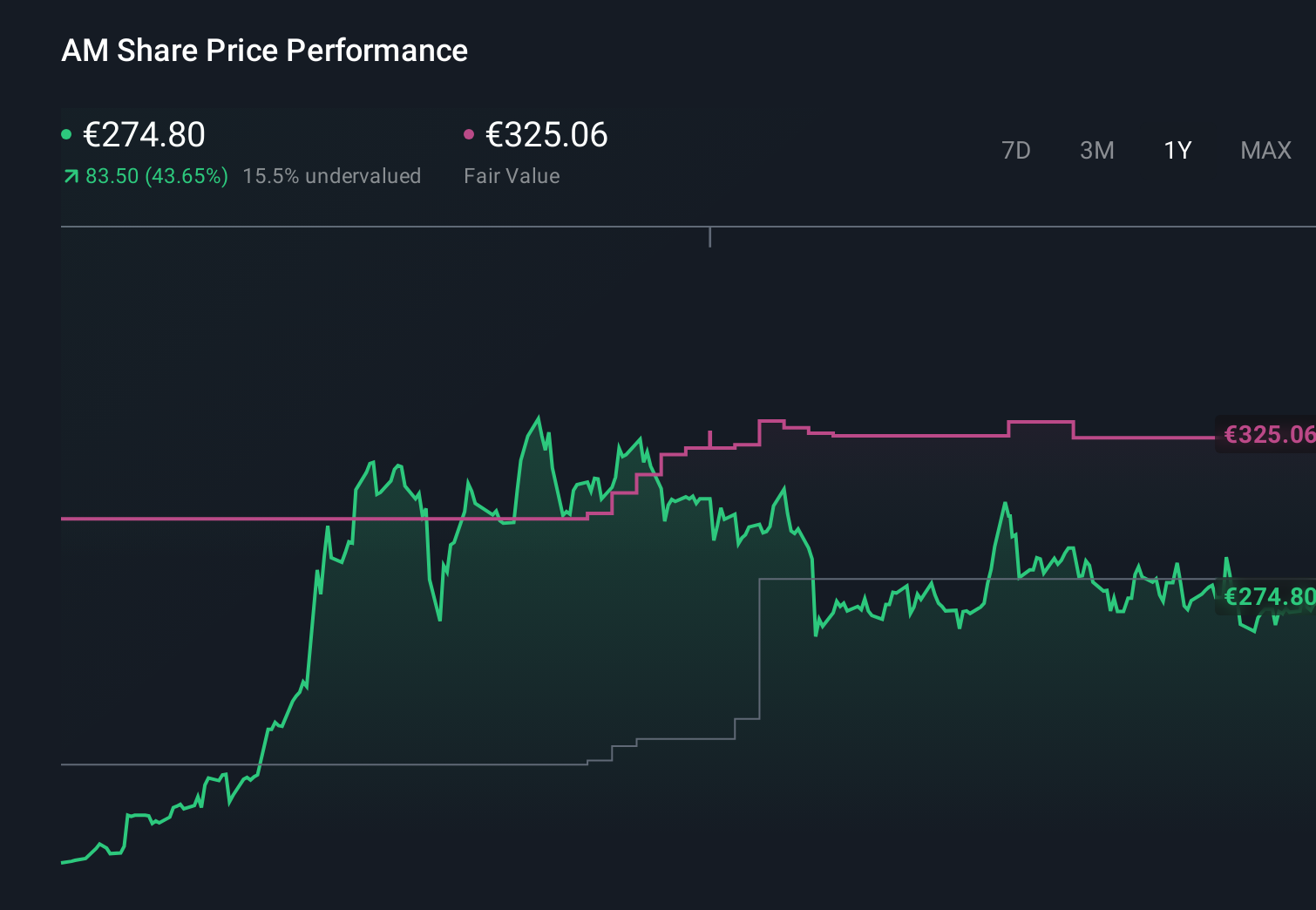

Uncover how Dassault Aviation société anonyme's forecasts yield a €325.06 fair value, a 21% upside to its current price.

Exploring Other Perspectives

Twelve members of the Simply Wall St Community currently place Dassault’s fair value between €242.99 and an upper extreme of about €1,028, highlighting very different views on upside. Against this backdrop, the Falcon 6X ramp and expanding Indian manufacturing footprint stand out as catalysts that could influence how reliably Dassault turns its backlog into future revenue and profit, so it is worth comparing several of these perspectives before forming a view.

Explore 12 other fair value estimates on Dassault Aviation société anonyme - why the stock might be worth over 3x more than the current price!

Build Your Own Dassault Aviation société anonyme Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dassault Aviation société anonyme research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Dassault Aviation société anonyme research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dassault Aviation société anonyme's overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com