Global Dividend Stocks: 3 Top Picks For Income Investors

As global markets navigate a complex landscape marked by interest rate adjustments and mixed economic signals, investors are increasingly turning their attention to income-generating opportunities. In this environment, dividend stocks can offer a balanced approach to investing, providing both potential for steady income and the possibility of capital appreciation.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.63% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.20% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.62% | ★★★★★★ |

| NCD (TSE:4783) | 4.05% | ★★★★★★ |

| Kyoritsu Electric (TSE:6874) | 3.71% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.03% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.06% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.43% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.59% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.87% | ★★★★★★ |

Click here to see the full list of 1321 stocks from our Top Global Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

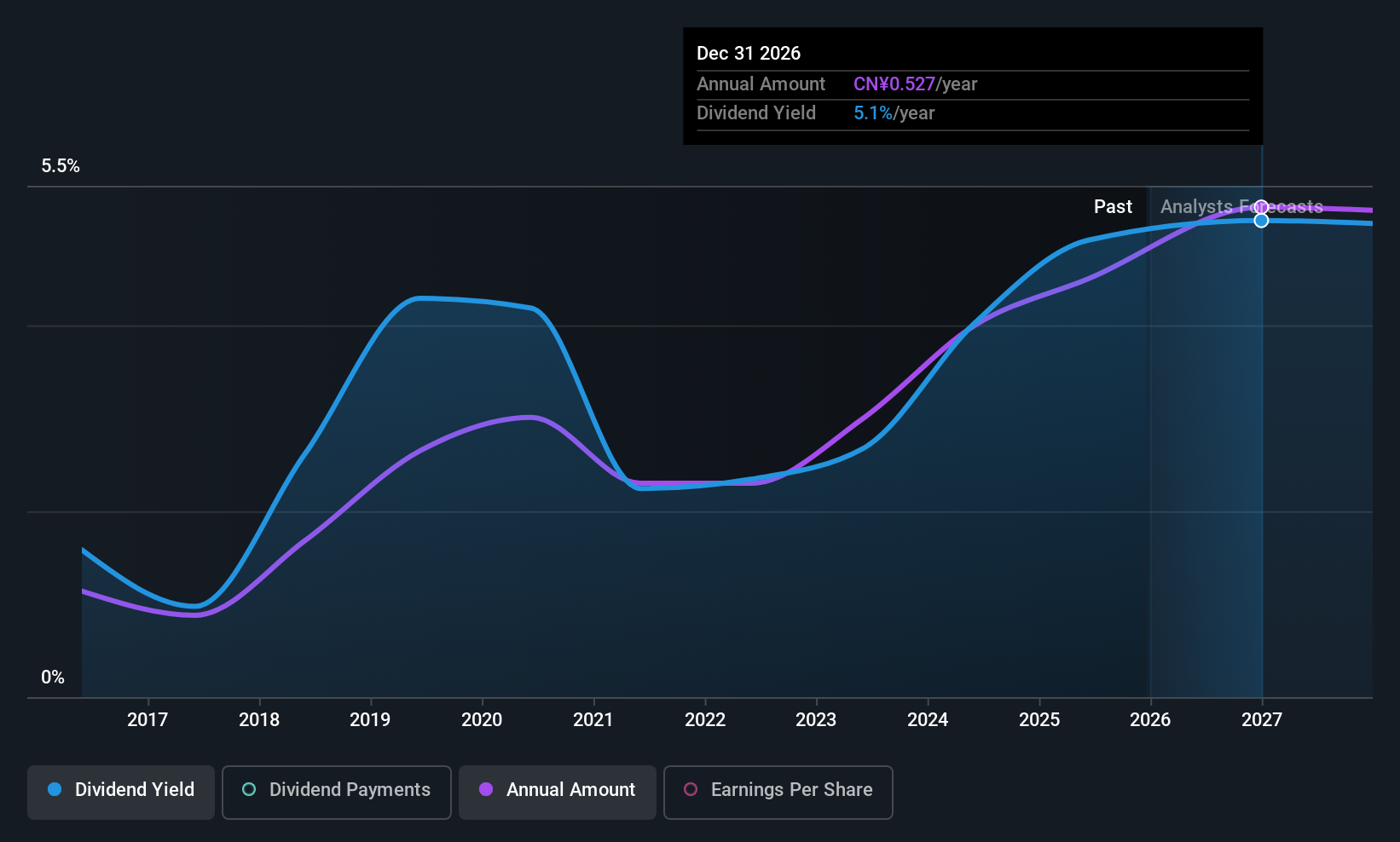

Sinoma International EngineeringLtd (SHSE:600970)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sinoma International Engineering Co., Ltd operates in engineering, equipment manufacturing and supply both in China and internationally, with a market cap of CN¥25.69 billion.

Operations: Sinoma International Engineering Co., Ltd generates revenue primarily from its Heavy Construction segment, which accounts for CN¥47.39 billion.

Dividend Yield: 4.4%

Sinoma International Engineering Ltd. offers a dividend yield of 4.42%, placing it in the top 25% of CN market payers, yet its dividends are not well covered by free cash flow, with a high cash payout ratio of 90.7%. Although earnings cover the dividends with a low payout ratio of 39.5%, past dividend payments have been volatile and unreliable, experiencing significant drops over the last decade despite some growth trends.

- Get an in-depth perspective on Sinoma International EngineeringLtd's performance by reading our dividend report here.

- Our expertly prepared valuation report Sinoma International EngineeringLtd implies its share price may be lower than expected.

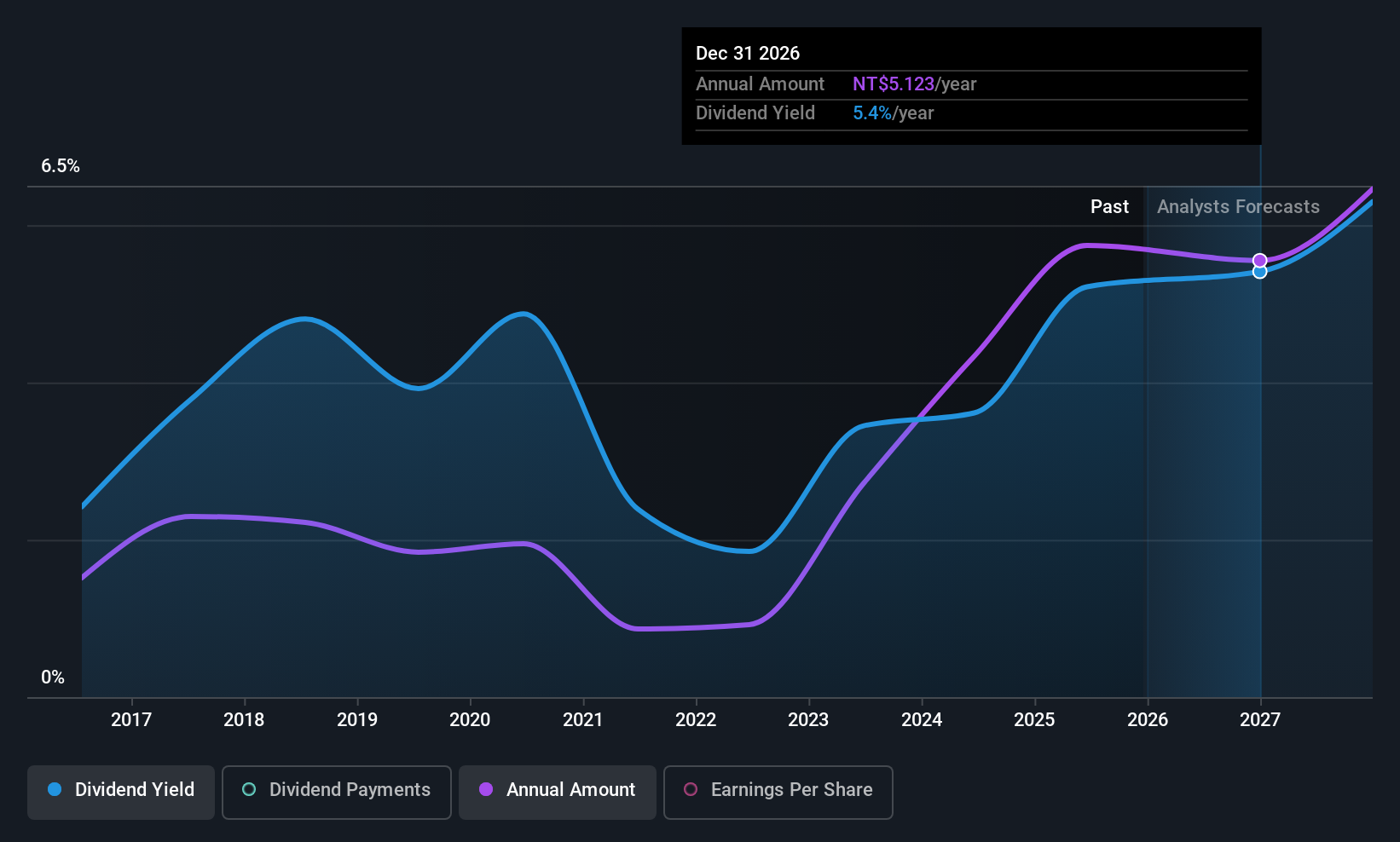

Tong Yang Industry (TWSE:1319)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tong Yang Industry Co., Ltd. manufactures and sells automobile parts, components, and models in Taiwan, China, the United States, and internationally with a market cap of NT$54.77 billion.

Operations: Tong Yang Industry Co., Ltd. generates revenue primarily from its Domestic Operating Entity, contributing NT$20.11 billion, and its Foreign Operating Entities, which add NT$5.40 billion.

Dividend Yield: 5.5%

Tong Yang Industry's dividend yield of 5.55% ranks in the top 25% of Taiwan's market, but its sustainability is questionable due to a high cash payout ratio of 102.1%, indicating dividends are not well covered by cash flows. Despite being undervalued and having potential for stock price appreciation, its dividend history has been volatile over the past decade, with payments not consistently reliable or stable despite some growth trends.

- Dive into the specifics of Tong Yang Industry here with our thorough dividend report.

- The analysis detailed in our Tong Yang Industry valuation report hints at an deflated share price compared to its estimated value.

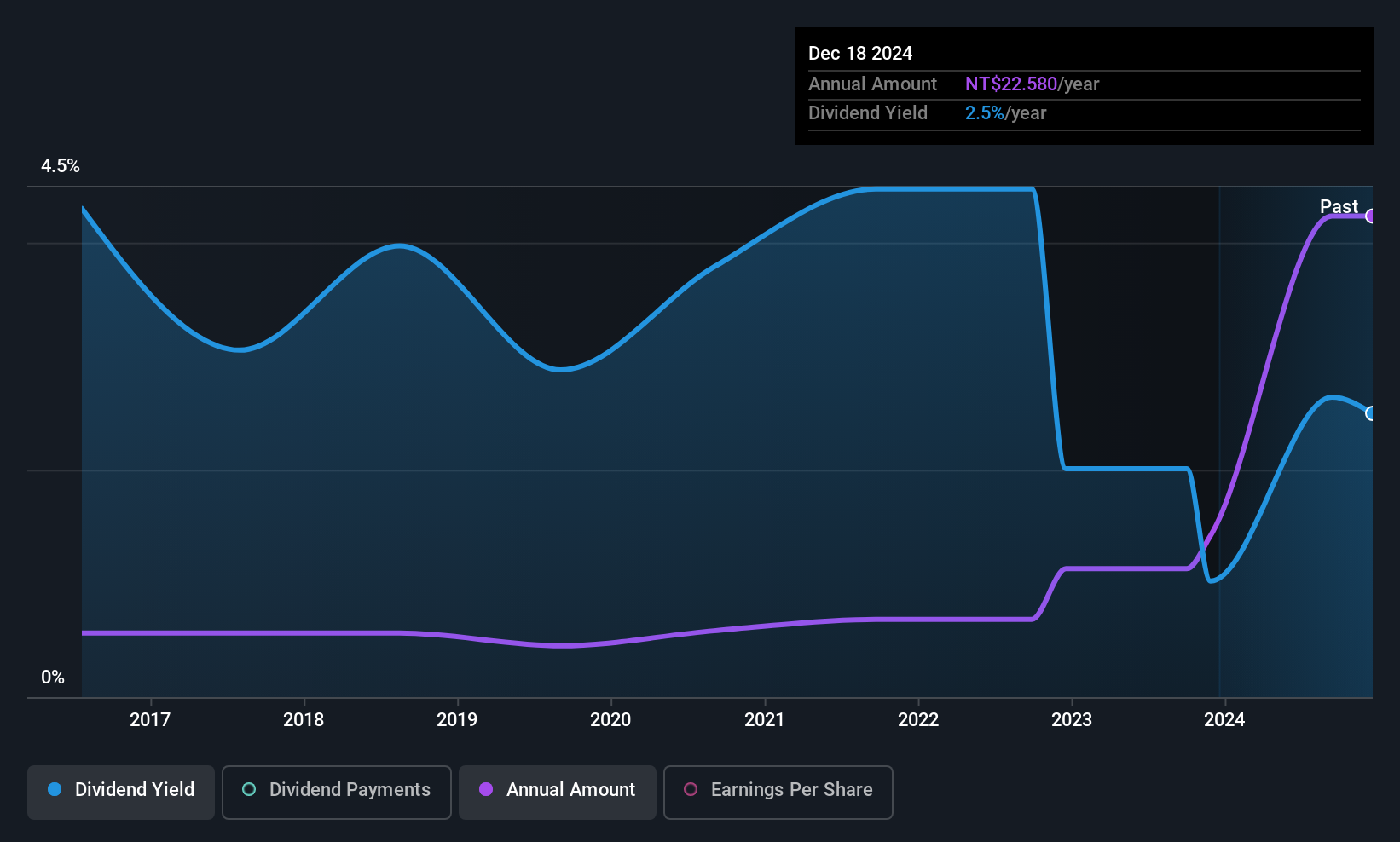

Jinan Acetate Chemical (TWSE:4763)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jinan Acetate Chemical Co., Ltd. operates in the research, development, production, and sale of cellulose acetate and related products across Asia, Europe, America, and Africa with a market capitalization of approximately NT$52.33 billion.

Operations: Jinan Acetate Chemical Co., Ltd.'s revenue from the production and sale of cellulose acetate amounts to NT$14.99 billion.

Dividend Yield: 9.2%

Jinan Acetate Chemical's dividend yield of 9.17% places it among the top 25% in Taiwan, yet sustainability concerns arise due to a high cash payout ratio of 108.1%, indicating dividends are not well supported by cash flows. Despite trading below estimated fair value and having a reasonable earnings payout ratio of 58.9%, its dividend history has been volatile and unreliable over the past decade, despite some growth in payments.

- Click here and access our complete dividend analysis report to understand the dynamics of Jinan Acetate Chemical.

- According our valuation report, there's an indication that Jinan Acetate Chemical's share price might be on the cheaper side.

Summing It All Up

- Take a closer look at our Top Global Dividend Stocks list of 1321 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com