High Growth Tech Stocks Including AsiaInfo Technologies And Two More With Promising Potential

As global markets experience fluctuations, with the Federal Reserve's recent interest rate cut boosting major U.S. indices to record highs while concerns over tech valuations weigh on the Nasdaq Composite, investors are closely monitoring small-cap stocks like those in the Russell 2000 Index for potential opportunities. In this dynamic environment, high-growth tech stocks such as AsiaInfo Technologies and others can be appealing due to their innovative capabilities and potential to adapt swiftly to changing market conditions, making them worth exploring for their promising growth prospects.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shengyi TechnologyLtd | 21.48% | 32.83% | ★★★★★★ |

| Fositek | 37.83% | 51.54% | ★★★★★★ |

| Giant Network Group | 34.73% | 40.54% | ★★★★★★ |

| Gold Circuit Electronics | 29.41% | 37.22% | ★★★★★★ |

| Hacksaw | 32.86% | 37.50% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| KebNi | 25.19% | 61.24% | ★★★★★★ |

| CD Projekt | 37.82% | 51.75% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

AsiaInfo Technologies (SEHK:1675)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AsiaInfo Technologies Limited is an investment holding company that provides telecom software products and related services in the People’s Republic of China, with a market capitalization of HK$6.93 billion.

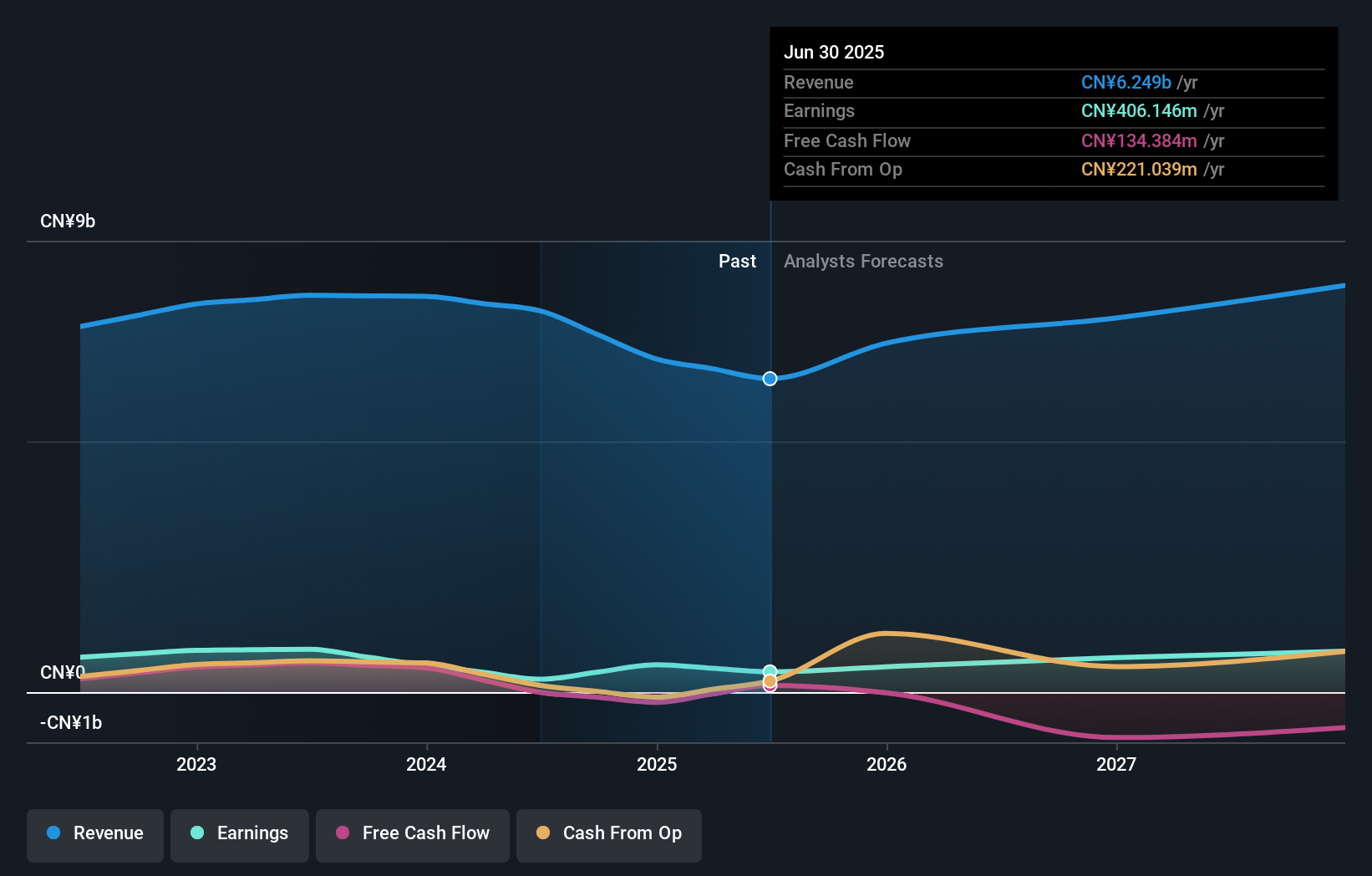

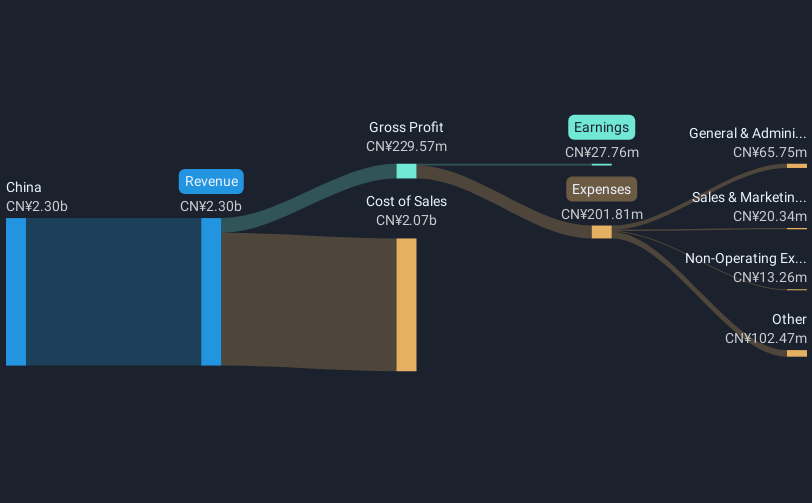

Operations: AsiaInfo Technologies generates revenue primarily from its communications software segment, amounting to CN¥6.25 billion.

AsiaInfo Technologies has demonstrated robust financial and strategic growth, particularly highlighted by its recent alliance with Alibaba Cloud. This partnership not only boosts its capabilities in AI and cloud computing but also aligns with industry trends towards deep learning and large model applications, promising enhanced competitive edges. Financially, AsiaInfo is on a positive trajectory with earnings expected to surge by 21.7% annually, outpacing the Hong Kong market's average of 12.1%. Moreover, its revenue growth at 9.3% annually surpasses the local market forecast of 8.5%, underscoring its potential in a dynamic tech landscape. This performance is supported by significant R&D investments tailored to spearhead innovations in AI-native applications and cloud solutions, ensuring sustained growth amidst evolving technological demands.

- Dive into the specifics of AsiaInfo Technologies here with our thorough health report.

Gain insights into AsiaInfo Technologies' past trends and performance with our Past report.

Hengdian EntertainmentLTD (SHSE:603103)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hengdian Entertainment Co., LTD operates in China focusing on film and television investment, production, distribution, film screening, and related derivative businesses with a market cap of CN¥9.85 billion.

Operations: The company generates revenue primarily through film screening and related derivative businesses in China. It is involved in the entire value chain of film and television, including investment, production, and distribution.

Hengdian EntertainmentLTD, transitioning into a high-growth trajectory, reported a significant surge in net income to CN¥206 million from CN¥17.39 million year-over-year, underpinned by robust sales growth of 14.8% annually. This performance is notably ahead of the broader Chinese market's growth rate of 14.5%, reflecting effective adaptation to industry demands and consumer preferences. The company's commitment to innovation is evident from its R&D spending trends, which are crucial for sustaining its competitive edge in the entertainment sector. Moreover, with earnings forecasted to grow at an impressive rate of 79% annually—triple the national average—Hengdian is poised for continued success in leveraging technological advancements and content diversification.

Taiwan Union Technology (TPEX:6274)

Simply Wall St Growth Rating: ★★★★★★

Overview: Taiwan Union Technology Corporation focuses on the production and distribution of copper clad laminates across Asia and international markets, with a market capitalization of NT$117.03 billion.

Operations: The company generates revenue primarily from two segments: foreign sales and manufacturing, contributing NT$16.49 billion, and domestic sales and manufacturing, accounting for NT$11.03 billion.

Taiwan Union Technology has demonstrated robust financial performance with a notable increase in sales, reaching TWD 8.06 billion this quarter, up from TWD 6.62 billion the previous year, reflecting a growth of 21.7%. This surge aligns with its earnings growth of 32.9% annually and an impressive forecasted annual earnings growth rate of 37.3%, significantly outpacing the broader Electronic industry's average of 6.6%. The company's aggressive investment in R&D is pivotal, ensuring it stays ahead in innovation amidst fierce market competition. With revenue expected to climb by 24.7% annually, Taiwan Union is well-positioned to leverage its technological advancements for sustained future growth.

Key Takeaways

- Gain an insight into the universe of 248 Global High Growth Tech and AI Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com