Teradata (TDC): Reassessing Valuation After a 35% Three-Month Share Price Rebound

Teradata (TDC) shares have quietly outpaced the broader software space over the past 3 months, climbing around 35%, even as the stock is still down over the past year and year to date.

See our latest analysis for Teradata.

The recent 30 day share price return of 14.35%, and 34.53% over 90 days, suggests momentum is rebuilding after a tougher stretch, even though the 1 year total shareholder return remains slightly negative.

If Teradata’s move has you watching software names more closely, this could be a good moment to scout other high growth tech and AI stocks that are starting to build momentum too.

With shares still below their five year total return high despite improving profitability and a hefty estimated intrinsic value gap, is Teradata quietly undervalued here, or are markets already factoring in the next leg of growth?

Most Popular Narrative Narrative: 7.5% Overvalued

With Teradata’s shares now trading modestly above the most widely followed fair value estimate of $27.80, the narrative sees only limited upside at current levels.

Recent organizational streamlining, leadership changes, and integration of go to market, product, and marketing functions are expected to create meaningful operating leverage, reduce SG&A and service related costs, and ultimately expand net margins and free cash flow as recurring revenue becomes a larger portion of the business.

Explore how modest revenue expectations can still underpin a richer earnings multiple and expanding margins over time, and see which earnings and cash flow levers carry this story.

Result: Fair Value of $27.8 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent revenue declines and intensifying competition from cloud hyperscalers could pressure Teradata’s margins and challenge assumptions that support today’s modestly overvalued narrative.

Find out about the key risks to this Teradata narrative.

Another Angle on Valuation

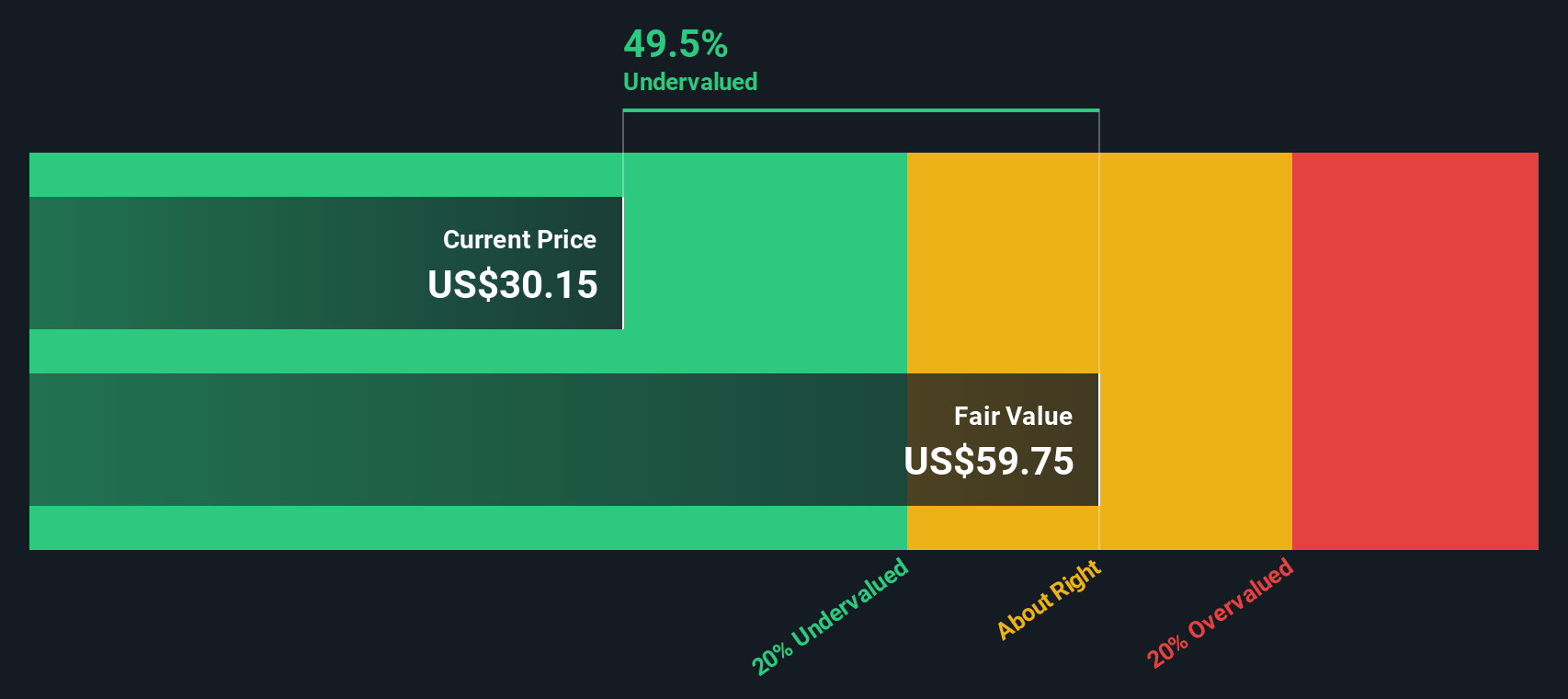

While the most popular narrative calls Teradata about 7.5% overvalued at $27.80, our DCF model paints a very different picture and suggests fair value closer to $59.60, almost 50% above today’s price. Is the market underestimating cash flow durability, or is the model too generous on growth and margins?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Teradata Narrative

If you see Teradata’s story differently or want to dive deeper into the numbers yourself, you can build a custom view in just minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Teradata.

Ready for your next investing move?

Before the market’s next swing leaves you second guessing, put your watchlist to work with fresh ideas from powerful screeners designed to highlight potential opportunities.

- Scan these 3641 penny stocks with strong financials to explore companies that already show robust balance sheets and improving fundamentals.

- Use these 26 AI penny stocks to find businesses that are focused on intelligent software and infrastructure as automation evolves.

- Review these 13 dividend stocks with yields > 3% for stocks that combine appealing yields with payout ratios and cash flows that appear more stable.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com