Acushnet (GOLF) Valuation Check After New $500M Bond Issue, Analyst Upgrade and FootJoy Insider Sale

Acushnet Holdings (GOLF) just tapped the bond market, issuing $500 million in senior notes to reshape its debt stack, while an insider sale and a bullish post earnings analyst update put the stock under a brighter spotlight.

See our latest analysis for Acushnet Holdings.

At $83.55, Acushnet’s recent bond deal, steady mid single digit revenue growth, and the FootJoy insider sale are landing against a backdrop of solid momentum, with a roughly mid teens year to date share price return and a near triple digit three year total shareholder return suggesting long term confidence remains intact even as short term expectations reset.

If this kind of steady compounder has your attention, it might be a good moment to broaden your watchlist and explore fast growing stocks with high insider ownership.

With steady growth, a fresh bond deal, and shares now hovering above the Street’s target but well below some intrinsic value estimates, is Acushnet an overlooked compounder, or is the market already pricing in its next decade of gains?

Most Popular Narrative: 6% Overvalued

With Acushnet closing at $83.55 versus a most popular narrative fair value of about $79, the story leans toward a modestly stretched price built on steady, not explosive, expectations.

Analysts expect earnings to reach $208.8 million (and earnings per share of $3.88) by about September 2028, down from $230.0 million today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as $245.7 million.

Curious how a flat to slightly lower earnings path can still support a premium earnings multiple and ongoing buybacks, all under a firm discount rate spine? The full narrative unpacks the growth, margin, and multiple math driving that fair value call.

Result: Fair Value of $79 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained growth in global golf participation and stronger than expected demand for premium launches could support higher revenue and margins than this narrative assumes.

Find out about the key risks to this Acushnet Holdings narrative.

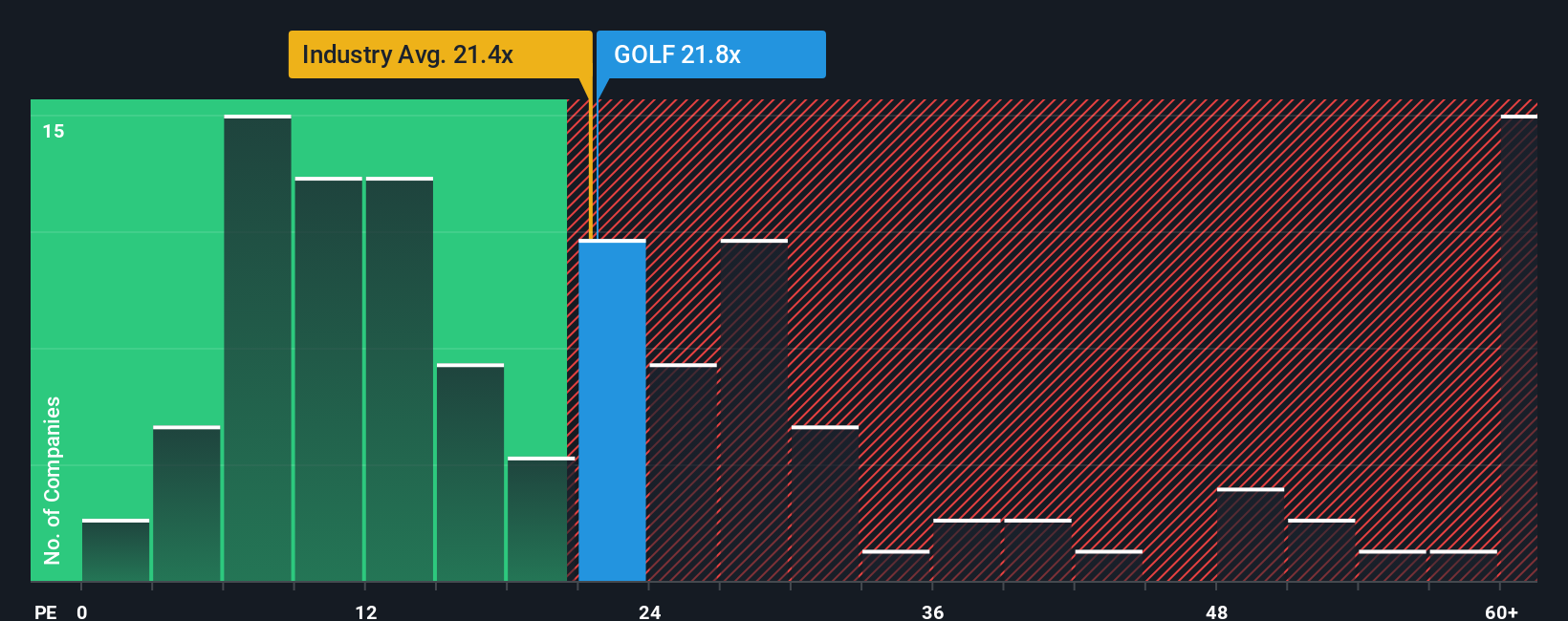

Another View: Market Ratios Send a Mixed Signal

On simple valuation ratios, Acushnet looks more demanding. The current P/E of about 22x sits just above the global leisure average of 21x and well above its own fair ratio of 15x. This implies the market could re rate the stock lower if growth or margins disappoint.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Acushnet Holdings Narrative

If this take does not quite fit your view, or you would rather dig into the numbers yourself, you can build a personalized narrative in under three minutes by starting with Do it your way.

A great starting point for your Acushnet Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Before you move on, lock in your next opportunity by using the Simply Wall Street Screener to pinpoint stocks that truly match your strategy and goals.

- Capture potential market mispricings by targeting companies trading below their intrinsic value with these 910 undervalued stocks based on cash flows tailored to investors hunting for upside.

- Position yourself at the forefront of technological disruption by focusing on these 26 AI penny stocks that are harnessing artificial intelligence to reshape entire industries.

- Strengthen your portfolio’s income stream by zeroing in on these 13 dividend stocks with yields > 3% that can help you build consistent, compounding cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com