3 European Dividend Stocks Yielding Over 3.1%

As Europe navigates a mixed economic landscape, with indices like the STOXX Europe 600 showing slight declines and varied performances across major markets, investors are closely watching central bank policies and economic data for cues. In such an environment, dividend stocks yielding over 3.1% can offer potential stability and income, making them attractive options for those looking to balance risk with steady returns amidst fluctuating market conditions.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.16% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.62% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.12% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.88% | ★★★★★★ |

| Evolution (OM:EVO) | 4.82% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.11% | ★★★★★★ |

| Credito Emiliano (BIT:CE) | 4.93% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.35% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.30% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.47% | ★★★★★☆ |

Click here to see the full list of 207 stocks from our Top European Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

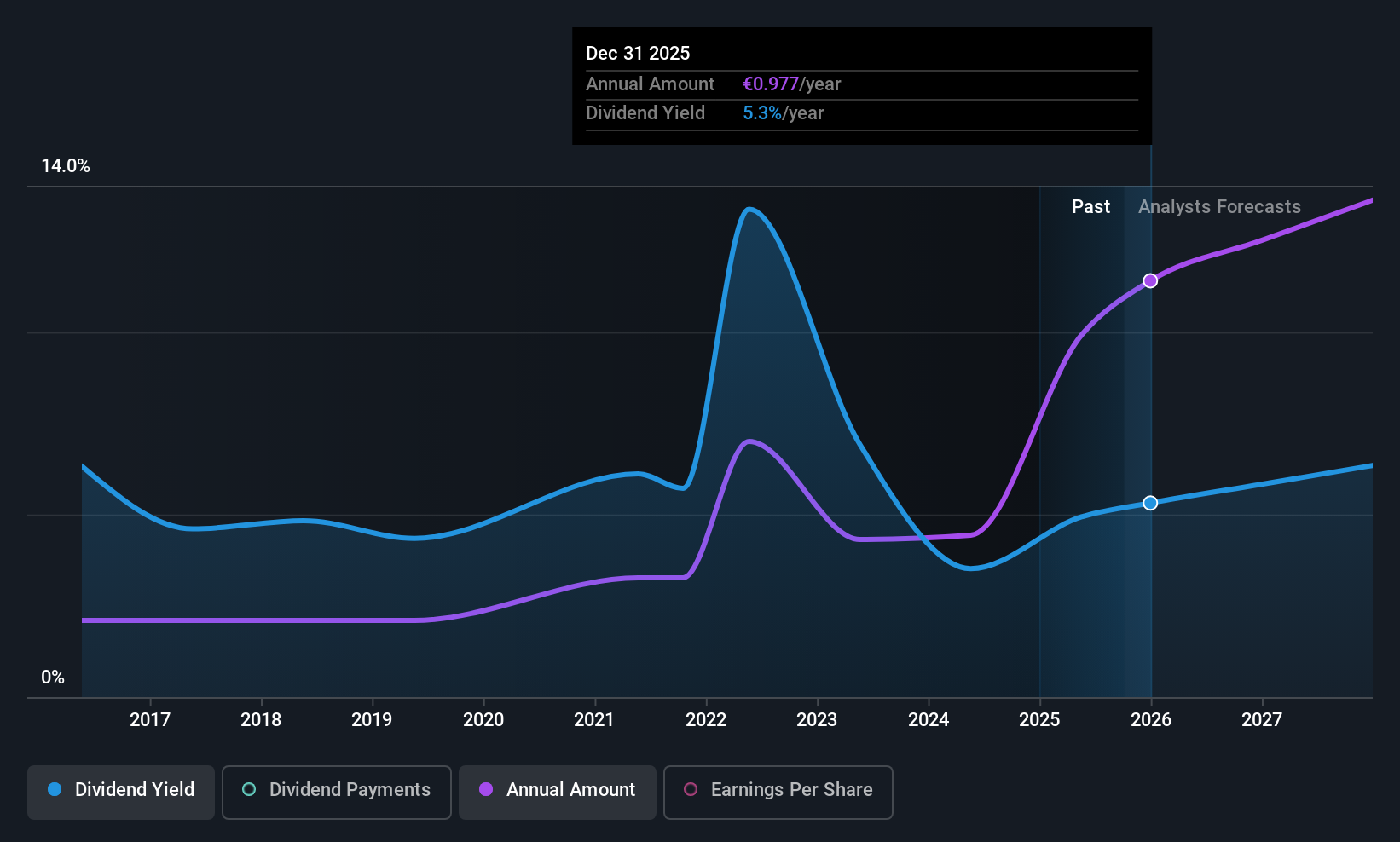

Unipol Assicurazioni (BIT:UNI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Unipol Assicurazioni S.p.A., along with its subsidiaries, offers insurance products and services mainly in Italy, with a market cap of €14.42 billion.

Operations: Unipol Assicurazioni S.p.A. generates its revenue primarily from the Insurance - Non-Life Business segment at €9.74 billion and the Insurance - Life Business segment at €875 million, alongside contributions from Banking Associates amounting to €394 million.

Dividend Yield: 4.2%

Unipol Assicurazioni's dividends are covered by earnings with a payout ratio of 54.1% and well-supported by cash flows, indicated by a low cash payout ratio of 20.6%. While the dividend yield is lower than the top Italian payers at 4.23%, it trades at good value relative to peers, being 18.7% below its estimated fair value. However, the dividend track record has been volatile over the past decade despite overall growth in payments.

- Get an in-depth perspective on Unipol Assicurazioni's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Unipol Assicurazioni is priced lower than what may be justified by its financials.

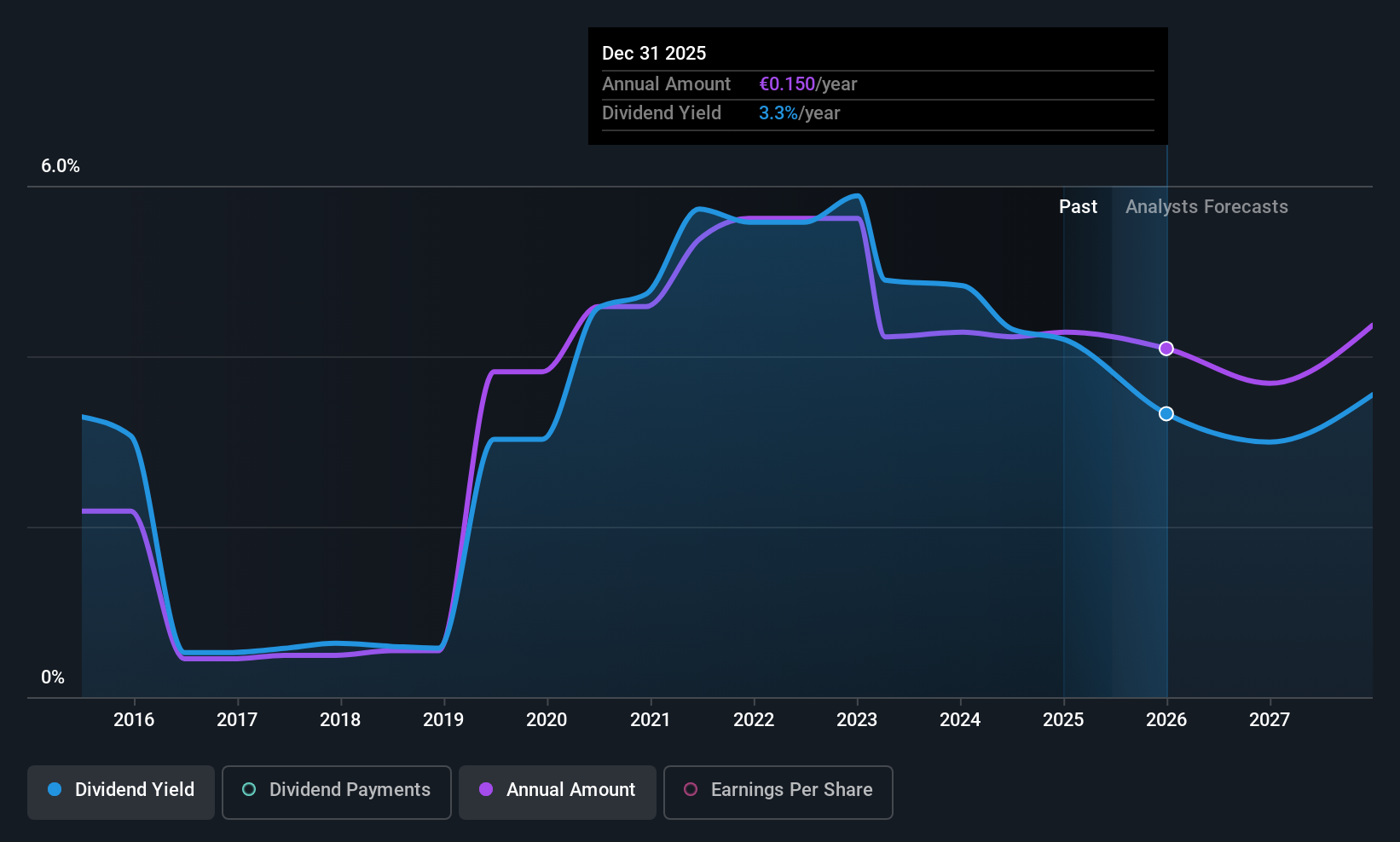

Faes Farma (BME:FAE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Faes Farma, S.A. is engaged in the research, development, production, and marketing of pharmaceutical products, healthcare products, and raw materials on an international scale with a market cap of approximately €1.53 billion.

Operations: Faes Farma generates revenue primarily from its Pharmaceutical Specialties and Healthcare segment, which accounts for €502.31 million, and its Nutrition and Animal Health segment, contributing €70.90 million.

Dividend Yield: 3.2%

Faes Farma's dividend payments are covered by earnings, with a payout ratio of 50.3%, and cash flows, with a cash payout ratio of 67.4%. Although the yield is lower than top Spanish payers at 3.19%, it trades at good value, being 41.2% below its estimated fair value. Despite past volatility in dividends, recent earnings growth may support future stability; however, net income slightly declined to €73.56 million for the nine months ended September 2025 compared to last year.

- Click here to discover the nuances of Faes Farma with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Faes Farma's share price might be too pessimistic.

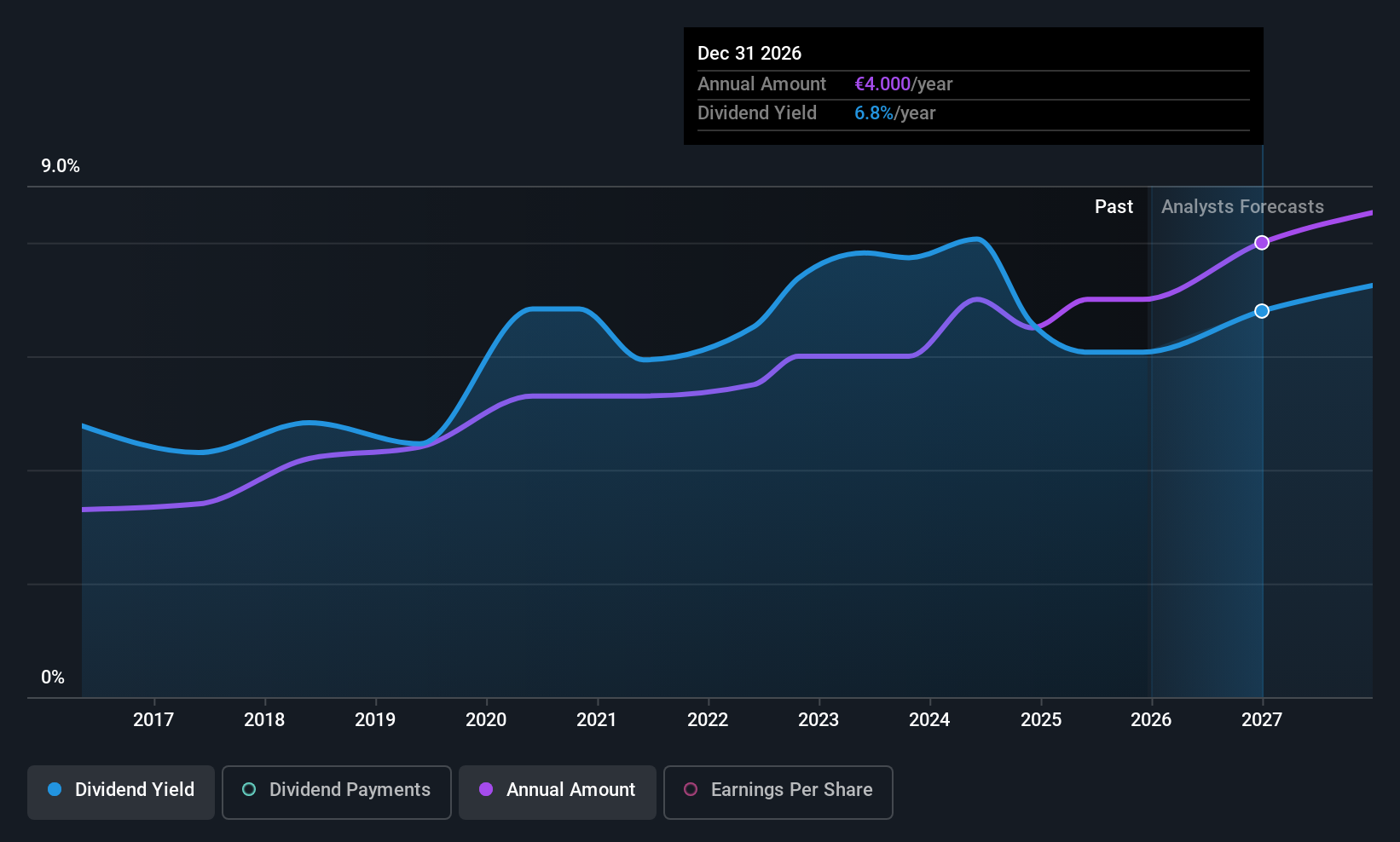

ageas (ENXTBR:AGS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ageas SA/NV, with a market cap of €11.26 billion, operates in the insurance industry through its subsidiaries.

Operations: Ageas SA/NV generates revenue through its Life insurance segment (€2.67 billion) and Non-Life insurance segment (€6.00 billion).

Dividend Yield: 5.9%

Ageas offers a reliable dividend yield of 5.93%, though it trails the top Belgian payers. Its dividends are well supported by earnings and cash flows, with payout ratios of 55.9% and 46.2%, respectively, reflecting sustainability. Over the past decade, Ageas has maintained stable and growing dividend payments. The stock trades at significant value, being 62.1% below estimated fair value, while recent moves include acquiring a remaining stake in AG Insurance SA/NV to consolidate its holdings further.

- Click here and access our complete dividend analysis report to understand the dynamics of ageas.

- The analysis detailed in our ageas valuation report hints at an deflated share price compared to its estimated value.

Taking Advantage

- Click here to access our complete index of 207 Top European Dividend Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com