3 European Growth Stocks With At Least 10% Insider Ownership

In recent weeks, the European market has experienced mixed performance, with the pan-European STOXX Europe 600 Index ending slightly lower and major stock indexes showing varied results. Amid these fluctuations, growth companies with significant insider ownership can offer unique insights into potential investment opportunities, as high insider stakes often indicate confidence in a company's long-term prospects.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Warimpex Finanz- und Beteiligungs (WBAG:WXF) | 25.9% | 100.6% |

| S.M.A.I.O (ENXTPA:ALSMA) | 16.1% | 72.8% |

| Skolon (OM:SKOLON) | 38.3% | 126.5% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| DNO (OB:DNO) | 13.5% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 66.1% |

| CD Projekt (WSE:CDR) | 29.7% | 51.8% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 49.6% |

Let's uncover some gems from our specialized screener.

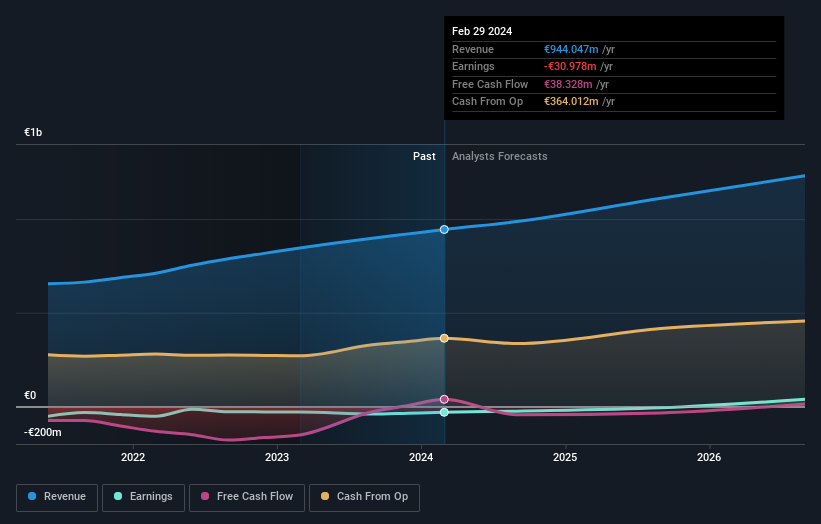

OVH Groupe (ENXTPA:OVH)

Simply Wall St Growth Rating: ★★★★★☆

Overview: OVH Groupe S.A. is a global provider of public and private cloud services, shared hosting, and dedicated server solutions with a market cap of approximately €1.03 billion.

Operations: The company's revenue segments consist of Web Cloud (€193.80 million), Private Cloud (€671.60 million), and Advertising, Publishing, and Public Relations (€219.20 million).

Insider Ownership: 12.7%

OVH Groupe, a leading European cloud provider, is experiencing significant earnings growth with forecasts of 64.5% annually, outpacing the French market. Despite high volatility in its share price and challenges covering interest payments with earnings, OVH's return on equity is expected to be very high at 40.8% in three years. Recent strategic partnerships and expansions into Germany highlight its commitment to international growth and technological innovation amidst evolving governance structures under founder Octave Klaba's leadership.

- Unlock comprehensive insights into our analysis of OVH Groupe stock in this growth report.

- According our valuation report, there's an indication that OVH Groupe's share price might be on the expensive side.

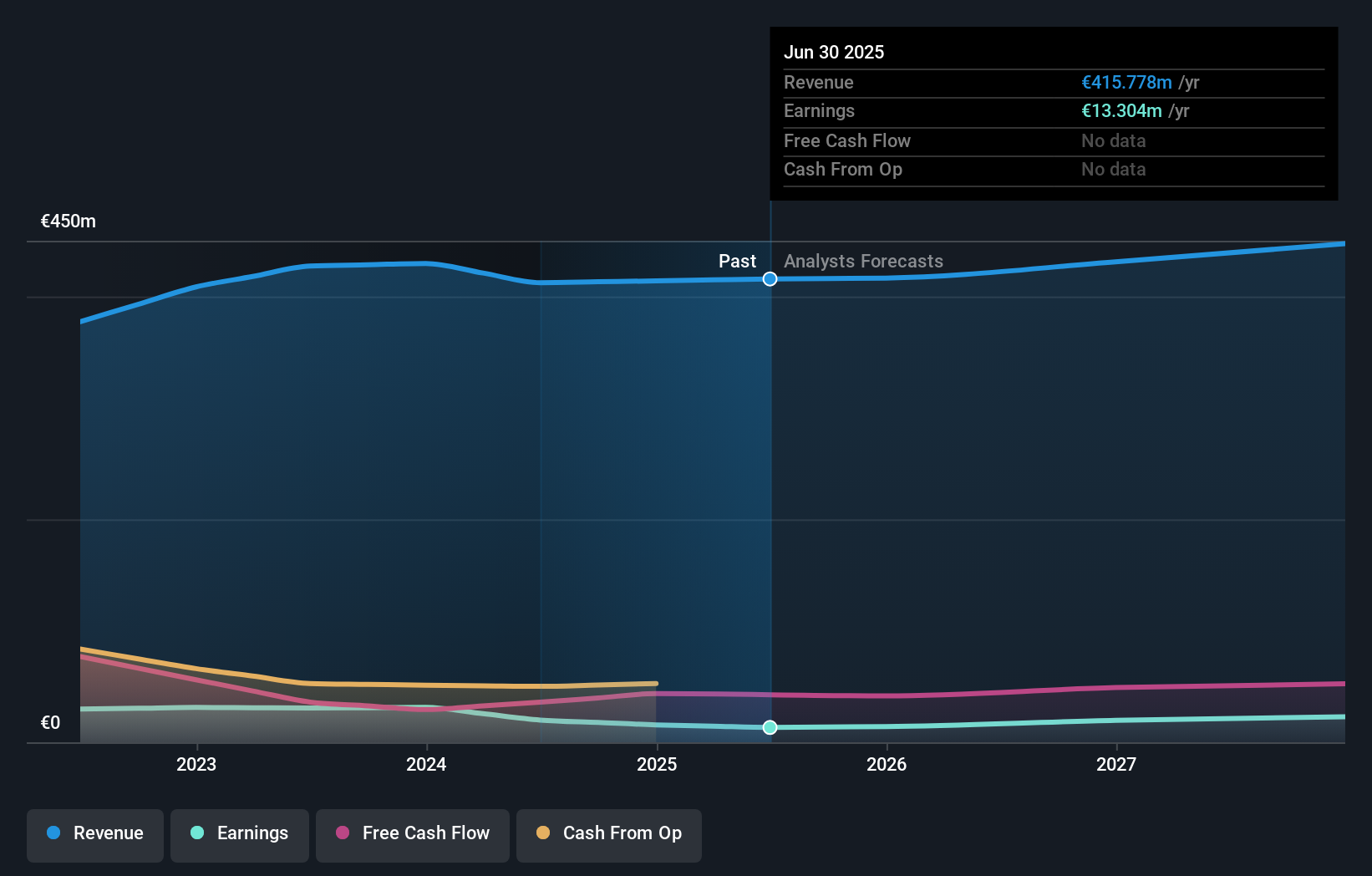

Roche Bobois (ENXTPA:RBO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Roche Bobois S.A. is involved in the design and distribution of furniture both in France and internationally, with a market cap of €329.23 million.

Operations: The company's revenue is derived from several segments, including Roche Bobois USA/Canada (€138.48 million), Roche Bobois France (€108.61 million), Roche Bobois Europe excluding France (€101.65 million), Cuir Center (€42.37 million), and Roche Bobois Others (Overseas) (€20.80 million).

Insider Ownership: 32.7%

Roche Bobois, a European furniture retailer, is experiencing slower revenue growth at 3% annually compared to the French market's 5.5%, yet its earnings are projected to grow significantly at 23.6% per year. Despite trading below fair value and analyst price targets, profit margins have decreased from last year. Recent executive board reorganization follows Antonin Roche's resignation, while the company anticipates stable or slightly declining full-year revenue for 2025 amidst evolving leadership dynamics.

- Navigate through the intricacies of Roche Bobois with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that Roche Bobois' current price could be quite moderate.

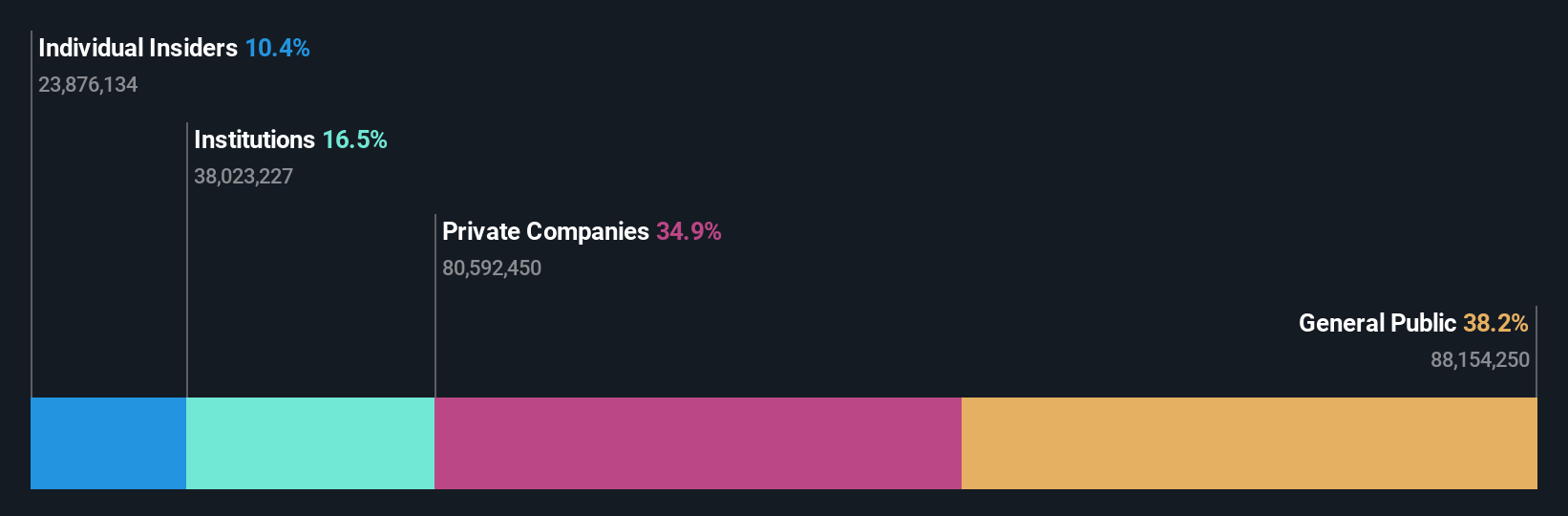

YIT Oyj (HLSE:YIT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: YIT Oyj offers construction services across Finland, the Czech Republic, Slovakia, Poland, and internationally with a market cap of €703.01 million.

Operations: The company's revenue is primarily derived from Building Construction (€657 million) and Infrastructure (€481 million) segments.

Insider Ownership: 10.3%

YIT Oyj, a European construction firm, is leveraging strategic alliances and projects to bolster growth. Recent ventures include a joint venture in Czechia for residential development and a €150 million urban project in Turku. Despite current net losses, YIT's forecasted revenue growth of 8.1% annually surpasses the Finnish market average. The company trades at 49% below estimated fair value with no significant insider trading activity reported recently, suggesting potential undervaluation amidst its expansion efforts.

- Click to explore a detailed breakdown of our findings in YIT Oyj's earnings growth report.

- According our valuation report, there's an indication that YIT Oyj's share price might be on the cheaper side.

Next Steps

- Unlock more gems! Our Fast Growing European Companies With High Insider Ownership screener has unearthed 209 more companies for you to explore.Click here to unveil our expertly curated list of 212 Fast Growing European Companies With High Insider Ownership.

- Looking For Alternative Opportunities? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com