Stoke Therapeutics (STOK) Valuation After Positive Long-Term Zorevunersen Data at AES Meeting

Stoke Therapeutics (STOK) just gave investors another reason to pay attention, with fresh long term data on lead candidate zorevunersen showing sustained seizure reductions and cognitive gains in Dravet syndrome at the AES meeting.

See our latest analysis for Stoke Therapeutics.

That backdrop helps explain why, even after a small 1 day share price pullback, Stoke’s 30 day share price return of 13.62% and blistering year to date share price return of 191.57% signal powerful positive momentum. The 3 year total shareholder return of 289.34% highlights how transformative the story has been for early believers despite a still negative 5 year total shareholder return.

If zorevunersen’s progress has you rethinking your exposure to innovative drug developers, this could be a good moment to explore other potential ideas among healthcare stocks.

With the stock now hovering just below analyst targets after a massive year to date surge, the key question is whether Stoke’s pipeline potential still leaves upside or if the market is already pricing in future growth.

Price-to-Earnings of 46.3x: Is it justified?

Stoke Therapeutics trades on a rich 46.3x price to earnings multiple at a last close of $32.86, a level that signals investors are pricing in ambitious expectations versus peers.

The price to earnings ratio compares the current share price with the company’s earnings per share, making it a core gauge of how much investors are willing to pay for each dollar of profit. In biotech, where many companies are still loss making, a high multiple on freshly achieved profitability can indicate confidence that current earnings are just the starting point rather than a peak.

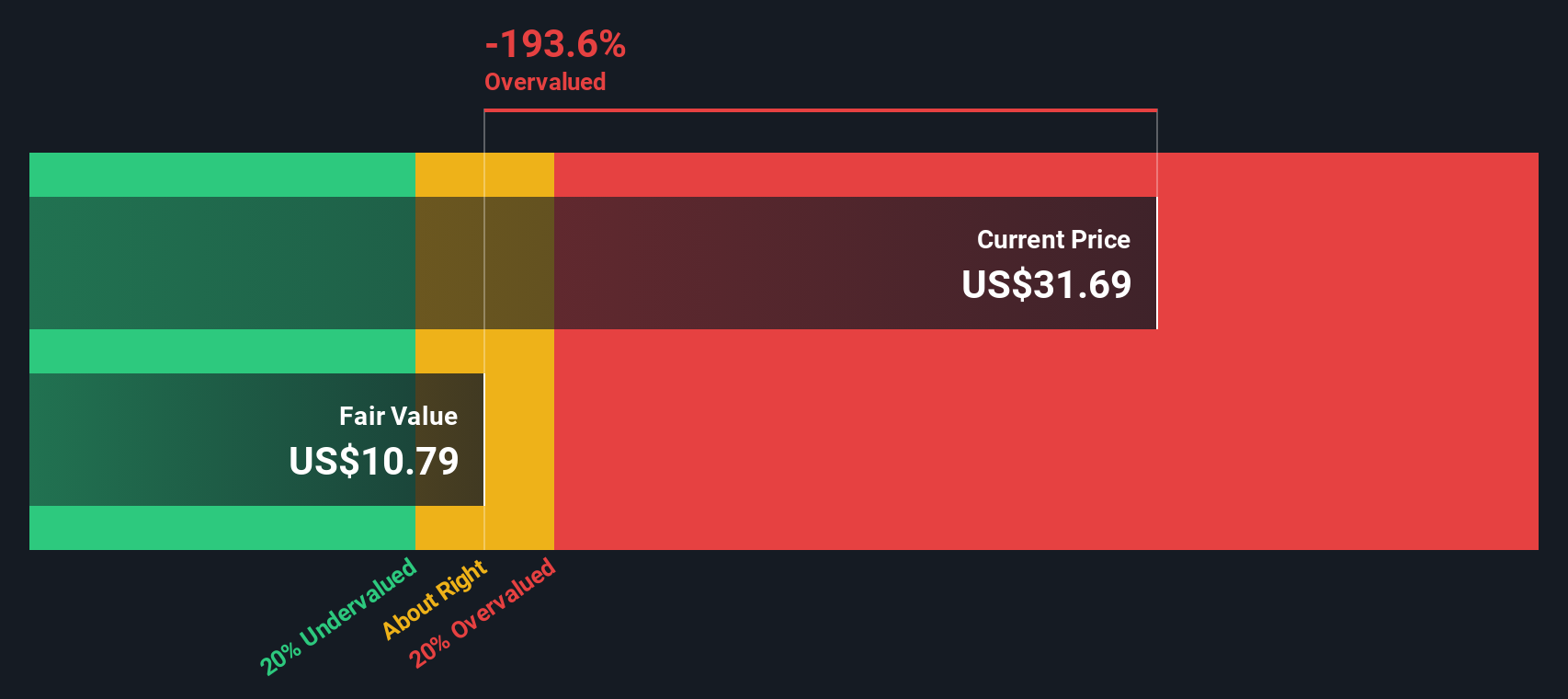

Here, the market is assigning Stoke roughly double the peer average multiple of 22.6x and more than triple the estimated fair price to earnings ratio of 14x. This suggests investors are willing to pay a steep premium for its platform, partnerships, and Dravet opportunity even though consensus forecasts call for earnings to decline on average over the next three years.

Compared with the broader US Biotechs industry average of 18.6x, Stoke’s 46.3x price to earnings ratio stands out as aggressively higher. This underscores how far sentiment has run ahead of both the sector and the level our fair ratio analysis points to as a more sustainable valuation anchor.

Explore the SWS fair ratio for Stoke Therapeutics

Result: Price-to-Earnings of 46.3x (OVERVALUED)

However, setbacks in zorevunersen’s trials, or slower than expected uptake from partnerships with Biogen and Acadia, could quickly challenge today’s premium valuation.

Find out about the key risks to this Stoke Therapeutics narrative.

Another View: Cash Flows Tell a Different Story

While the price to earnings ratio suggests a relatively high valuation, our DCF model indicates that Stoke is trading about 11.8% below its estimated fair value of $37.26 a share. If the market is focused on near term earnings, long term cash flows may be where the potential value lies.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Stoke Therapeutics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Stoke Therapeutics Narrative

If you would rather dig into the numbers yourself and challenge this view, you can build a personalized Stoke narrative in minutes: Do it your way.

A great starting point for your Stoke Therapeutics research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with a single biotech winner, use the Simply Wall Street Screener to uncover more opportunities that match your goals before the market catches on.

- Capture early stage growth by scanning these 3637 penny stocks with strong financials that pair tiny market caps with real balance sheet strength and improving fundamentals.

- Position your portfolio for tomorrow’s tech by targeting these 26 AI penny stocks harnessing artificial intelligence to reshape industries and drive revenue growth.

- Explore potential bargains by filtering for these 906 undervalued stocks based on cash flows where you can compare current prices to what their cash flows suggest they may be worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com