Insider Confidence Drives Growth In December 2025

As the U.S. market navigates a complex landscape marked by rising unemployment and mixed performances across major indices, investor attention is increasingly drawn to companies where insider confidence remains robust. In this environment, high insider ownership can be a compelling indicator of potential growth, suggesting that those who know the company best are committed to its future success.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 50.7% |

| StubHub Holdings (STUB) | 14.2% | 73.9% |

| SES AI (SES) | 12% | 68.9% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| Karman Holdings (KRMN) | 17.3% | 78.5% |

| Credo Technology Group Holding (CRDO) | 10.4% | 30.7% |

| Corcept Therapeutics (CORT) | 11.4% | 52.7% |

| Atour Lifestyle Holdings (ATAT) | 18% | 24.4% |

| Astera Labs (ALAB) | 11.7% | 29.0% |

| AppLovin (APP) | 27.4% | 27.1% |

We're going to check out a few of the best picks from our screener tool.

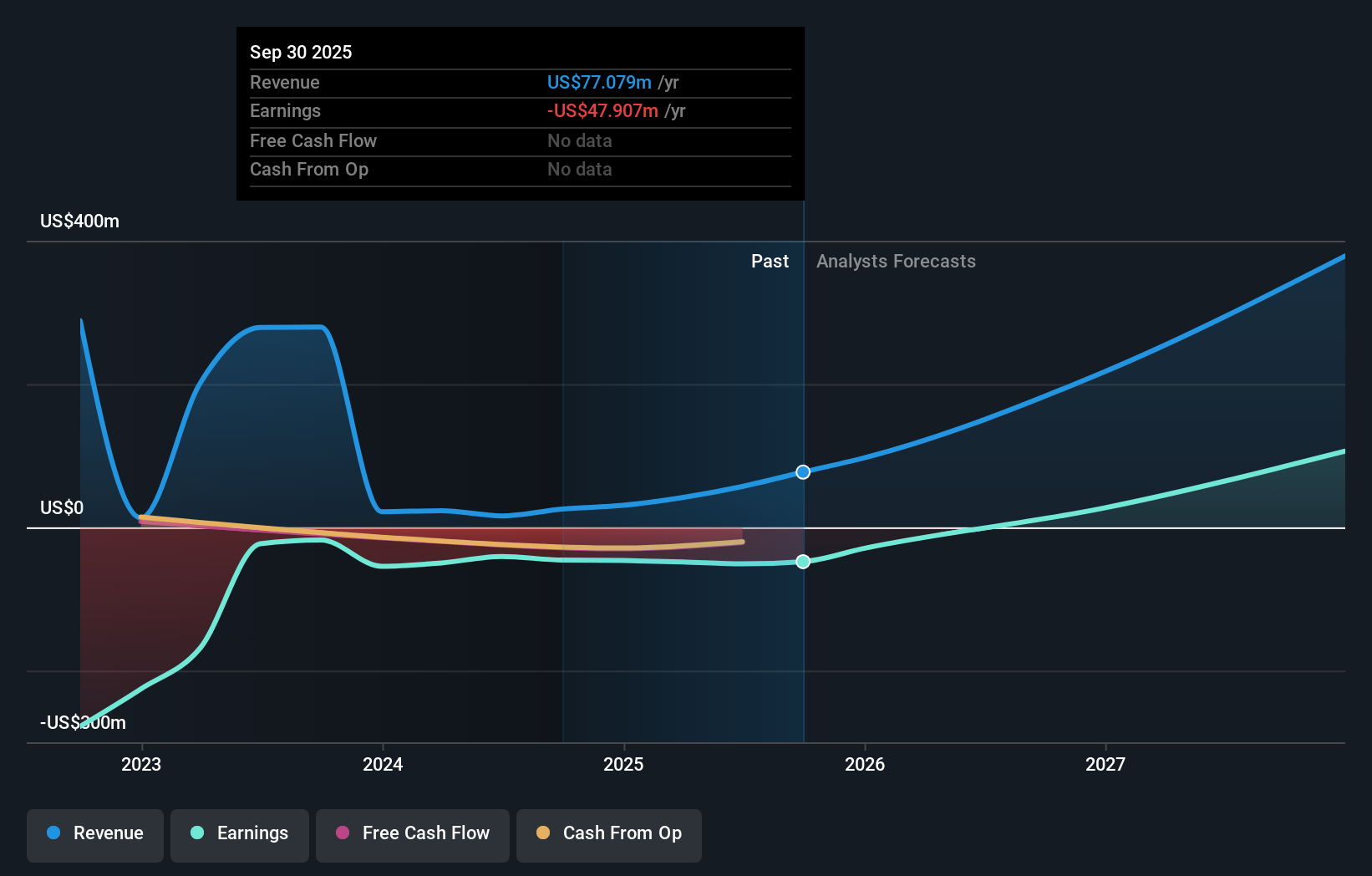

Prenetics Global (PRE)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Prenetics Global Limited is a health sciences company dedicated to advancing consumer health in Hong Kong, the United States, and internationally, with a market cap of $268.92 million.

Operations: Prenetics Global Limited generates revenue through its health sciences operations, focusing on consumer health advancements across Hong Kong, the United States, and international markets.

Insider Ownership: 22.9%

Revenue Growth Forecast: 69.8% p.a.

Prenetics Global demonstrates substantial growth potential, with revenue projected to grow 69.8% annually, outpacing the US market. Despite recent shareholder dilution and a volatile share price, the company reported significant third-quarter revenue growth of ~568% year-over-year to US$23.6 million and reduced net losses compared to last year. The firm is expected to become profitable within three years and has reaffirmed its full-year 2025 revenue guidance between US$90 million and US$100 million.

- Click here and access our complete growth analysis report to understand the dynamics of Prenetics Global.

- In light of our recent valuation report, it seems possible that Prenetics Global is trading beyond its estimated value.

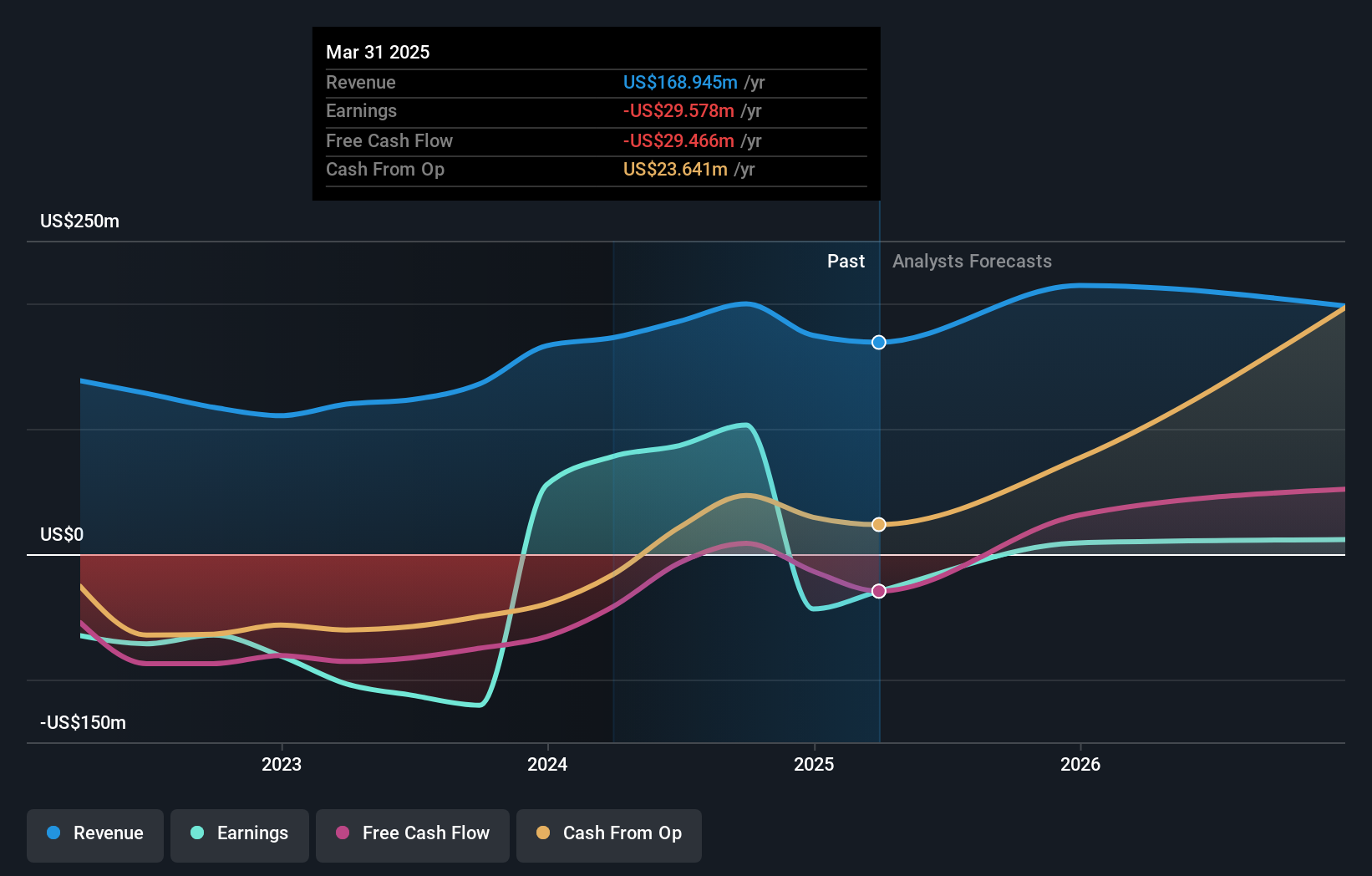

McEwen (MUX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: McEwen Inc. is involved in the exploration, development, production, and sale of gold and silver deposits across the United States, Canada, Mexico, and Argentina with a market cap of approximately $1.05 billion.

Operations: The company's revenue segments include $69.53 million from Canada, $0.65 million from Mexico, and $96.27 million from the United States of America (USA).

Insider Ownership: 15.7%

Revenue Growth Forecast: 38.3% p.a.

McEwen Inc. is poised for growth, with revenue expected to increase 38.3% annually, surpassing US market averages. The company plans to enhance its El Gallo Mine and Gold Bar Mine Complex, potentially extending mine life and increasing production capacity. Recent developments include securing an Environmental Impact Assessment for El Gallo and advancing exploration at Froome Mine, which could improve operational economics. McEwen trades significantly below estimated fair value, offering potential upside for investors focused on insider ownership dynamics.

- Get an in-depth perspective on McEwen's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report McEwen implies its share price may be lower than expected.

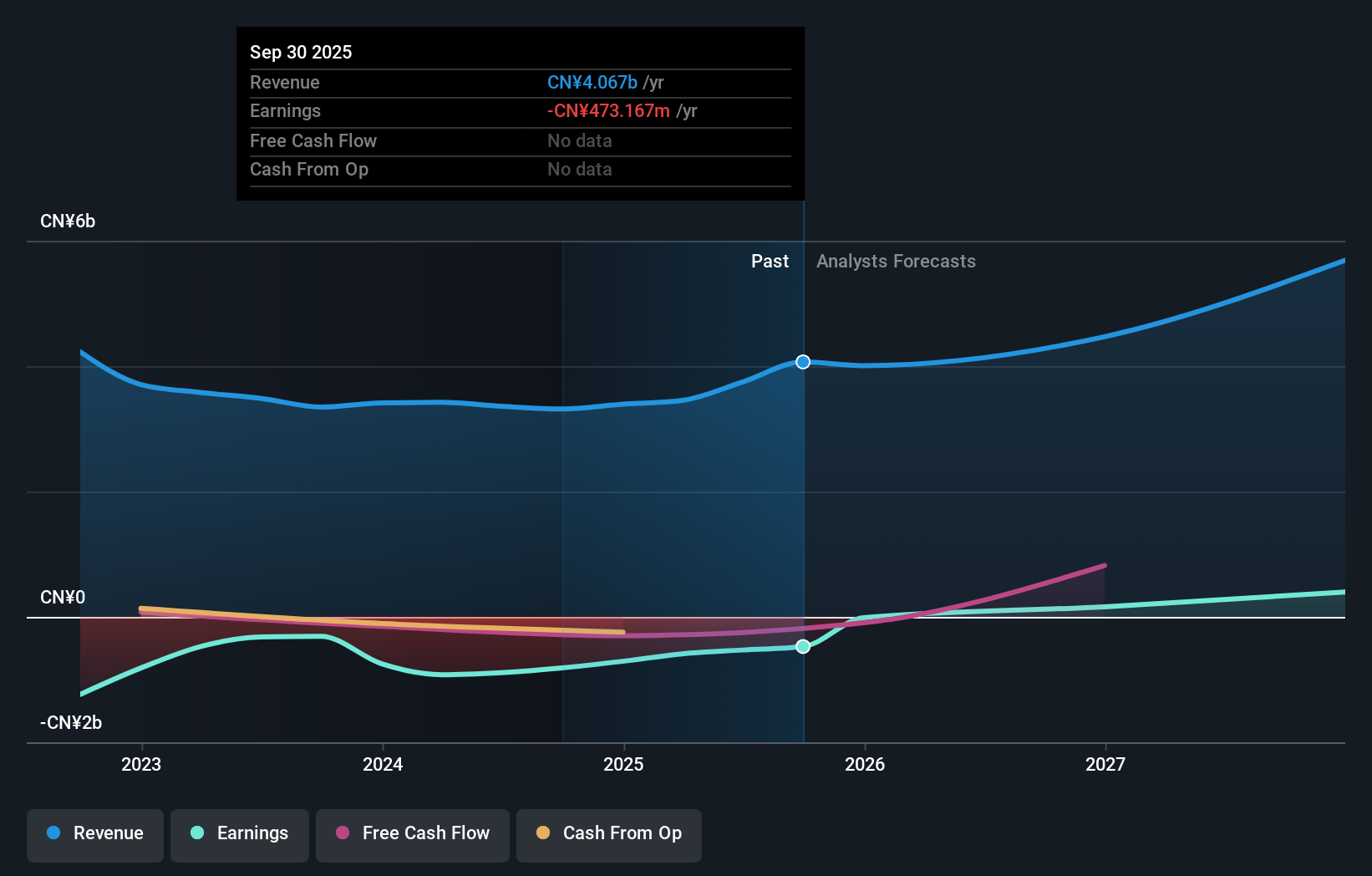

Yatsen Holding (YSG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Yatsen Holding Limited, along with its subsidiaries, develops and sells beauty products in the People’s Republic of China and has a market cap of approximately $394.82 million.

Operations: Yatsen Holding Limited generates revenue through the development and sale of beauty products in China.

Insider Ownership: 37.8%

Revenue Growth Forecast: 13.5% p.a.

Yatsen Holding demonstrates potential for growth, with revenue forecasted to grow at 13.5% annually, outpacing the US market average. Recent earnings show a reduction in net loss and an increase in sales to CNY 998.42 million for Q3 2025. Despite high share price volatility, Yatsen is trading significantly below its estimated fair value and expects substantial revenue growth of up to 30% year-over-year for Q4 2025, reflecting optimistic market conditions.

- Take a closer look at Yatsen Holding's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Yatsen Holding is priced lower than what may be justified by its financials.

Turning Ideas Into Actions

- Take a closer look at our Fast Growing US Companies With High Insider Ownership list of 206 companies by clicking here.

- Interested In Other Possibilities? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com