High Growth Tech Stocks To Watch In The US December 2025

As the U.S. market navigates a complex landscape marked by rising unemployment and mixed performances across major indices, the tech-heavy Nasdaq managed to tick higher, snapping a losing streak amid ongoing concerns about an AI bubble. In this climate of uncertainty, identifying high growth tech stocks becomes crucial for investors looking to capitalize on opportunities within sectors that show resilience and potential for innovation-driven expansion.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Marker Therapeutics | 75.24% | 59.07% | ★★★★★★ |

| Palantir Technologies | 28.00% | 32.57% | ★★★★★★ |

| Kiniksa Pharmaceuticals International | 17.51% | 33.44% | ★★★★★☆ |

| Workday | 11.13% | 32.18% | ★★★★★☆ |

| Circle Internet Group | 23.14% | 84.30% | ★★★★★☆ |

| RenovoRx | 71.45% | 71.45% | ★★★★★☆ |

| Zscaler | 15.85% | 45.93% | ★★★★★☆ |

| Cellebrite DI | 15.29% | 20.24% | ★★★★★☆ |

| Duos Technologies Group | 53.36% | 152.11% | ★★★★★☆ |

| Procore Technologies | 11.70% | 116.48% | ★★★★★☆ |

Click here to see the full list of 76 stocks from our US High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Trade Desk (TTD)

Simply Wall St Growth Rating: ★★★★★☆

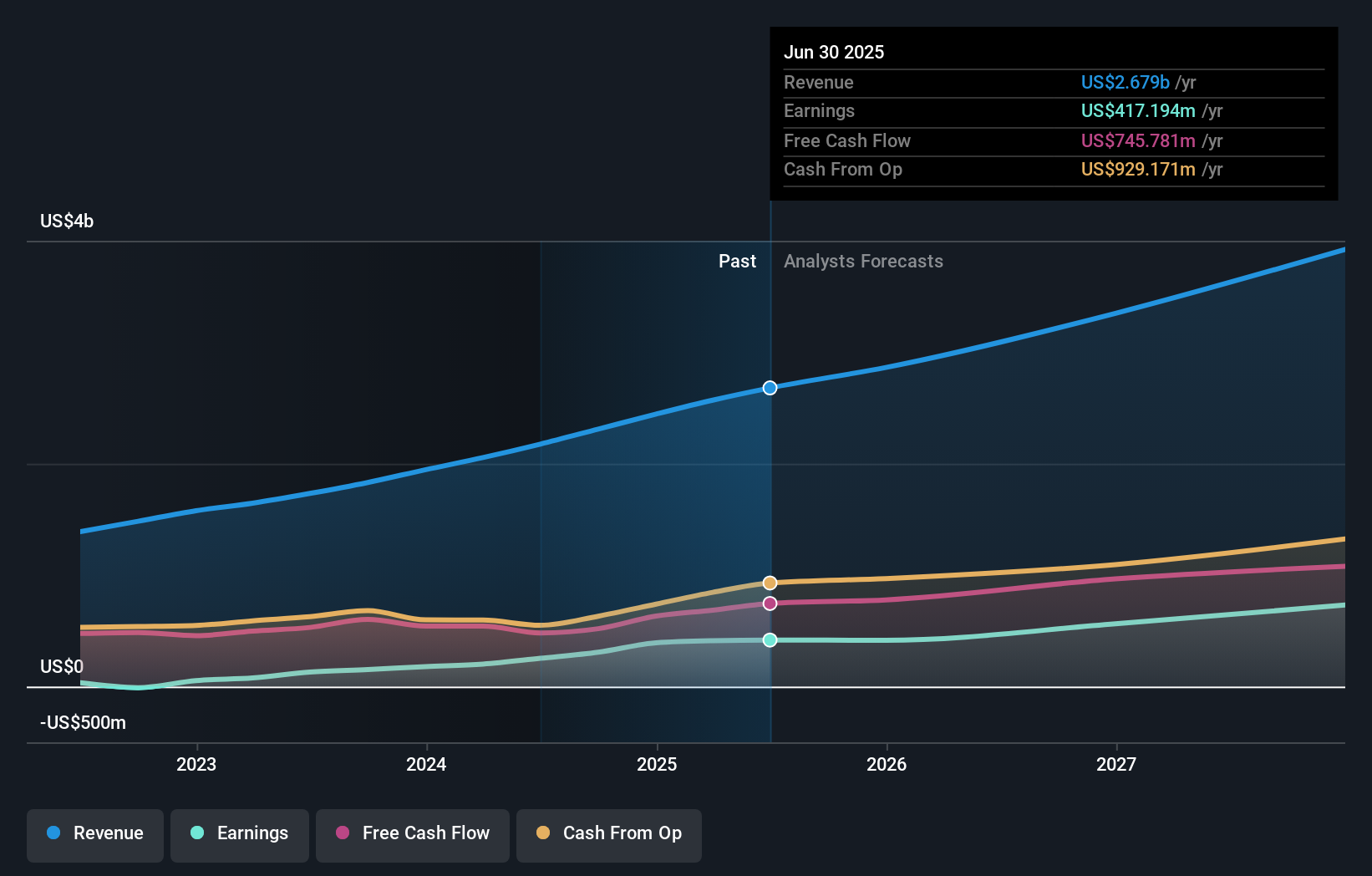

Overview: The Trade Desk, Inc. is a technology company that provides a global advertising technology platform, with a market capitalization of approximately $17.98 billion.

Operations: The Trade Desk generates revenue primarily from its advertising technology platform, amounting to approximately $2.79 billion.

The Trade Desk has demonstrated robust financial and strategic growth, evident from its recent earnings report where Q3 sales surged to $739.43 million, up from $628.02 million the previous year, alongside a net income increase to $115.55 million from $94.16 million. This performance is bolstered by innovative partnerships, such as with Intuit's SMB MediaLabs, enhancing ad precision on its platform and expanding reach across digital channels—a move that taps into the significant spending power of U.S. small businesses which constitute 99% of companies nationwide. Furthermore, the company's proactive approach in share repurchases, with 6.23 million shares bought back recently for $375.05 million, underscores a strong commitment to shareholder value amidst expanding market operations and technological advancements in advertising solutions like Audience Unlimited and Ventura TV OS integration with DIRECTV.

- Unlock comprehensive insights into our analysis of Trade Desk stock in this health report.

Examine Trade Desk's past performance report to understand how it has performed in the past.

Vericel (VCEL)

Simply Wall St Growth Rating: ★★★★☆☆

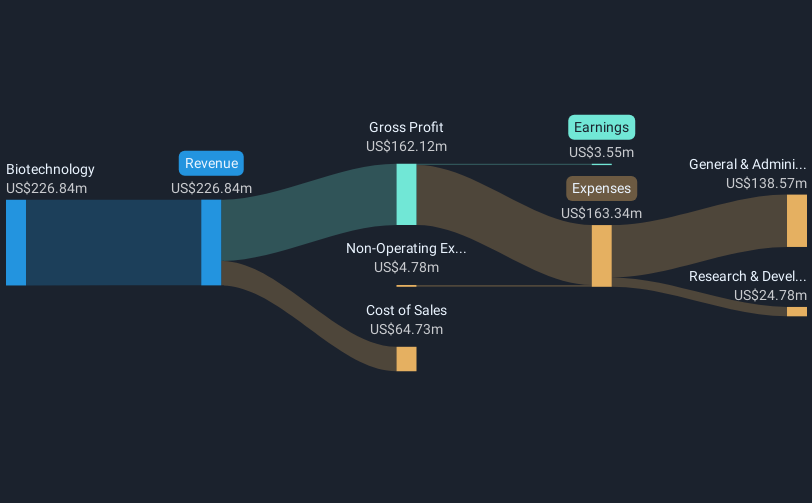

Overview: Vericel Corporation is a commercial-stage biopharmaceutical company focused on developing and distributing cellular therapies and specialty biologic products for the sports medicine and severe burn care markets in North America, with a market cap of $1.80 billion.

Operations: The company generates revenue primarily from its biotechnology segment, amounting to $258.72 million. Vericel's operations include research, development, manufacturing, and distribution of cellular therapies and specialty biologic products targeted at sports medicine and severe burn care markets in North America.

Vericel's recent performance underscores its dynamic growth trajectory, with a notable 268.7% surge in earnings over the past year, significantly outpacing the biotech industry's 52% average. This leap is anchored by an annual revenue increase of 16.8%, reflecting robust market demand and effective strategic positioning. The company's commitment to innovation is evident from its R&D investments, crucial for sustaining its competitive edge in a rapidly evolving sector. Additionally, Vericel has projected a promising revenue outlook for 2025, estimating it to reach up to $276 million, which highlights confidence in continued growth and market expansion.

- Take a closer look at Vericel's potential here in our health report.

Gain insights into Vericel's past trends and performance with our Past report.

CyberArk Software (CYBR)

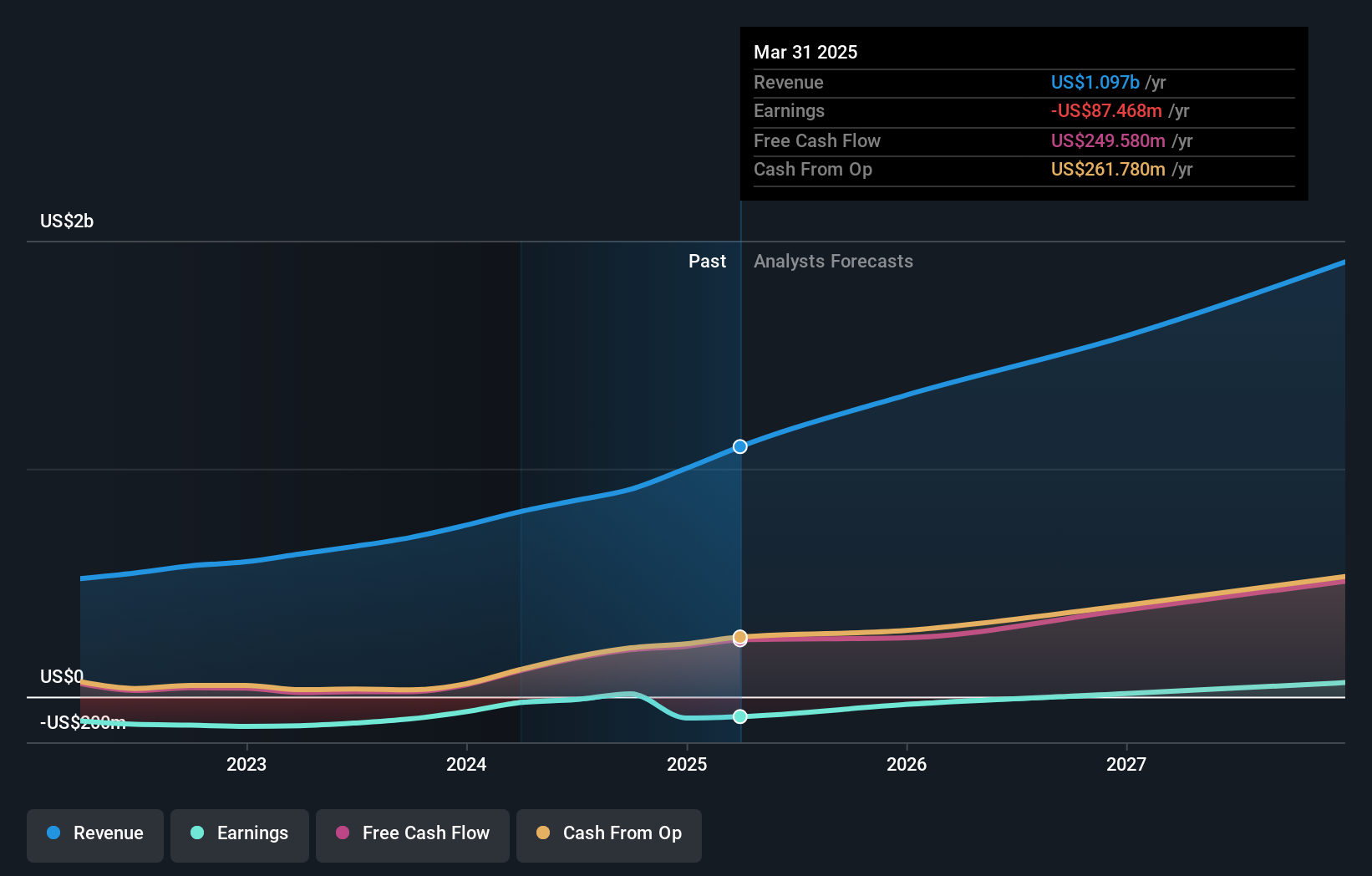

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CyberArk Software Ltd. is a company that develops, markets, and sells software-based identity security solutions and services across various regions including the United States, Israel, the United Kingdom, Europe, the Middle East, Africa, and internationally with a market cap of $22.37 billion.

Operations: CyberArk generates revenue primarily through its security software and services, amounting to $1.30 billion. The company operates across multiple regions, focusing on identity security solutions.

CyberArk Software, amidst a challenging fiscal quarter with a reported net loss of $50.44 million from revenues of $342.84 million, contrasts sharply against its previous year's net income of $11.11 million. Despite these figures, the company is forging ahead in high-growth areas like AI and machine identity security, evidenced by their latest product launches aimed at enhancing autonomous AI agent and machine identity protections. These strategic moves are pivotal as CyberArk projects to pivot into profitability within three years with an expected earnings growth rate of 93.46% annually, outpacing the broader software industry's growth rate of 22.5%. This focus on cutting-edge technology solutions for emerging cybersecurity challenges underscores CyberArk’s proactive approach in a rapidly evolving market landscape.

- Click here to discover the nuances of CyberArk Software with our detailed analytical health report.

Explore historical data to track CyberArk Software's performance over time in our Past section.

Turning Ideas Into Actions

- Investigate our full lineup of 76 US High Growth Tech and AI Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com