Broadcom (AVGO): Revisiting Valuation After Recent Share Price Pullback

Broadcom (AVGO) has quietly cooled off after a strong run this year, slipping about 4% over the past month. That pullback is getting investors to revisit what they are actually paying for.

See our latest analysis for Broadcom.

That recent 7 day share price slide of about 21 percent comes after a strong multi year run, with Broadcom still boasting an impressive five year total shareholder return of roughly 750 percent. This suggests momentum is cooling rather than collapsing.

If Broadcom’s volatility has you rethinking your tech exposure, it could be a good moment to explore other high growth chip and software names through high growth tech and AI stocks.

With earnings still growing briskly and the stock trading nearly 40 percent below the average analyst target but a bit above some intrinsic estimates, investors face a key question: is this a genuine buying window, or has the market already priced in Broadcom’s next leg of growth?

Most Popular Narrative: 19.2% Undervalued

Broadcom’s most followed narrative pegs fair value well above the last close of $326.02, implying the recent pullback has opened a valuation gap.

Strong multi year bookings, a record $110 billion backlog (driven primarily by AI), and disciplined capital allocation (R&D investments, high free cash flow, and dividends) build a foundation for continued earnings growth and per share expansion.

Want to see what kind of growth and margin profile justifies that higher fair value? The narrative leans on aggressive compounding, higher profitability, and a richer future earnings multiple. Curious how those moving parts combine into a premium valuation story? Explore the full breakdown to see which assumptions really carry the model.

Result: Fair Value of $403.66 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concentrated AI customer exposure and potential VMware integration hiccups could quickly challenge the optimistic growth and valuation assumptions that underpin this narrative.

Find out about the key risks to this Broadcom narrative.

Another Angle on Valuation

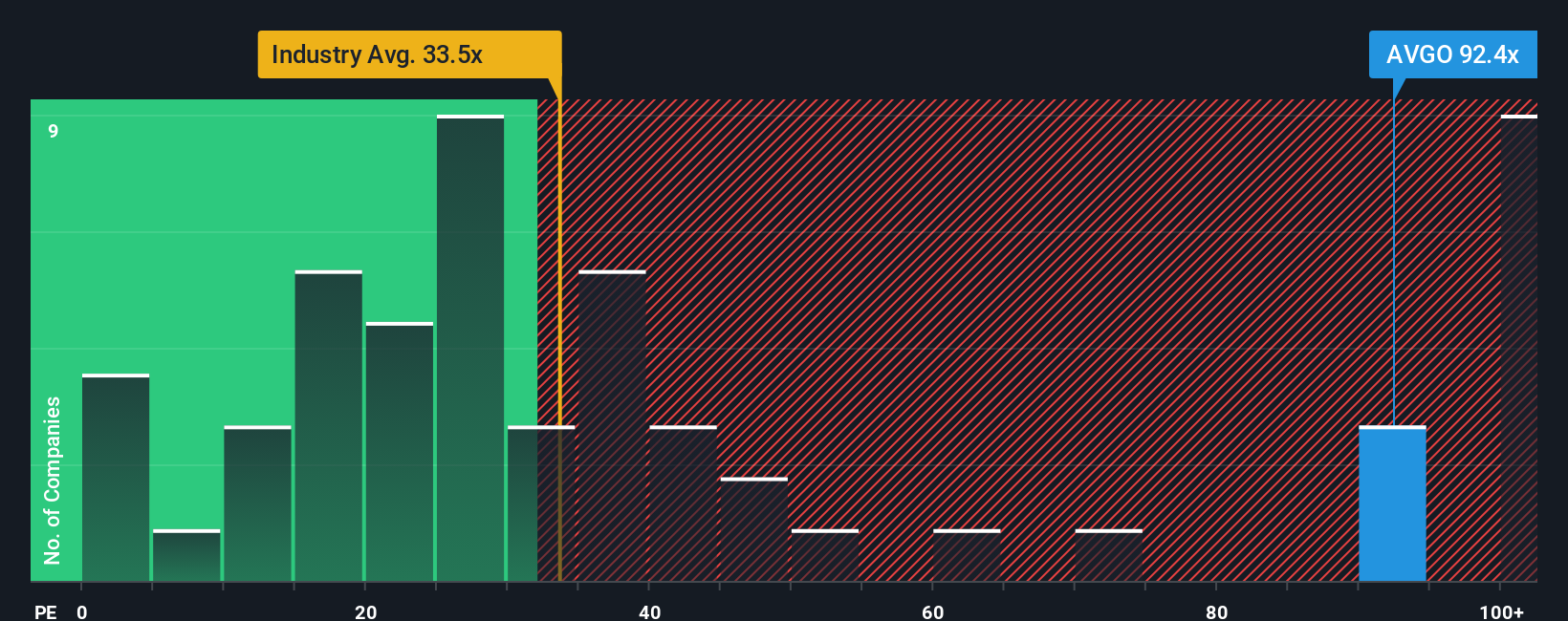

While the narrative suggests Broadcom is 19.2 percent undervalued, its current price earnings ratio of 66.6 times sits well above both peers at 51.9 times and a fair ratio of 54.8 times. That premium narrows the margin of safety, so the question becomes whether the growth story is strong enough.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Broadcom Narrative

If that perspective does not quite fit your view, or you would rather dig into the numbers yourself, you can craft a personalized thesis in minutes, Do it your way.

A great starting point for your Broadcom research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, put Simply Wall Street’s powerful screener to work so you do not miss stocks quietly lining up for their next big move.

- Identify potential multi baggers early by focusing on these 3639 penny stocks with strong financials that already show strong financial characteristics and significant room for expansion.

- Explore the next wave of innovation by targeting these 26 AI penny stocks that operate at the intersection of rapid adoption, earnings growth and scalable technology.

- Find quality at potentially attractive prices by reviewing these 908 undervalued stocks based on cash flows that appear mispriced relative to their long term cash flow prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com