LegalZoom (LZ): Valuation Check as Record Q3 Revenue and Raised Outlook Lift Investor Expectations

LegalZoom.com (LZ) just delivered record third quarter revenue and lifted its full year outlook, a combination that has investors reassessing the stock even as a recent insider sale grabs short term headlines.

See our latest analysis for LegalZoom.com.

At around $10.10 per share, LegalZoom.com has delivered a robust year to date share price return of 33.6 percent and a 12 month total shareholder return of 30.3 percent, suggesting momentum is rebuilding after a softer recent quarter as investors focus on upgraded growth guidance rather than routine insider selling.

If LegalZoom's renewed momentum has you thinking about what else might be setting up for the next leg higher, this is a good moment to explore fast growing stocks with high insider ownership.

Yet with LegalZoom trading well below analyst targets but boasting rapid earnings growth and a rich valuation, investors face a key question: Is this a genuine buying opportunity, or is the market already pricing in its future expansion?

Most Popular Narrative: 18.3% Undervalued

With the narrative fair value near $12.36 against LegalZoom.com's last close of $10.10, the story leans optimistic and puts its growth engine under the spotlight.

Strong momentum in high margin, recurring subscription offerings, especially within compliance and concierge "do it for me" products, signals continued growth in predictable revenues and improved customer retention, directly supporting higher net margins and earnings stability.

Want to see why this narrative is comfortable projecting faster earnings than revenue, rising margins, and a richer future earnings multiple than the sector? The full valuation walkthrough reveals the growth runway, profitability inflection and long term return expectations that justify a share price well above today’s level.

Result: Fair Value of $12.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising generative AI competition and lower retention from bundled, lower priced services could erode LegalZoom's subscription economics and pressure long term margins.

Find out about the key risks to this LegalZoom.com narrative.

Another Lens on Value

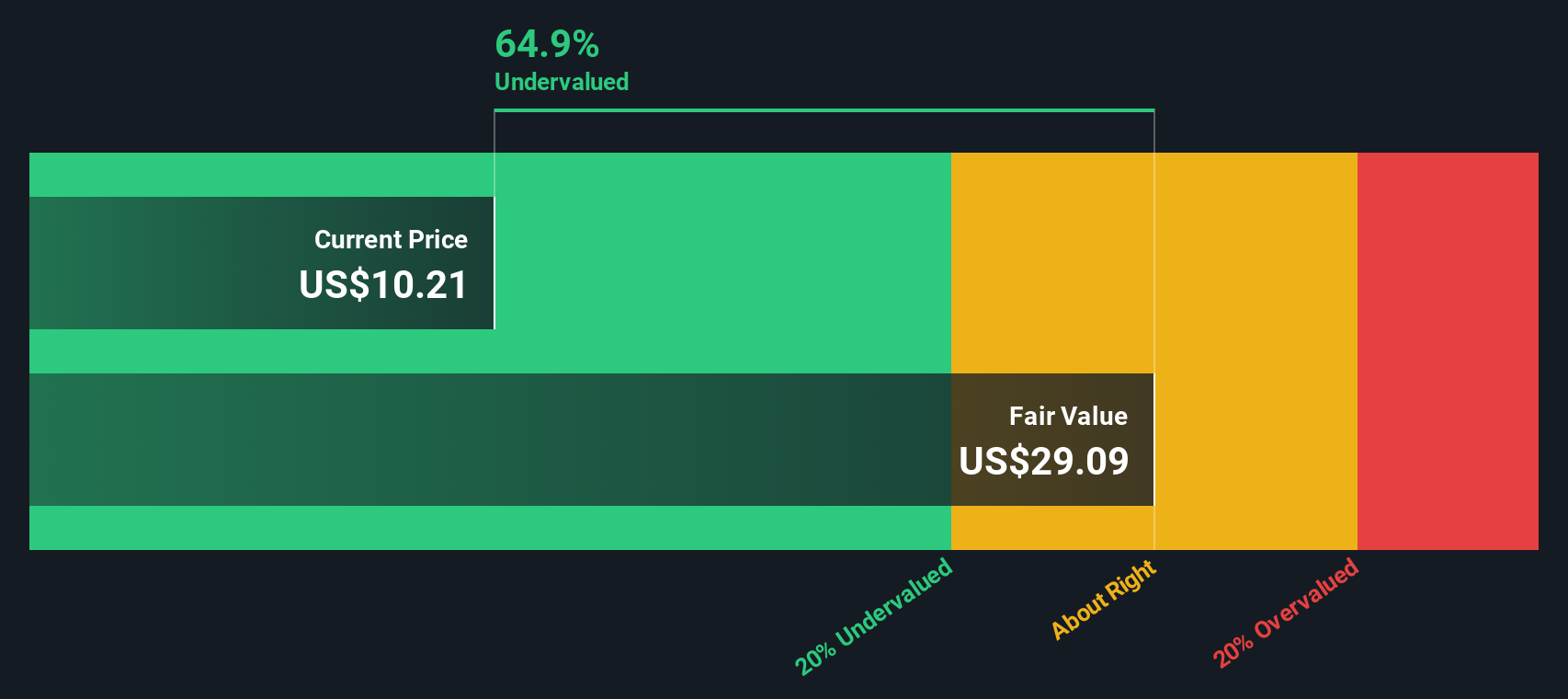

While the narrative suggests LegalZoom.com is about 18 percent undervalued at $12.36, our SWS DCF model paints a far more optimistic picture. It implies fair value closer to $29.12 per share and a roughly 65 percent discount. Is the market missing something, or are the cash flow assumptions too generous?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own LegalZoom.com Narrative

If you see the story differently or want to dig into the numbers yourself, you can craft a personalized take in just minutes. Do it your way.

A great starting point for your LegalZoom.com research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider using our stock screener so potential opportunities are easier to identify and track.

- Explore mispriced opportunities by targeting companies that appear inexpensive based on future cash flows with these 908 undervalued stocks based on cash flows.

- Focus on businesses developing real-world applications of machine learning and automation through these 26 AI penny stocks.

- Review companies offering payouts above 3 percent via these 13 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com