US stock outlook | Futures of the three major stock indexes jumped after Micron's performance jumped, US CPI for November released tonight

Pre-market market trends

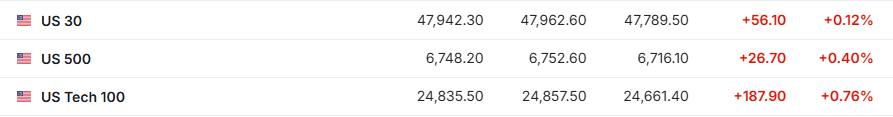

1. On December 18 (Thursday), the futures of the three major US stock indexes rose sharply before the US stock market. As of press release, Dow futures were up 0.12%, S&P 500 futures were up 0.40%, and NASDAQ futures were up 0.76%.

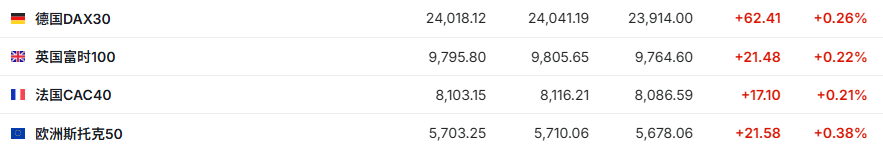

2. As of press release, the German DAX index rose 0.26%, the UK FTSE 100 index rose 0.22%, the French CAC40 index rose 0.21%, and the European Stoxx 50 index rose 0.38%.

3. As of press release, WTI crude oil rose 0.09% to $55.86 per barrel. Brent crude oil fell 0.02% to $59.67 per barrel.

Market news

The market ushered in a critical watershed! The first CPI after the shutdown was released tonight. Can the “second era” of inflation open the door to interest rate cuts and the “Christmas market” of US stocks? Wall Street is anxiously awaiting the November Consumer Price Index (CPI) report to be released on Thursday. This will be the first data reading for the period since the end of the record US government shutdown last month. Economists expect a 3.1% year-on-year increase in US CPI in November, and a 3.0% year-on-year increase in core CPI excluding highly volatile projects such as food and energy. Jose Torres, a senior economist at Yingtou Securities, believes that the overall inflation rate for November is likely to range between 2.9% and 3.1%. If the report shows a reading of 2.9%, this could provide some positive impetus for the stock market to enter 2026. Torres believes that such numbers will clear the barriers to the so-called “Santa Claus market.” He also believes that this will affect interest rate prospects next year — the Federal Reserve is expected to cut interest rates once next year.

Yingtou Securities bucked the trend and sang down on US stocks! The second year of the presidential term plus the new Federal Reserve chairman = a “bad year” for the market. The S&P 500 will drop to 6,500 points by the end of next year. Steve Sosnick, chief strategist at Yingtou Securities, has set a year-end target of 6,500 points for the S&P 500 index. This forecast means that the stock index will fall about 3% from current levels. Historical data plays an important role in Sosnick's analysis, particularly the impact of the presidential term cycle. “There have only been two bear years in history, both in the second year of the presidential term,” he said. He used the “end of volatility” incident in February 2018 as an example to illustrate market turbulence in such a cycle. At the same time, Sosnick expressed concern that the new chairman of the Federal Reserve often faces tests early in his term. He cited historical cases such as Alan Greenspan (who was hit by the 1987 stock market crash soon after taking office) and Ben Bernanke (facing a financial crisis at the beginning of his term), saying “new Federal Reserve presidents usually experience market tests around the first time they take office.”

UBS: The US data is showing a red light, and there is a reason for the Federal Reserve to cut interest rates “insured” next year. According to UBS's analysis, the employment data released this week revealed the potential weakness of the US labor market, which may be the basis for the Federal Reserve to cut interest rates further early next year. According to the data, the number of people employed in non-farm payrolls increased by only 64,000 in November, which is basically the same as in April; the unemployment rate climbed to 4.6%. UBS chief economist Donovan pointed out that these data “sounded many alarm bells.” He added that since the government shutdown has exacerbated the low response rate to the Bureau of Labor Statistics survey, the quality of the data itself needs to be treated with caution. However, the health of the labor market may already be worrying enough to prove that it is reasonable for the Federal Reserve to “cut interest rates by insurance” next year.

Apollo warns: Slowing growth and stubborn inflation coexist, and the Federal Reserve is concerned about the risk of stagflation in 2026. Apollo Asset Management's chief economist Thorsten Slocke said that when looking ahead to 2026, Federal Reserve officials are increasingly concerned about the risk of stagflation. This risk is reflected in a situation where slowing economic growth and rising prices coexist. Recent forecasts show significant changes: Officials generally agree that both inflation and unemployment are at greater upward risk, a highly unusual and worrying combination. Slock pointed out that these assessments indicate that the Federal Reserve is worried that there will be a period where price pressure cannot cool down even if labor market conditions weaken. Such an outcome would complicate monetary policy and limit the ability of the Federal Reserve to stimulate growth without increasing inflation.

Trump takes charge of becoming the next chairman of the Federal Reserve: supports a “drastic” interest rate cut. In a televised address to the nation, US President Trump said that the nominee for the next Federal Reserve Chairman will soon be announced, and that this candidate will support a “drastic” reduction in interest rates. Trump said, “I'm about to announce our next Federal Reserve Chairman. This person supports a drastic reduction in interest rates, and mortgage repayments will fall further.” When Trump announced at the end of last month that the candidate for the next Federal Reserve Chairman had been decided, Kevin Hassett was seen as the most likely candidate to become the next Federal Reserve Chairman. Recently, however, former Federal Reserve Governor Kevin Walsh and Federal Reserve Governor Christopher Waller have re-entered the eyes of investors. Currently, on the prediction platform Polymarket, Hassett has the highest probability of winning the election — 52%, Walsh's probability of winning the election is 25%, and Waller's probability of winning is 13.2%.

Individual stock news

Demand for storage is booming under the AI infrastructure frenzy! Micron Technology's (MU.US) performance crushed expectations, implying that the “supercycle” will extend to 2027. Financial reports show that in the first quarter of the 2026 fiscal year ending November 27, Micron Technology's revenue increased 57% year over year to US$13.6 billion, better than market expectations of US$13 billion; non-GAAP operating profit increased 62% year over year to US$6.419 billion, better than market expectations of US$5.37 billion; and adjusted earnings per share were US$4.78, better than market expectations of US$3.95. At the same time, the company expects second-quarter revenue of US$183-19.1 billion, better than the market forecast of US$14.4 billion, which has been raised several times; adjusted earnings per share for the second quarter are expected to be US$8.22-8.62, far exceeding market expectations of US$4.71. This guideline shows that demand for memory chips is very strong under the global wave of AI infrastructure. The company also raised its capital expenditure forecast for the 2026 fiscal year from US$18 billion to US$20 billion, highlighting that the bursting demand for memory chips is beginning to accelerate the pace of the company's capacity expansion. As of press release, Micron Technology's US stock rose more than 11% in the premarket on Thursday.

After 28 years of holding it, it was sold off, and a director of Nvidia (NVDA.US) cashed out $44 million. According to regulatory documents, Nvidia board member Harvey Jones sold more than $44 million worth of company shares. According to the documents, Jones, who has been a director of this chipmaker since 1993, sold 250,000 shares at an average price of $177.33 per share on December 15. After the sale, Jones still held more than 7 million Nvidia shares indirectly through HC Jones Living Trust. Since this year, Nvidia's stock price has risen by about 28%, and its market capitalization has reached about 4.32 trillion US dollars. After a series of surges, the market began to worry about its valuation level.

Sales have slipped to a three-year low, and Tesla (TSLA.US) has also “stalled” in the US? According to estimates by industry research firm Cox Automotive, Tesla is expected to sell 125,937 electric vehicles in the US between October and December, which will be more than 22% lower than the level of 162,388 units sold in the same period last year. This will also reduce Tesla's total electric vehicle deliveries in the US to 577,097 units this year, down 8.9% from 2024. According to Cox's estimates, Tesla's share of the overall US car market is expected to drop 0.5 percentage points to 3.5%. Tesla's problems aren't limited to the mainland. It is also facing resistance in the Chinese and European markets. Overall, the company is likely to face a second straight year of declining sales. Facing multiple challenges such as policy adjustments, fierce competition, and changes in consumer sentiment, its sales difficulties may continue.

Change the coach again in two years! British Petroleum (BP.US) probed the head of an Australian energy giant after falling deep into transformation difficulties and returned to its roots to focus on the oil and gas business. BP made major personnel changes and appointed Meg O'Neill, head of Australia's Woodside Energy Company, as CEO to replace Murray Auchinclos, who has only been in office for two years. O'Neill is not only the CEO of British Petroleum's first external airlift in its 100-year history, but she also became the first female head of the world's top five oil giants. This is the second time that BP has changed its head in just over two years. This sudden change in management comes at a time when BP is falling behind competitors due to a series of headwinds. After taking charge of British Petroleum, O'Neill will shoulder the heavy responsibility of improving the company's profitability and refocusing on the main oil and gas business. This marks an important correction in the company's strategic direction after experiencing exploration in the field of new energy.

Wall Street's “vultures” hunt yoga giants: Elliott spent $1 billion betting on Lululemon (LULU.US) and nominated a new CEO. Wall Street “Vulture” fund Elliott Investment Management, known for its aggressive strategies, has established a shareholding of over $1 billion in Lululemon. People familiar with the matter revealed that Elliott is recommending potential CEO candidates to the troubled sportswear retailer. Elliott thinks retail executive Jane Nielsen, who was Ralph Lauren's chief financial officer and chief operating officer, is a suitable candidate for CEO. As of press release, Lululemon's US stocks rose more than 6% before the market on Thursday.

Key economic data and event forecasts

US November CPI data at 21:30 Beijing time

21:30 Beijing time Number of jobless claims in the US at the beginning of the week ending December 13

21:30 Beijing time US December Philadelphia Federal Reserve Manufacturing Index

Performance Forecast

Friday morning: FedEx (FDX.US), Nike (NKE.US)

Friday pre-market: Carnival Cruises (CCL.US)