“Extremely crowded” alert sounded! Komo warns: these six speculative growth stocks face the risk of trend reversal

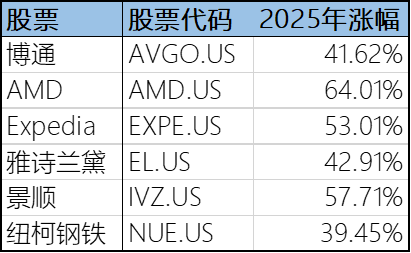

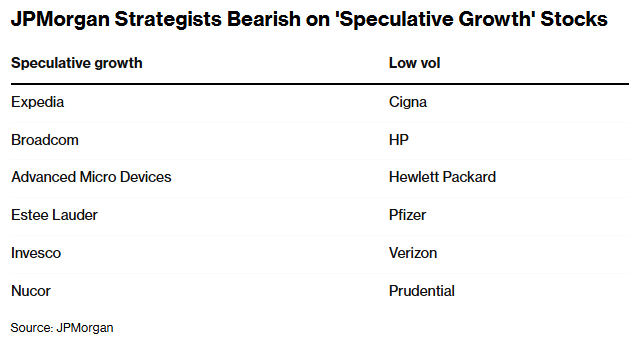

The Zhitong Finance App learned that recent fluctuations in the US stock market have highlighted the risk that J.P. Morgan strategists have been warning of — some stocks that have risen sharply this year are facing “extreme congestion.” The bank listed six speculative growth stocks, including Broadcom (AVGO.US), AMD (AMD.US), Expedia (EXPE.US), Estée Lauder (EL.US), Invesco (IVZ.US), and NUE.US (NUE.US), and warned that the trend of these stocks is “easy to reverse” if any major macroeconomic event occurs.

The data showed that the S&P 500 index fell 1.2% on Wednesday and has been falling for the fourth consecutive trading day after hitting a record high last week. Technology stocks led the decline in this round of sell-off, and investors are rotating out of the “winners” sector. This is exactly what J.P. Morgan's quantitative analysts warned about. They said the “crowding” influx into these highly volatile, high-risk stocks has reached the 99th percentile — an “extreme” level that could cause investors to quickly close positions they need to hedge against.

Bram Kaplan, head of American equity derivatives strategy at J.P. Morgan Chase, said: “These companies are more sensitive to shocks, putting them at risk of sudden repricing.” He added that compared to many high-volatility stocks that are “sub-speculative AI concept stocks,” “low volatility stocks have more attractive risk-return characteristics.”

Since December 10, Broadcom's stock price has fallen by more than 21%, AMD has fallen 11%, Estée Lauder, Invesco, and Nucor have also fallen; Expedia alone has risen about 3%.

The market increasingly feels that the AI boom can no longer drive all stocks higher, and investors are trying to identify winners and losers. Investors seeking to profit from the AI boom this year have scattered from big tech stocks such as Nvidia (NVDA.US) and Microsoft (MSFT.US) and poured into targets they expect to benefit from the AI wave. J.P. Morgan called the listed stocks “secondary speculative AI beneficiaries” and said they are prone to large fluctuations because these companies need to use capital markets or debt markets to finance expansion rather than rely on endogenous growth.

Kaplan offers a simple strategy for clients who want to seize the present moment — buy put options on speculative stocks and establish bullish positions on less volatile stocks. Investors can consider shorting high-momentum stocks while also going long on “boring” low-volatility weighted stocks such as Cigna (CI.US), Pfizer (PFE.US), and Verizon (VZ.US).

Of course, the decline in these momentum stocks for many days may only be due to a temporary rotating outflow of capital from a few popular stocks, rather than a major shift in the market pattern. The impressive results announced by Micron Technology (MU.US) on Wednesday — once again driving the rise of AI concept stocks — confirm this view.

Alexis Maubugay, chief investment officer of Swiss hedge fund Adapt Investment Managers, said: “Real asset owners — retail investors and large institutions — are the only market players that can push the market beyond short-term, shallow, and technical pullbacks. Major fundamental changes, such as a substantial shift in the AI narrative, are needed before they can liquidate their positions.”