Discover UK Penny Stocks: Journeo And 2 Others To Watch

The UK market has recently faced challenges, with the FTSE 100 index experiencing a downturn due to weak trade data from China, highlighting global economic interdependencies. In such fluctuating conditions, investors often look for stocks that can offer growth potential at lower entry points. Penny stocks, though an older term, continue to represent opportunities in smaller or newer companies that might not be on every investor's radar but have the potential for significant returns when backed by strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.14 | £474.95M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.00 | £161.57M | ✅ 4 ⚠️ 2 View Analysis > |

| On the Beach Group (LSE:OTB) | £2.30 | £333.28M | ✅ 5 ⚠️ 1 View Analysis > |

| Ingenta (AIM:ING) | £0.815 | £12.3M | ✅ 2 ⚠️ 3 View Analysis > |

| System1 Group (AIM:SYS1) | £2.30 | £29.18M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.675 | $392.4M | ✅ 4 ⚠️ 2 View Analysis > |

| Impax Asset Management Group (AIM:IPX) | £1.466 | £177.55M | ✅ 3 ⚠️ 2 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.48 | £71.47M | ✅ 3 ⚠️ 3 View Analysis > |

| M.T.I Wireless Edge (AIM:MWE) | £0.445 | £38.36M | ✅ 3 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.115 | £179.44M | ✅ 6 ⚠️ 1 View Analysis > |

Click here to see the full list of 305 stocks from our UK Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Journeo (AIM:JNEO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Journeo plc offers solutions for the transport community to capture, process, and display essential information to enhance journeys both in the United Kingdom and internationally, with a market cap of £85.72 million.

Operations: The company's revenue is primarily derived from its Fleet Systems (£27.94 million), Passenger Systems (£10.38 million), Infotec (£7.50 million), and Journeo Denmark (£2.79 million) segments.

Market Cap: £85.72M

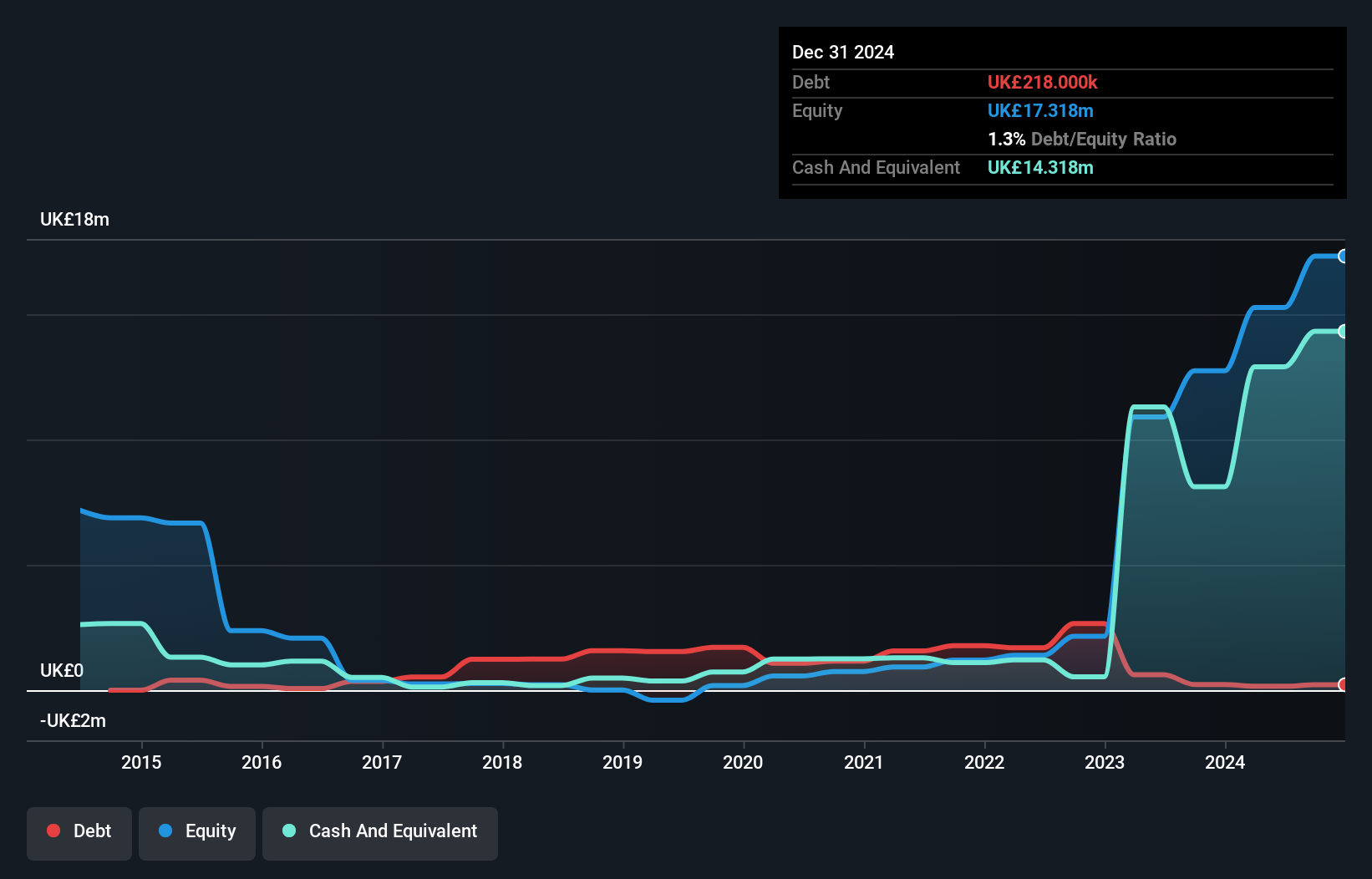

Journeo plc, with a market cap of £85.72 million, demonstrates financial stability and growth potential within the penny stock sector. The company has effectively reduced its debt to equity ratio from 190.4% to 0.8% over five years and maintains more cash than total debt, indicating robust financial health. Recent purchase orders totaling £2.6 million from Worcestershire County Council and a Northern Transport Partnership highlight Journeo's continued expansion in transport technology solutions, bolstering its revenue streams across Fleet Systems and Passenger Systems segments. Despite a slight decline in recent earnings compared to the previous year, Journeo's strategic contracts underscore its capacity for sustainable growth amidst industry challenges.

- Navigate through the intricacies of Journeo with our comprehensive balance sheet health report here.

- Examine Journeo's earnings growth report to understand how analysts expect it to perform.

Quartix Technologies (AIM:QTX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Quartix Technologies plc designs, develops, markets, and delivers vehicle telematics services across the United Kingdom, France, the United States, and other European territories with a market cap of £133.18 million.

Operations: The company's revenue is derived from the United Kingdom (£19.46 million), France (£8.53 million), the United States of America (£3.18 million), and other European territories (£2.77 million).

Market Cap: £133.18M

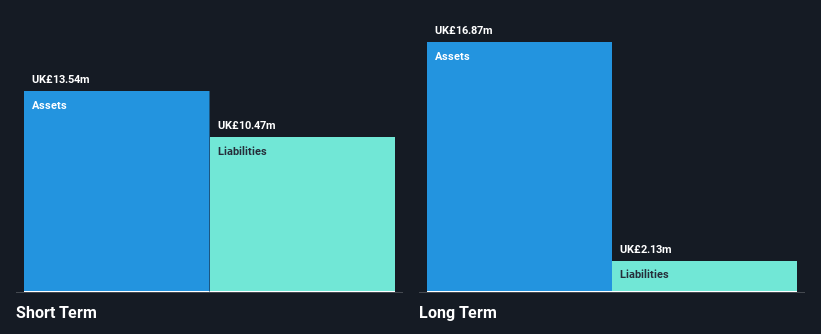

Quartix Technologies plc, with a market cap of £133.18 million, has recently transitioned to profitability and is trading at 11.7% below its estimated fair value. The company boasts high-quality earnings and a robust financial position, with short-term assets (£15.4M) comfortably covering both short-term (£9.6M) and long-term liabilities (£1.4M). Despite an inexperienced management team (1.5 years average tenure), Quartix's return on equity stands at a high 25%. Analysts anticipate the stock price could rise by 30.9%, although significant insider selling in the past quarter may warrant caution for potential investors.

- Unlock comprehensive insights into our analysis of Quartix Technologies stock in this financial health report.

- Evaluate Quartix Technologies' prospects by accessing our earnings growth report.

Taylor Maritime (LSE:TMI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Taylor Maritime Limited is an investment company involved in acquiring, managing, and operating dry bulk ships, with a market cap of $286.40 million.

Operations: The company generates revenue through its segment focused on shipping vessels to generate investment returns whilst reserving capital, amounting to -$66.35 million.

Market Cap: $286.4M

Taylor Maritime Limited, with a market cap of $286.40 million, is currently unprofitable and generates less than US$1 million in revenue. Despite being debt-free and having short-term assets of $6.2M exceeding its short-term liabilities of $4M, the company faces challenges such as a negative return on equity (-21.43%) and declining revenue by 56.8% over the past year. The board's average tenure is 1.2 years, indicating inexperience. Although trading at 40.3% below its estimated fair value, the dividend yield of 9.2% isn't well covered by earnings despite recent affirmations for a dividend payout.

- Get an in-depth perspective on Taylor Maritime's performance by reading our balance sheet health report here.

- Gain insights into Taylor Maritime's outlook and expected performance with our report on the company's earnings estimates.

Key Takeaways

- Unlock more gems! Our UK Penny Stocks screener has unearthed 302 more companies for you to explore.Click here to unveil our expertly curated list of 305 UK Penny Stocks.

- Contemplating Other Strategies? We've found 13 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com