Birkenstock (NYSE:BIRK): Reassessing Valuation After Earnings Beat and Strong Sales, Profit Growth

Birkenstock Holding (NYSE:BIRK) just delivered a full year earnings update that topped expectations, with stronger sales and a big jump in profit putting fresh attention on what investors are really paying for this growth.

See our latest analysis for Birkenstock Holding.

Those numbers appear to be shifting sentiment, with the share price now at $46.4 and a strong 1 month share price return of 17.41% contrasting with a weaker 1 year total shareholder return of 18.82% in the red. This suggests that momentum is rebuilding after a tough year.

If Birkenstock’s rebound has your attention, this could be a good moment to broaden your watchlist and explore fast growing stocks with high insider ownership.

With earnings surging and analysts projecting close to 50% upside, Birkenstock’s valuation is back in focus. Are investors still getting a deal here, or has the market already priced in the next leg of growth?

Price-to-Earnings of 23.7x: Is it justified?

On a pure valuation basis, Birkenstock’s 23.7x price to earnings multiple looks slightly rich against US luxury names, even with the stock still below many analysts’ targets.

The price to earnings ratio compares today’s share price to the company’s per share earnings. It is a quick gauge of how much investors are willing to pay for each dollar of profit. For a consumer brand like Birkenstock, that multiple effectively reflects how durable the market thinks its margins and growth runway are.

Here, the market is paying more than the estimated fair price to earnings level of 20.3x. This signals that investors are already assigning a premium to Birkenstock’s growth story despite earnings being forecast to grow only moderately faster than the broader US market. That premium may narrow over time if sentiment cools or the share price tracks back toward the level implied by the fair multiple.

Relative to the US luxury industry average of 22.6x, Birkenstock’s 23.7x multiple stands out as a notch higher. This suggests that investors see it as a higher quality or faster growing story than many peers, even though it remains under the peer average of 38.1x for a broader comparable set. The fair price to earnings ratio of 20.3x provides a lower benchmark, implying there is room for the market’s optimism to reset closer to that level if expectations temper.

Explore the SWS fair ratio for Birkenstock Holding

Result: Price-to-Earnings of 23.7x (OVERVALUED)

However, investors should still weigh risks such as slowing consumer demand or brand saturation, which could pressure margins and undermine the market’s premium expectations.

Find out about the key risks to this Birkenstock Holding narrative.

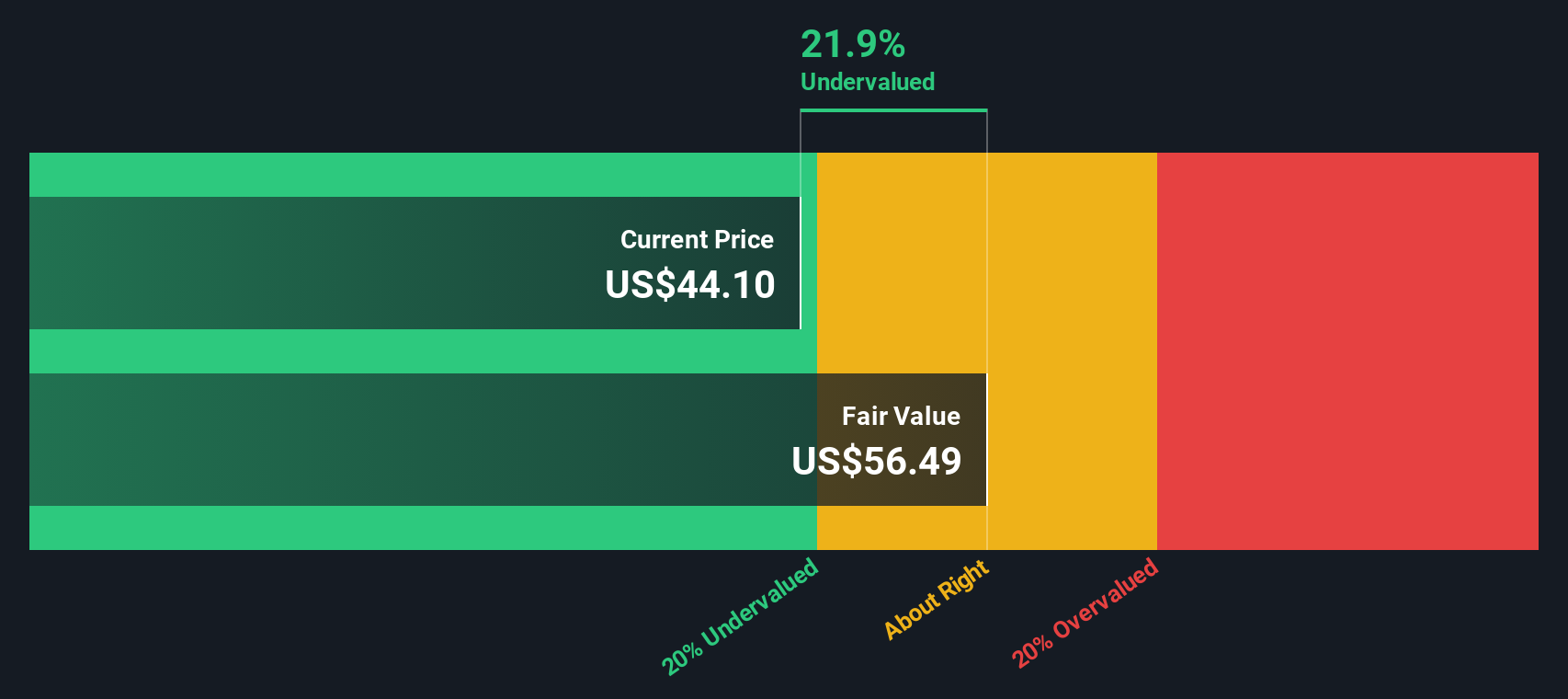

Another View: Our DCF Suggests Upside

While the price to earnings ratio points to a rich valuation, our DCF model presents a different perspective. With BIRK trading around $46.40 versus an estimated fair value of $57.31, the shares appear roughly 19% undervalued. This raises the question of whether the market may be underestimating how long this growth can last.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Birkenstock Holding for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 909 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Birkenstock Holding Narrative

If you see the story differently, or want to dig into the numbers yourself, you can build a tailored view in minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Birkenstock Holding.

Ready for your next investing move?

Before you move on, lock in your advantage by scanning fresh opportunities on Simply Wall Street’s screener, where curated ideas can sharpen your next portfolio decision.

- Capture long term compounding potential with reliable cash generators by focusing on these 13 dividend stocks with yields > 3% that can strengthen total returns in volatile markets.

- Position yourself at the forefront of innovation by targeting these 26 AI penny stocks that could benefit most as artificial intelligence reshapes entire industries.

- Hunt for mispriced opportunities by zeroing in on these 909 undervalued stocks based on cash flows where market pessimism may have created attractive entry points.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com