What Lamb Weston Holdings (LW)'s Q1 Earnings Beat And Reaffirmed Outlook Means For Shareholders

- Earlier this year, Lamb Weston reported Q1 2026 results that exceeded analyst expectations, with adjusted EPS of US$0.74 and net sales of US$1.66 billion, supported by 6% volume growth, cost savings, and lower SG&A expenses.

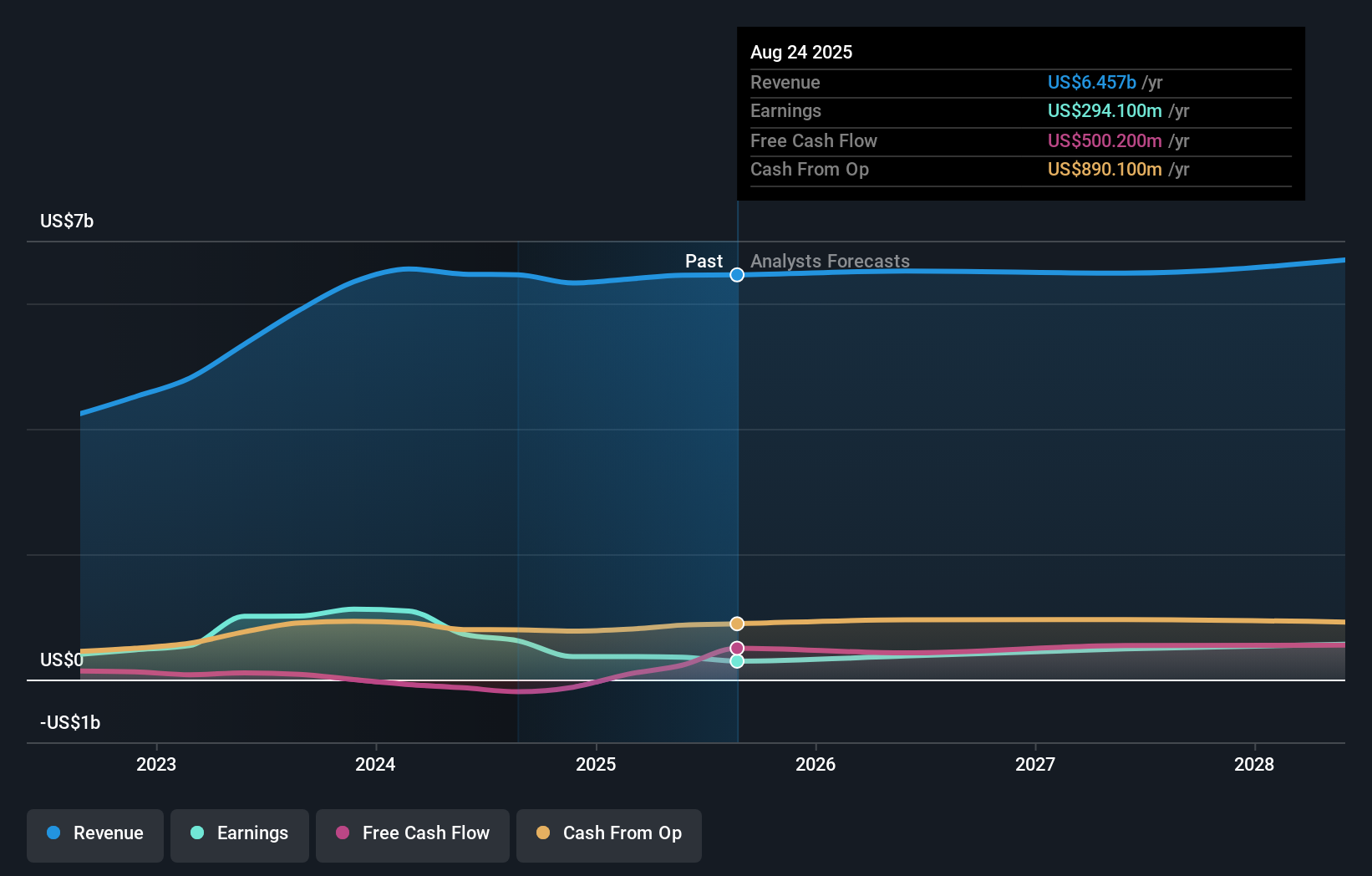

- Management’s full-year outlook for net sales of US$6.35–US$6.55 billion and adjusted EBITDA of US$1.00–US$1.20 billion signals a focus on stabilizing operations while executing its ‘Focus to Win’ efficiency program.

- We’ll now examine how this earnings beat and reaffirmed full-year outlook shape Lamb Weston’s existing investment narrative and risk profile.

AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Lamb Weston Holdings Investment Narrative Recap

To own Lamb Weston today, you need to believe it can translate its scale and “infrastructure-like” role in frozen potatoes into durable cash generation, even as restaurant traffic and pricing remain under pressure. The Q1 2026 beat and reaffirmed full year guidance support that thesis in the near term, but they do not remove the key risk that ongoing promotions and competitive pricing could keep margins compressed longer than investors might like.

The most relevant update here is management’s reiteration of its Focus to Win program, targeting at least US$250 million of cost savings by fiscal 2027. In the context of softer pricing and a mixed demand backdrop, this efficiency plan is a central catalyst, because it is designed to protect profitability and support the company’s EBITDA guidance range of US$1.00 billion to US$1.20 billion even if pricing remains under strain.

Yet investors should be aware that persistent price and promotion pressure in key QSR channels could still...

Read the full narrative on Lamb Weston Holdings (it's free!)

Lamb Weston Holdings' narrative projects $6.7 billion revenue and $550.7 million earnings by 2028. This requires 1.3% yearly revenue growth and about a $193.5 million earnings increase from $357.2 million today.

Uncover how Lamb Weston Holdings' forecasts yield a $66.00 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Eight fair value estimates from the Simply Wall St Community span roughly US$48 to US$195 per share, underscoring how far apart views on Lamb Weston can be. When you set that range against current concerns about sustained price and promotion driven margin pressure, it becomes even more important to weigh several different opinions before deciding how this stock fits your portfolio.

Explore 8 other fair value estimates on Lamb Weston Holdings - why the stock might be worth over 3x more than the current price!

Build Your Own Lamb Weston Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lamb Weston Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Lamb Weston Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lamb Weston Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com