Economic growth is showing resilience! The ECB's fourth consecutive no-go easing cycle may have come to an end

The Zhitong Finance App learned that since the inflation rate hovered near the target level and the Eurozone economy withstood the impact, the ECB kept the deposit mechanism interest rate unchanged at 2% for the fourth time in a row on Thursday, in line with market expectations. Policymakers continue not to provide guidance on future policy paths, stressing that they will make decisions on a conference by conference basis based on the latest data.

The background of this meeting is that the Eurozone economy appears to be more stable than in recent months, continued to expand during the worst trade frictions, and even surpassed expectations in the third quarter. According to a business survey released by S&P Global, economic momentum remained stable in the last few months of this year, and Germany's fiscal stimulus measures are expected to further support growth on this basis.

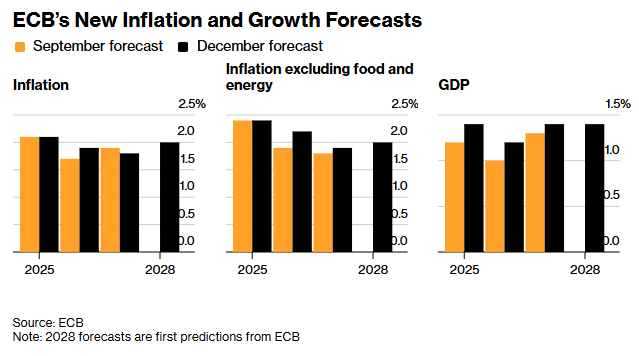

Meanwhile, the latest forecast released with the resolution shows that economic expansion will be more steady, and inflation will return to 2% in 2028 after falling below target levels in the next two years. The ECB said in a statement that the latest assessment “once again confirms that inflation will stabilize at the target level of 2% in the medium term.”

ECB's latest inflation and economic growth forecasts

Most ECB officials have previously signalled that they are prepared to accept the prospect that price growth will fall below the target level for a period of time, and believe that a short period of time below the target does not require immediate action. ECB Executive Board member Isabelle Schnabel said that as long as this bias is small, she won't worry too much. The long-term suspension of interest rates will limit the number of interest rate cuts in this easing cycle to eight. This will be the result Schnabel is happy to see, and she believes that no matter when the next step is taken, interest rate hikes may be possible. Bank of Lithuania Governor Gediminas Simkus previously opened the door to the possibility of cutting interest rates again, and now also said that due to the surprisingly strong economy, he believes there is no need for further policy relaxation.

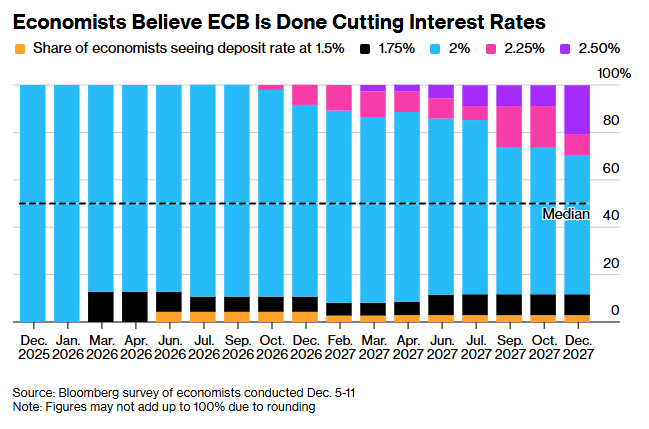

In another survey, economists also generally expect Eurozone policy interest rates to remain at current levels until 2027. However, this is not the case with all central banks. The Bank of England chose to cut interest rates by 25 basis points earlier on Thursday. The Federal Reserve also announced a 25 basis point cut last week, and both central banks are likely to further relax their policies next year. In this case, the EUR/GBP and EUR/USD exchange rates may be supported.

Furthermore, investors have begun to lower expectations for further global easing and are betting that the ECB may raise interest rates for the first time in 2026 as soon as possible. ECB President Christine Lagarde (Christine Lagarde) will hold a press conference after the interest rate decision is announced to explain her judgment.