Is Federal Realty Stock Underperforming the Nasdaq?

With a market cap of $8.8 billion, Federal Realty Investment Trust (FRT) is a leading owner, operator, and redeveloper of high-quality retail-based and mixed-use properties primarily located in major coastal markets with strong economic and demographic fundamentals. The company focuses on creating strong community-driven destinations where retail demand exceeds supply.

Companies valued less than $10 billion are generally described as “mid-cap” stocks, and Federal Realty fits right into that category. Its diversified portfolio includes 103 properties with millions of square feet of commercial space and thousands of residential units, supporting a wide range of tenants.

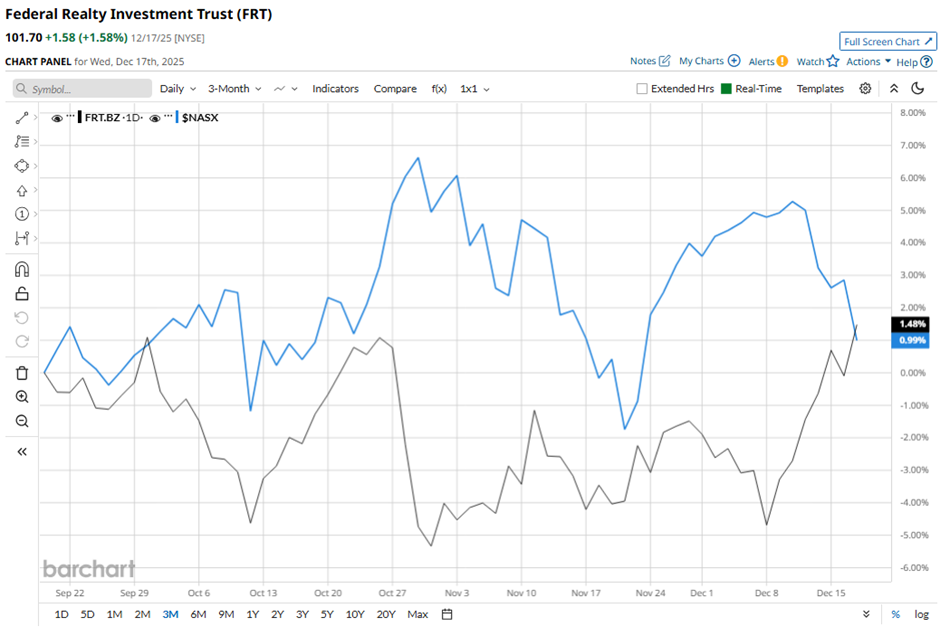

Shares of the REIT have declined 12% from its 52-week high of $115.59. FRT stock has risen 2.4% over the past three months, slightly outperforming the broader Nasdaq Composite's ($NASX) 1.9% gain over the same time frame.

Longer term, FRT stock is down 9.2% on a YTD basis, lagging behind NASX's 17.5% increase. Also, shares of Federal Realty have decreased 11.1% over the past 52 weeks, compared to NASX's 12.9% return over the same time frame.

Despite recent fluctuations, the stock has been trading above its 50-day moving average since mid-August.

Shares of Federal Realty rose 1.4% on Oct. 31 after the company reported better-than-expected Q3 2025 FFO of $1.77 per share and revenue of $322.3 million. The company also posted strong operating performance, including record leasing volume of 727,029 square feet with rent growth of 28% on a cash basis and comparable property operating income growth of 4.4%. Additionally, Federal Realty raised its full-year 2025 FFO guidance to $7.05 per share - $7.11 per share.

In comparison, rival Simon Property Group, Inc. (SPG) has outpaced FRT stock. SPG stock has returned nearly 7% YTD and 7.4% over the past 52 weeks.

Despite FRT’s weak performance over the past year, analysts remain moderately optimistic about its prospects. Among the 19 analysts covering the stock, there is a consensus rating of “Moderate Buy,” and the mean price target of $109.47 is a premium of 7.6% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.