Principal Financial Group (PFG): Is the Recent Share Price Rally Now Fully Valued?

Principal Financial Group (PFG) has quietly put together a solid run, with the stock up about 9% over the past month and 15% year to date, outpacing many peers in the financial sector.

See our latest analysis for Principal Financial Group.

That steady climb to a recent share price of $89.37, backed by a roughly mid-teens year to date share price return and a strong five year total shareholder return, suggests investors are gradually rewarding Principal Financial Group for improving growth and a perceived reduction in long term risk.

If Principal’s momentum has you thinking about what else could compound steadily over time, this might be a good moment to explore fast growing stocks with high insider ownership.

With shares hovering just below Wall Street’s target and fundamentals improving, the obvious question is whether Principal Financial Group is still trading at a discount or if the market is already pricing in the next leg of growth.

Most Popular Narrative Narrative: 0.3% Overvalued

With Principal Financial Group trading just above the most popular narrative fair value of about $89.08, the story hinges on steady earnings expansion and disciplined capital use.

The company has been aligning expenses with revenue through disciplined cost management, which is likely to positively impact net margins and earnings even during volatile market conditions. By focusing on higher quality and higher fee mandates, particularly in asset management, Principal stands to improve its revenue rate and margins across its portfolio, thereby contributing to future earnings growth.

Curious how modest revenue growth, rising margins and a lower future earnings multiple can still point to meaningful upside? The narrative spells out a surprisingly ambitious earnings runway, share count reduction and profitability shift that all have to line up. Want to see exactly how those moving parts add up to today’s fair value call?

Result: Fair Value of $89.08 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent flow headwinds in fee businesses or renewed market volatility could still undercut revenue growth assumptions and compress margins more than expected.

Find out about the key risks to this Principal Financial Group narrative.

Another Angle on Valuation

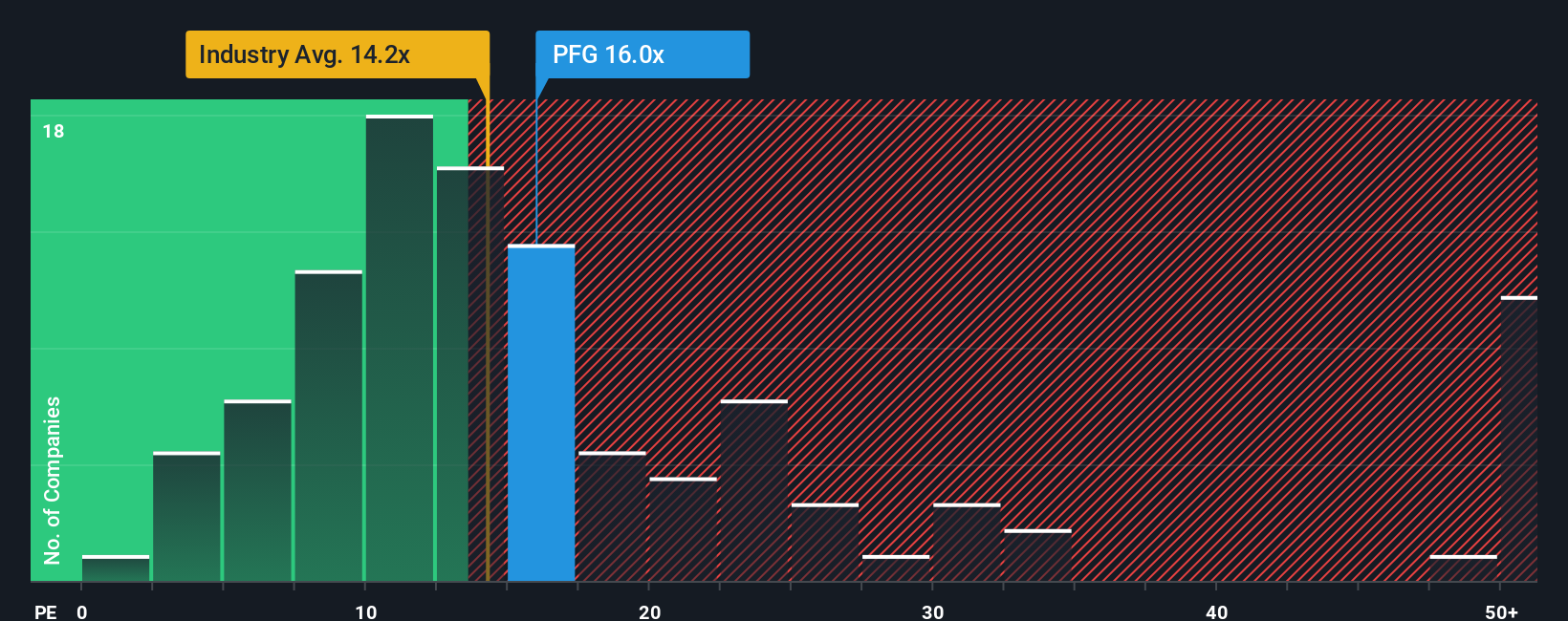

While the most popular narrative sees Principal Financial Group as roughly fairly priced, its current 12.5x price to earnings sits below the US Insurance industry at 13.4x and well under a 17x fair ratio, hinting at upside if sentiment and earnings hold up.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Principal Financial Group Narrative

If you see the numbers differently or want to dig into the details yourself, you can build a custom view in minutes, Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Principal Financial Group.

Looking for more investment ideas?

Before you move on, you can explore additional opportunities by scanning targeted stock ideas on Simply Wall Street that may help sharpen and diversify your portfolio.

- Explore potential mispriced opportunities by reviewing these 908 undervalued stocks based on cash flows which focuses on companies with strong cash flow potential and attractive entry points.

- Review these 26 AI penny stocks to find companies involved in machine learning and automation that are positioned for structural, long term growth.

- Assess your income strategy by looking at these 13 dividend stocks with yields > 3% which highlights dividend payers with yields above 3 percent and solid underlying fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com