The Bull Case For Citigroup (C) Could Change Following Restructuring Gains And Legal Win - Learn Why

- In recent days, Citigroup Inc. has issued several fixed‑income securities totaling more than US$216 million, advanced its Banamex exit by selling a 25% stake to Mexican investor Fernando Chico Pardo, and won a UK court ruling that blocked a very large foreign‑exchange lawsuit alongside other major banks.

- Together with fresh analyst upgrades and commentary that its multi‑year restructuring is about two‑thirds complete, these moves reinforce investors’ perception that Citigroup’s simplification and efficiency efforts are gaining real traction across its global franchise.

- With analysts highlighting tangible restructuring progress as a key driver, we’ll now examine how this latest milestone could influence Citigroup’s investment narrative.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Citigroup Investment Narrative Recap

To own Citigroup today, you generally need to believe its simplification plan can lift returns closer to peers while keeping regulatory and legal risks contained. The most important near term catalyst remains execution on restructuring, including the Banamex exit, while the biggest risk is still elevated regulatory and transformation costs. The recent bond issuance, preferred stock designation, and FX lawsuit win do not materially change that balance, but they support funding flexibility and legal clarity at the margin.

Among the recent developments, the accelerated sale of a 25% stake in Banamex to Fernando Chico Pardo stands out as most relevant. It advances Citi’s multi year exit from Mexican consumer banking, aligning with the core catalyst of strategic simplification and cost reduction, while also underscoring the ongoing risk that prolonged restructuring, uncertain IPO timing, and stranded costs could weigh on returns if progress stalls.

Yet even with these encouraging steps, investors still need to be aware of how persistent regulatory scrutiny and transformation expenses could...

Read the full narrative on Citigroup (it's free!)

Citigroup's narrative projects $88.8 billion revenue and $17.2 billion earnings by 2028. This requires 6.8% yearly revenue growth and a $4.3 billion earnings increase from $12.9 billion today.

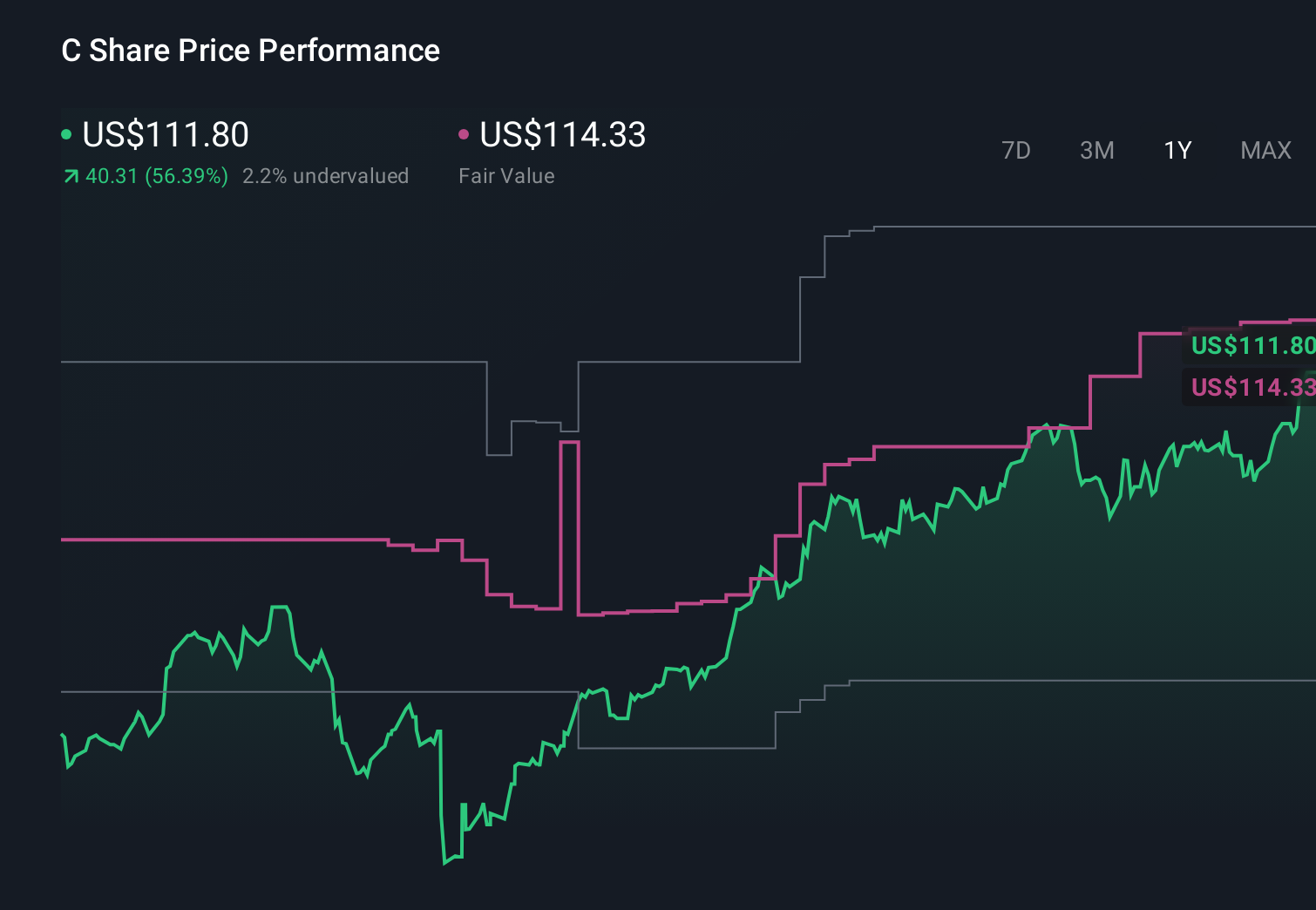

Uncover how Citigroup's forecasts yield a $116.00 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Some of the most optimistic analysts were already assuming roughly US$91.3 billion of revenue and US$20.0 billion of earnings by 2028, so if you are weighing Citi’s latest bond issuance and Banamex stake sale, it is worth asking whether these upbeat expectations around AI driven efficiency and margin expansion still feel realistic or need revisiting in light of how differently investors can view the same set of risks and catalysts.

Explore 12 other fair value estimates on Citigroup - why the stock might be worth 23% less than the current price!

Build Your Own Citigroup Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Citigroup research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Citigroup research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Citigroup's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com