3 Promising Penny Stocks With Market Caps Over $30M

Major stock indexes in the United States recently experienced a boost, with inflation data coming in cooler than anticipated, leading to a positive shift in market sentiment. For investors willing to explore beyond well-known companies, penny stocks—often associated with smaller or newer firms—continue to offer intriguing opportunities. Despite their vintage label, these stocks can provide growth potential at lower price points when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.82 | $488.62M | ✅ 3 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $1.08 | $198.38M | ✅ 4 ⚠️ 2 View Analysis > |

| LexinFintech Holdings (LX) | $3.08 | $526.66M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.21 | $1.32B | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect (PERF) | $1.72 | $175.18M | ✅ 5 ⚠️ 0 View Analysis > |

| CI&T (CINT) | $4.72 | $623.12M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 1 ⚠️ 5 View Analysis > |

| VAALCO Energy (EGY) | $3.45 | $351.35M | ✅ 2 ⚠️ 3 View Analysis > |

| BAB (BABB) | $0.89 | $6.46M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.82 | $89.72M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 342 stocks from our US Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Alto Ingredients (ALTO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Alto Ingredients, Inc. operates in the United States producing, distributing, and marketing specialty alcohols, renewable fuel, and essential ingredients with a market cap of approximately $189.49 million.

Operations: The company's revenue is primarily derived from its Pekin Campus Production at $583.46 million, Western Production at $129.65 million, and Marketing and Distribution at $213.32 million.

Market Cap: $189.49M

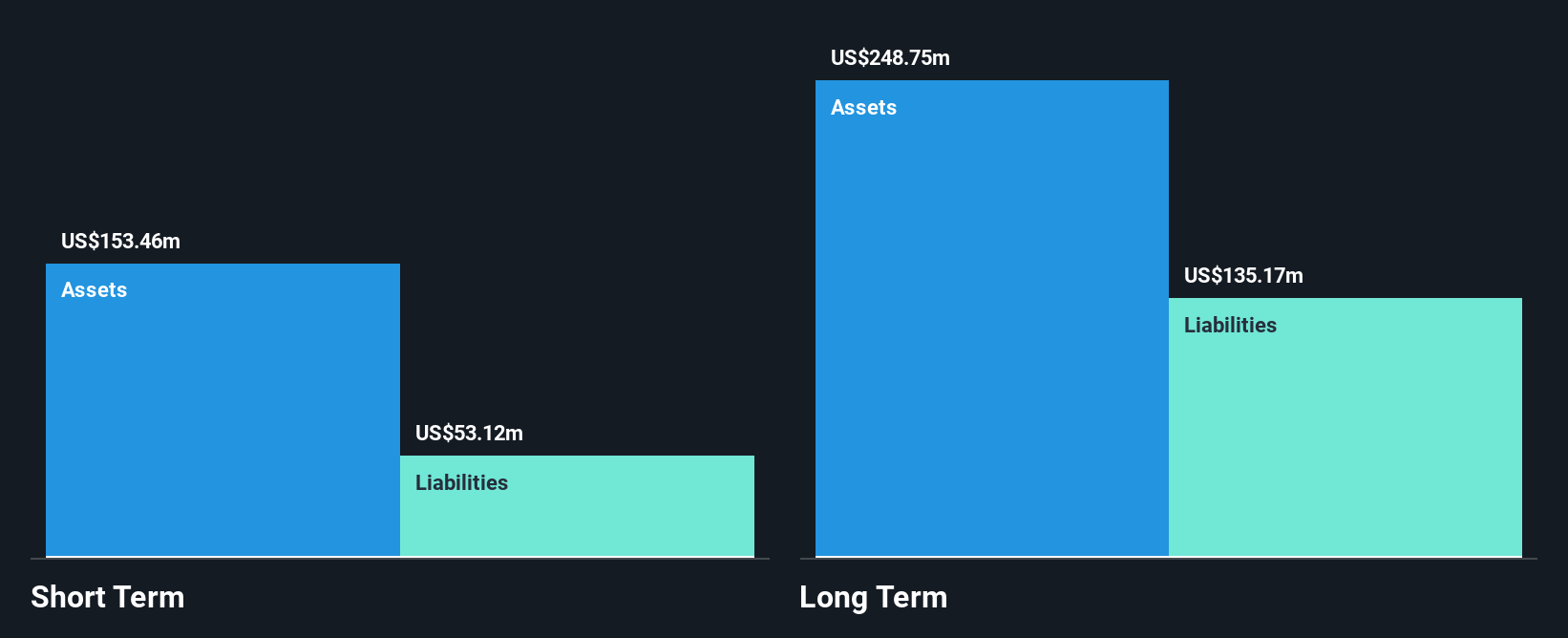

Alto Ingredients, Inc. operates with a market cap of US$189.49 million, deriving significant revenue from its Pekin Campus Production, Western Production, and Marketing and Distribution segments. Despite reporting a net income of US$14.21 million for Q3 2025, the company remains unprofitable over the past year with losses increasing at an annual rate of 38.4% over five years. The company benefits from an experienced management team and board, reduced debt levels to a satisfactory net debt to equity ratio of 30.6%, and maintains sufficient cash runway for more than three years despite high share price volatility recently observed.

- Click here to discover the nuances of Alto Ingredients with our detailed analytical financial health report.

- Review our growth performance report to gain insights into Alto Ingredients' future.

Century Therapeutics (IPSC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Century Therapeutics, Inc. is a clinical-stage biotechnology company focused on developing allogeneic cell therapies for treating solid tumors, hematological malignancies, and autoimmune diseases, with a market cap of $54.35 million.

Operations: The company generates revenue from its biotechnology startups segment, totaling $113.34 million.

Market Cap: $54.35M

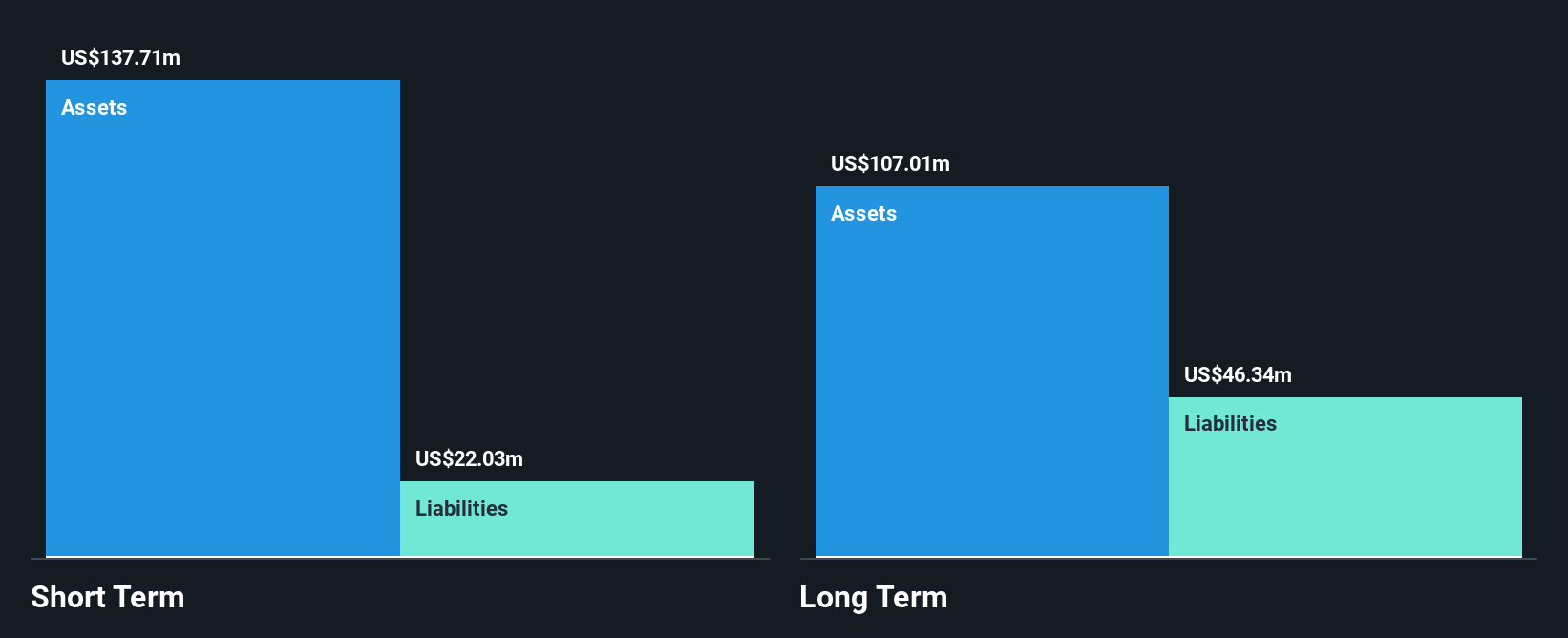

Century Therapeutics, Inc. operates with a market cap of US$54.35 million and is currently pre-revenue, focusing on developing innovative cell therapies. Recent strategic moves include appointing two experienced directors to its board and proposing a reverse stock split to manage share structure effectively. The company reported a net loss of US$34.42 million for Q3 2025 but has shown improved earnings over the past five years, reducing losses by 2.1% annually despite being unprofitable overall. Century maintains sufficient short-term assets to cover liabilities but faces challenges with cash runway sustainability if current cash flow trends persist.

- Jump into the full analysis health report here for a deeper understanding of Century Therapeutics.

- Understand Century Therapeutics' earnings outlook by examining our growth report.

Zedge (ZDGE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zedge, Inc. operates digital marketplaces and develops competitive games focused on user-generated content for self-expression, with a market cap of $38.62 million.

Operations: Zedge has not reported any specific revenue segments.

Market Cap: $38.62M

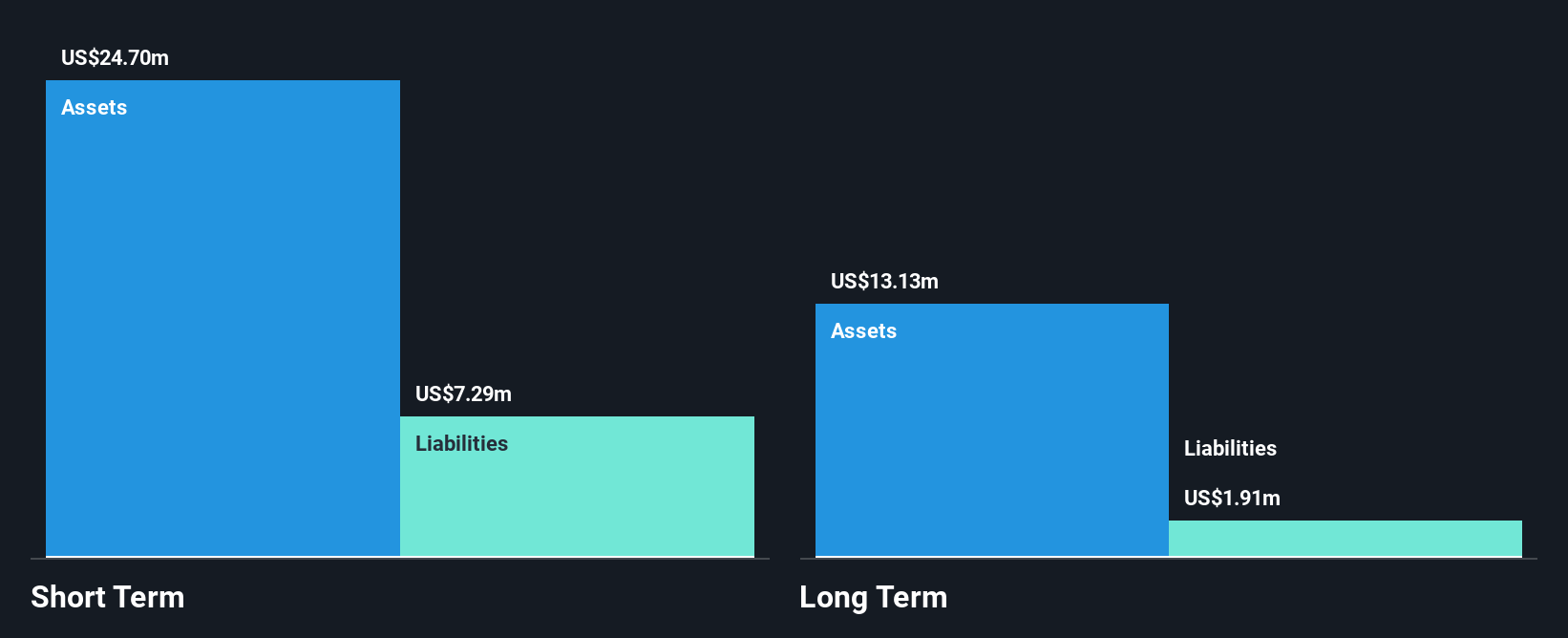

Zedge, Inc., with a market cap of US$38.62 million, has shown resilience despite recent challenges. The company reported Q1 2026 earnings with sales of US$7.61 million and a net income of US$0.788 million, marking an improvement from the previous year's losses. While unprofitable overall, Zedge maintains a strong cash position with over three years of runway due to positive free cash flow and no debt obligations. Recent initiatives include share buybacks and the introduction of a quarterly dividend program, reflecting efforts to enhance shareholder value amid high share price volatility and negative return on equity.

- Click to explore a detailed breakdown of our findings in Zedge's financial health report.

- Assess Zedge's future earnings estimates with our detailed growth reports.

Where To Now?

- Unlock our comprehensive list of 342 US Penny Stocks by clicking here.

- Contemplating Other Strategies? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com