ZoomInfo (GTM): Reassessing Valuation After BTIG’s Upbeat Coverage and AI‑Driven Growth Confidence

ZoomInfo Technologies (GTM) grabbed attention after BTIG kicked off coverage with an upbeat stance, sending the stock up about 6% as investors reassessed the company’s AI driven growth story and contract momentum.

See our latest analysis for ZoomInfo Technologies.

The upbeat move following BTIG’s coverage fits into a mixed picture, with a solid 1 month share price return but a weaker 3 month share price return and still deeply negative multi year total shareholder returns. This suggests sentiment is improving, but the longer term reset is not yet fully repaired.

If ZoomInfo’s AI driven story has your attention, this could be a good moment to explore other high growth tech and AI names using our high growth tech and AI stocks.

Yet with shares still down sharply over three and five years, trading at a discount to analyst targets despite renewed AI optimism, is ZoomInfo quietly undervalued, or is the market already baking in the next leg of growth?

Most Popular Narrative: 18.5% Undervalued

With ZoomInfo closing at $10.07 against a narrative fair value a little above $12, the current share price sits notably below that storyline.

As leading enterprises consolidate their go to market tech stacks and seek seamless integration of sales intelligence platforms with CRMs and marketing automation, ZoomInfo's product innovation and early mover advantage in AI powered sales tools (Copilot, Go To Market Studio) are cementing its indispensability. This underpins long term growth and provides the foundation for premium pricing and resilience against commoditization, directly benefitting both revenue and margin outlooks.

Want to see the math behind that gap? The narrative leans on slowing top line growth, sharply rising profitability, and a future earnings multiple that might surprise you.

Result: Fair Value of $12.35 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concentrated exposure to a smaller pool of large enterprise clients, along with persistent downmarket weakness, could quickly unravel the AI led, upmarket driven upside case.

Find out about the key risks to this ZoomInfo Technologies narrative.

Another Angle on Valuation

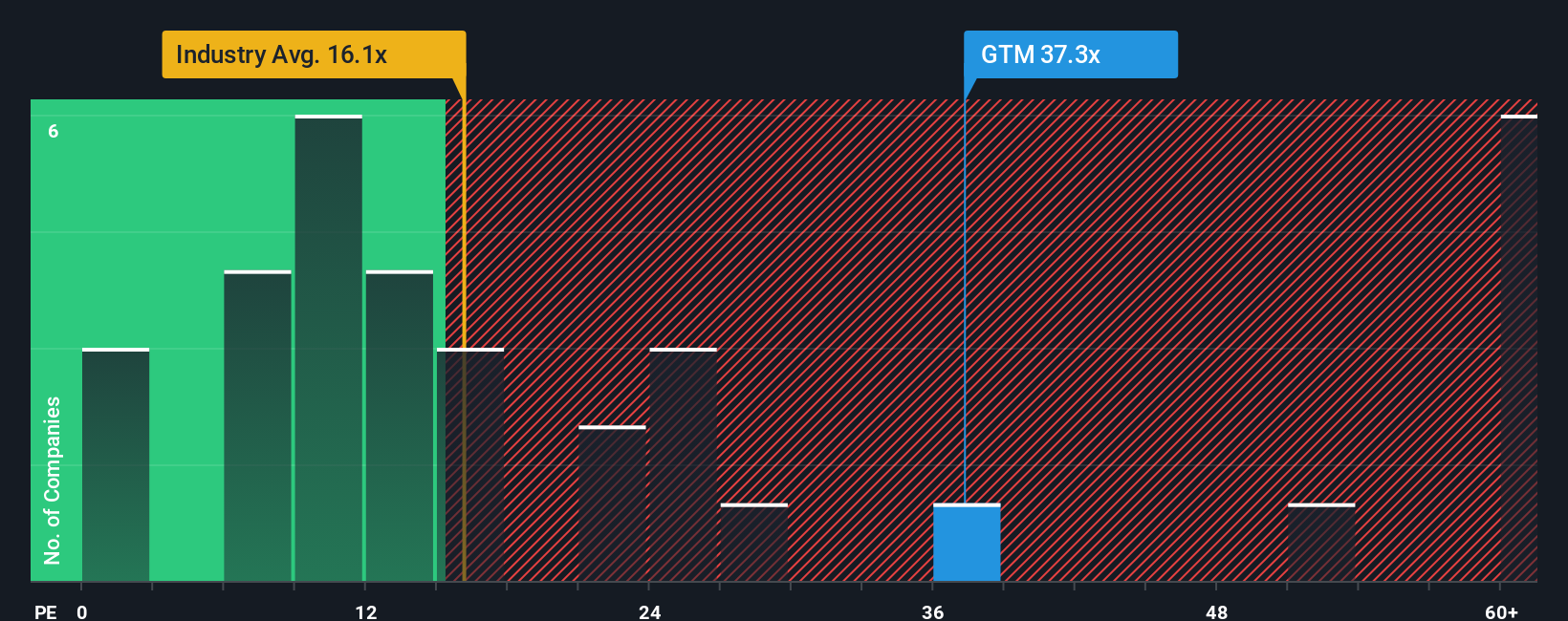

While the narrative fair value suggests ZoomInfo is 18.5% undervalued, the earnings based view cuts the other way. At about 30 times earnings, versus 16.6 times for its industry and 7 times for peers, and above a fair ratio of 20.8 times, the stock screens as expensive. Is the market rightly front running AI growth, or simply overpaying for a slow top line?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ZoomInfo Technologies Narrative

If you see the numbers differently, or want to dig into the details yourself, you can build a personalized ZoomInfo view in minutes, Do it your way.

A great starting point for your ZoomInfo Technologies research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, line up your next opportunities with data backed stock ideas from our screener so you are not chasing the market later.

- Secure potential hidden bargains early by reviewing these 908 undervalued stocks based on cash flows that may offer meaningful upside based on strong cash flow support.

- Ride powerful secular themes by targeting these 26 AI penny stocks positioned to benefit from rapid advances in artificial intelligence adoption.

- Boost your income game by scanning these 13 dividend stocks with yields > 3% that can strengthen portfolio yields while still passing fundamental quality checks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com