Orchid Island Capital (ORC): Reassessing Valuation After Compass Point Initiation and Strong Q3 Earnings

Compass Point’s new coverage of Orchid Island Capital (ORC) is putting the spotlight on how tighter mortgage spreads and a generous dividend policy could shape returns, especially after the company’s strong third quarter earnings beat.

See our latest analysis for Orchid Island Capital.

That backdrop helps explain why, at a latest share price of $7.27, Orchid Island Capital’s 1 year total shareholder return of 12.9% contrasts with a weaker year to date share price return of negative 7.6%. This suggests momentum has cooled even as income has supported overall returns.

If income focused mortgage REITs are on your radar, this could be a good moment to also explore fast growing stocks with high insider ownership for other potential opportunities building quieter momentum.

With earnings running ahead of expectations, a double digit yield, and shares trading just shy of Compass Point’s $7.50 target, the key question now is whether Orchid Island Capital is undervalued or if markets are already pricing in future growth.

Most Popular Narrative: 9.1% Undervalued

With Orchid Island Capital last closing at $7.27, the most followed narrative points to a fair value closer to $8, implying modest upside from here.

The confluence of historically wide mortgage spreads over swaps (circa 200 bps on production coupons) and low market volatility presents a rare opportunity for Orchid Island Capital to acquire high carry, attractively priced assets and hedge effectively. This positions the company for margin expansion and sustained earnings growth as spreads eventually normalize. Robust, persistent demand for U.S. housing driven by demographic shifts and constrained housing supply is supporting stable prepayment speeds and elevated mortgage balances, underpinning Orchid's asset base and enabling steady, predictable income flow even in a challenging macro environment, which benefits both revenue and earnings stability.

Curious how a mortgage REIT can target rapid revenue expansion, near maximal margins, and a low future earnings multiple at the same time? Unpack the full playbook behind that projection driven fair value call and see which bold profitability and growth assumptions have to line up for this outcome to materialize.

Result: Fair Value of $8 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained rate volatility and Orchid’s reliance on leverage and equity raises could quickly compress margins and derail those optimistic growth assumptions.

Find out about the key risks to this Orchid Island Capital narrative.

Another View: Valuation Signals Are Mixed

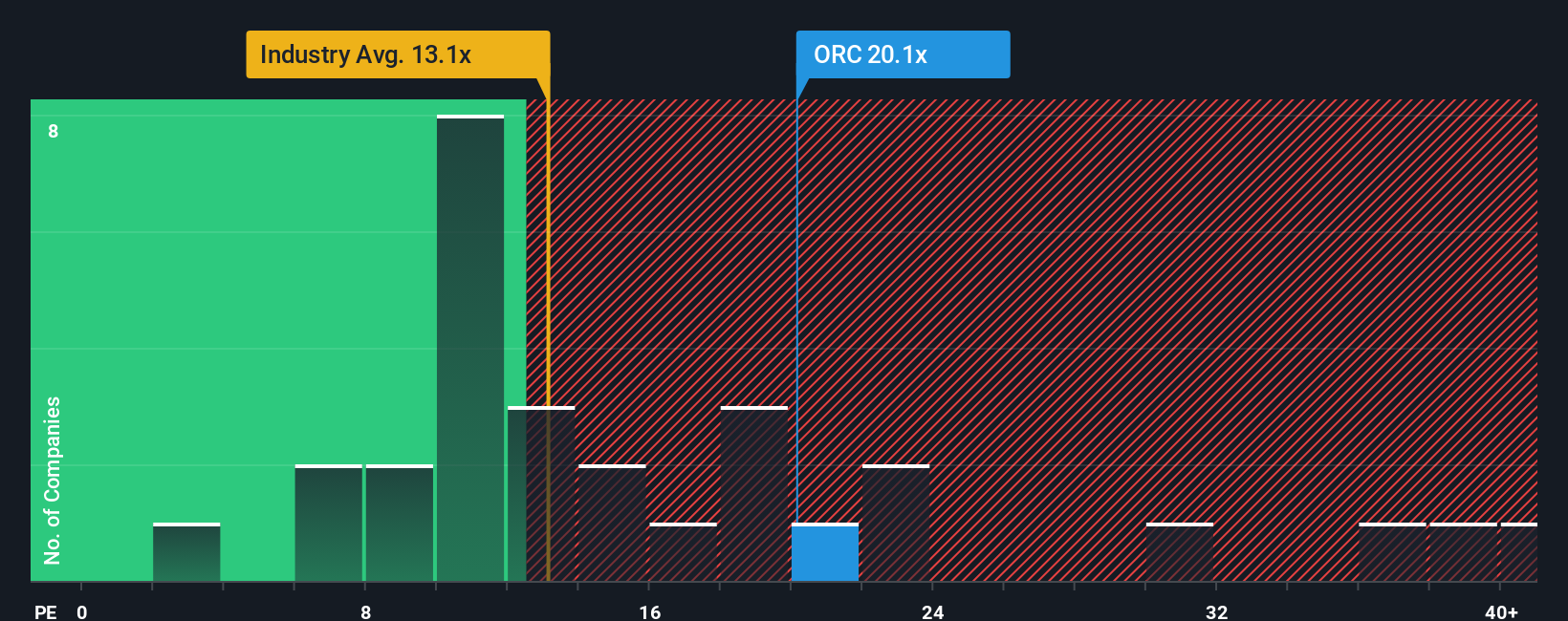

While the narrative suggests Orchid Island Capital is 9.1% undervalued, its 19.9x price to earnings ratio looks stretched versus Mortgage REIT peers at 13.1x and only just below its 20x fair ratio. That leaves little margin for error if growth or dividends disappoint.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Orchid Island Capital Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your Orchid Island Capital research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investing opportunities?

Before you move on, lock in your next edge by using the Simply Wall St Screener to surface fresh, data driven ideas tailored to your strategy.

- Target overlooked value by scanning these 908 undervalued stocks based on cash flows that may be priced well below their long term cash flow potential.

- Ride cutting edge innovation by focusing on these 26 AI penny stocks that could benefit most from accelerating artificial intelligence adoption.

- Strengthen your passive income plan with these 13 dividend stocks with yields > 3% that aim to deliver reliable, above average cash yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com