Is Bank of Montreal (TSX:BMO) Still Undervalued After Its Strong 2024 Share Price Rally?

Bank of Montreal (TSX:BMO) has quietly pulled ahead this year, with shares up about 27% year to date and roughly 34% over the past year, outpacing many Canadian bank peers.

See our latest analysis for Bank of Montreal.

That strength is not a flash in the pan. A 26.6% year to date share price return and a 33.6% one year total shareholder return hint that investors are warming to BMO’s growth and risk profile.

If BMO’s run has you rethinking where you hunt for opportunities, this could be a smart time to explore fast growing stocks with high insider ownership as a fresh idea source.

With BMO trading just below analyst targets, yet at a hefty premium to some book and earnings metrics, investors face a key question: is this still an undervalued compounder, or has the market already priced in its next leg of growth?

Most Popular Narrative Narrative: 2.3% Undervalued

With Bank of Montreal closing at CA$177.03 against a narrative fair value near CA$181, the story leans slightly in favor of upside from here.

The fair value estimate has risen slightly from CA$175.93 to CA$181.27, reflecting moderately improved expectations for the bank's long term earnings power. The net profit margin has improved slightly from 25.22 percent to 26.16 percent, suggesting incremental gains in underlying profitability.

Curious what justifies paying up for a traditional bank in a slow growth world? The key lies in steady revenue expansion, fatter margins, and a surprisingly disciplined earnings multiple that anchors this valuation.

Result: Fair Value of $181.27 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer Canadian growth or renewed U.S. credit strains could quickly lift provisions, squeeze margins, and challenge the assumption of a comfortably undervalued BMO.

Find out about the key risks to this Bank of Montreal narrative.

Another Angle: Market Ratios Flash a Caution Light

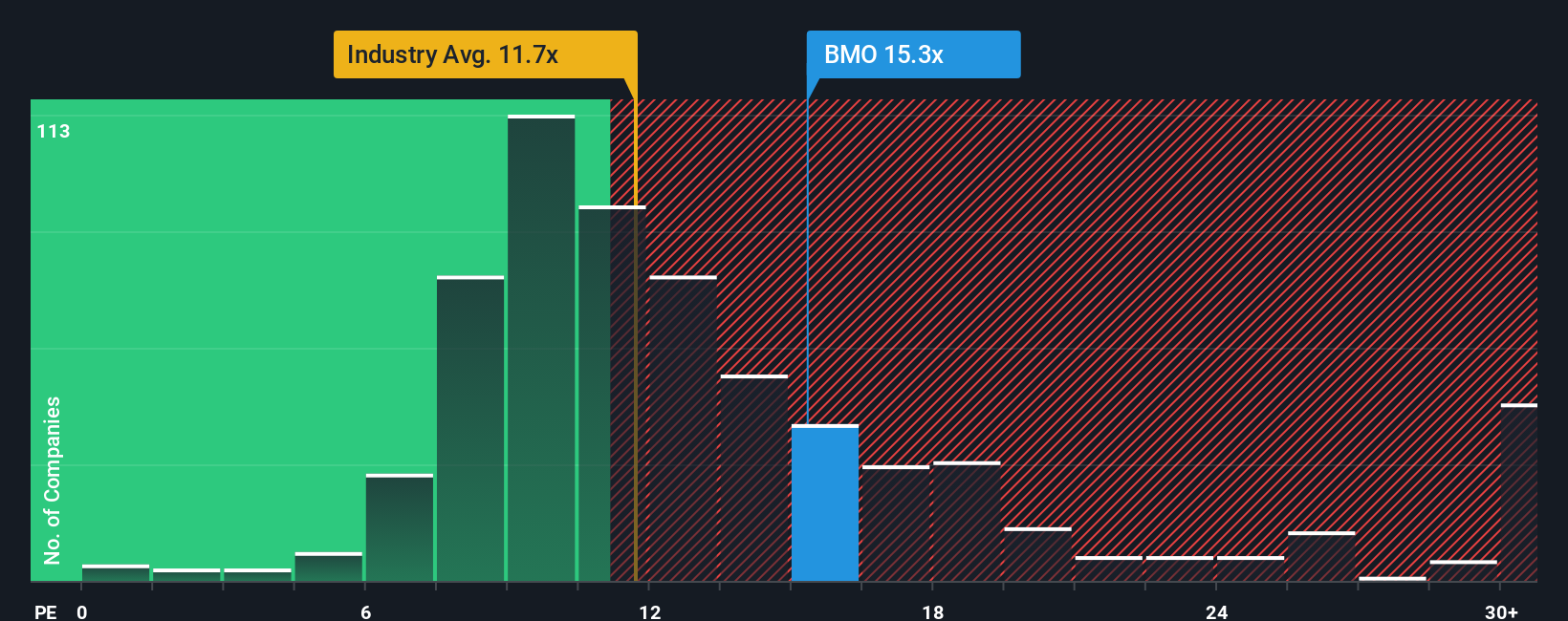

Market ratios tell a cooler story. BMO trades at about 15.2 times earnings versus a 14.8 times peer average, a 12.1 times broader North American bank average, and above a 14.7 times fair ratio, which implies limited margin of safety if sentiment turns.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bank of Montreal Narrative

If this outlook does not quite match your view, or you would rather dig into the numbers yourself, you can build a tailored narrative in just a few minutes, starting with Do it your way.

A great starting point for your Bank of Montreal research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Before you stop at one bank, put Simply Wall St’s powerful screener to work and uncover ideas you may not want to miss when the next potential opportunities emerge.

- Identify possible mispricings by targeting quality companies trading below their estimated worth with these 908 undervalued stocks based on cash flows and consider positioning yourself ahead of any potential market re rating.

- Seek exposure to structural trends in automation and data with these 25 AI penny stocks, focusing on businesses generating real revenue from artificial intelligence rather than just buzzwords.

- Support your income objectives by focusing on these 13 dividend stocks with yields > 3%, where yields above 3 percent may help provide an anchor for your portfolio through different market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com