Taylor Wimpey (LSE:TW.): Exploring Valuation After Recent Share Price Uptick

Taylor Wimpey (LSE:TW.) has quietly edged higher over the past week, and that steady climb is starting to catch investors attention. With the share price still down year-to-date, the risk reward balance looks interesting.

See our latest analysis for Taylor Wimpey.

That recent 7 day share price return of 2.96 percent sits against a year to date share price decline of 14.72 percent, while the 3 year total shareholder return of 28.87 percent shows the longer term momentum has been much healthier.

If this kind of shift in sentiment has you curious, it could be a good moment to broaden your watchlist and explore fast growing stocks with high insider ownership.

With earnings rebounding and the share price still trading at a hefty discount to analyst targets and intrinsic value estimates, is Taylor Wimpey a classic value opportunity, or is the market already baking in its future growth potential?

Most Popular Narrative: 18.6% Undervalued

With Taylor Wimpey last closing at £1.04 against a narrative fair value of £1.28, the valuation case leans in favour of upside if the growth story plays out.

The company's robust balance sheet and long-duration land bank allow it to deliver growth without significant incremental capital requirements, meaning Taylor Wimpey can scale volume and revenue while maintaining attractive and sustainable shareholder returns through the cycle.

Want to see what justifies that level of confidence? The narrative highlights powerful earnings upgrades, expanding margins, and a future valuation multiple usually reserved for top tier cyclicals. Curious which forecasts would need to be met for that upside to hold? Read on and unpack the full blueprint behind this price target.

Result: Fair Value of £1.28 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent affordability pressures and lingering cladding remediation costs could still weigh on margins, delay volume recovery and challenge the optimistic valuation narrative.

Find out about the key risks to this Taylor Wimpey narrative.

Another View: Multiples Paint a Richer Picture

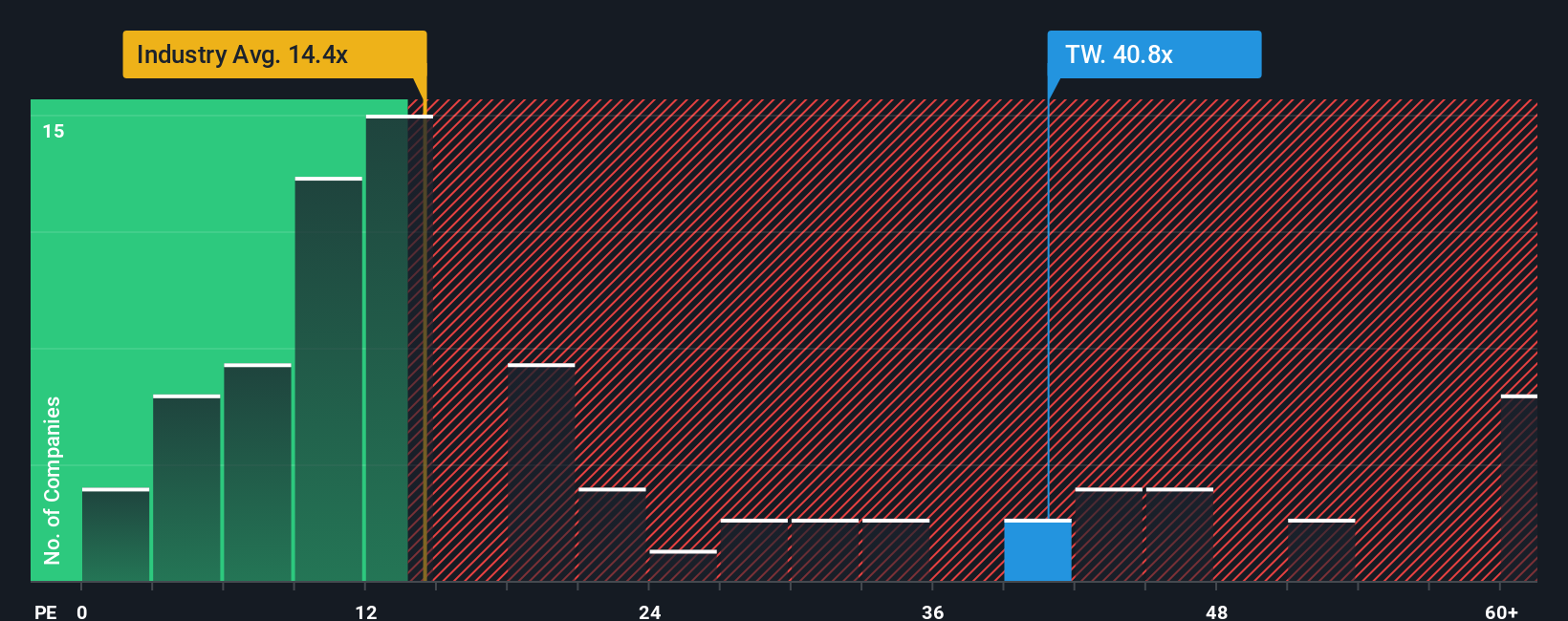

On simple earnings multiples, Taylor Wimpey looks far less of a bargain. Its price to earnings ratio of 43.5 times towers over both the European Consumer Durables average of 15.8 times and a fair ratio of 32 times, hinting at valuation risk if growth disappoints. Could today’s premium compress faster than the bullish narratives expect?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Taylor Wimpey Narrative

If you are not fully convinced by this viewpoint, or would rather dig into the numbers yourself, you can build a personalised thesis in minutes: Do it your way.

A great starting point for your Taylor Wimpey research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, give yourself the chance to uncover fresh opportunities beyond Taylor Wimpey with focused stock ideas shaped by clear, data driven themes.

- Capture potential value by targeting quality names trading below their intrinsic worth through these 914 undervalued stocks based on cash flows built on cash flow fundamentals.

- Ride secular growth trends in automation and machine learning by scanning these 24 AI penny stocks that already show real commercial traction.

- Strengthen your income stream by filtering for companies in these 13 dividend stocks with yields > 3% offering yields above 3 percent supported by current fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com