Ricegrowers (ASX:SGLLV) Margin Gains Reinforce Branded-Growth Narrative Despite Softer Revenue Trend

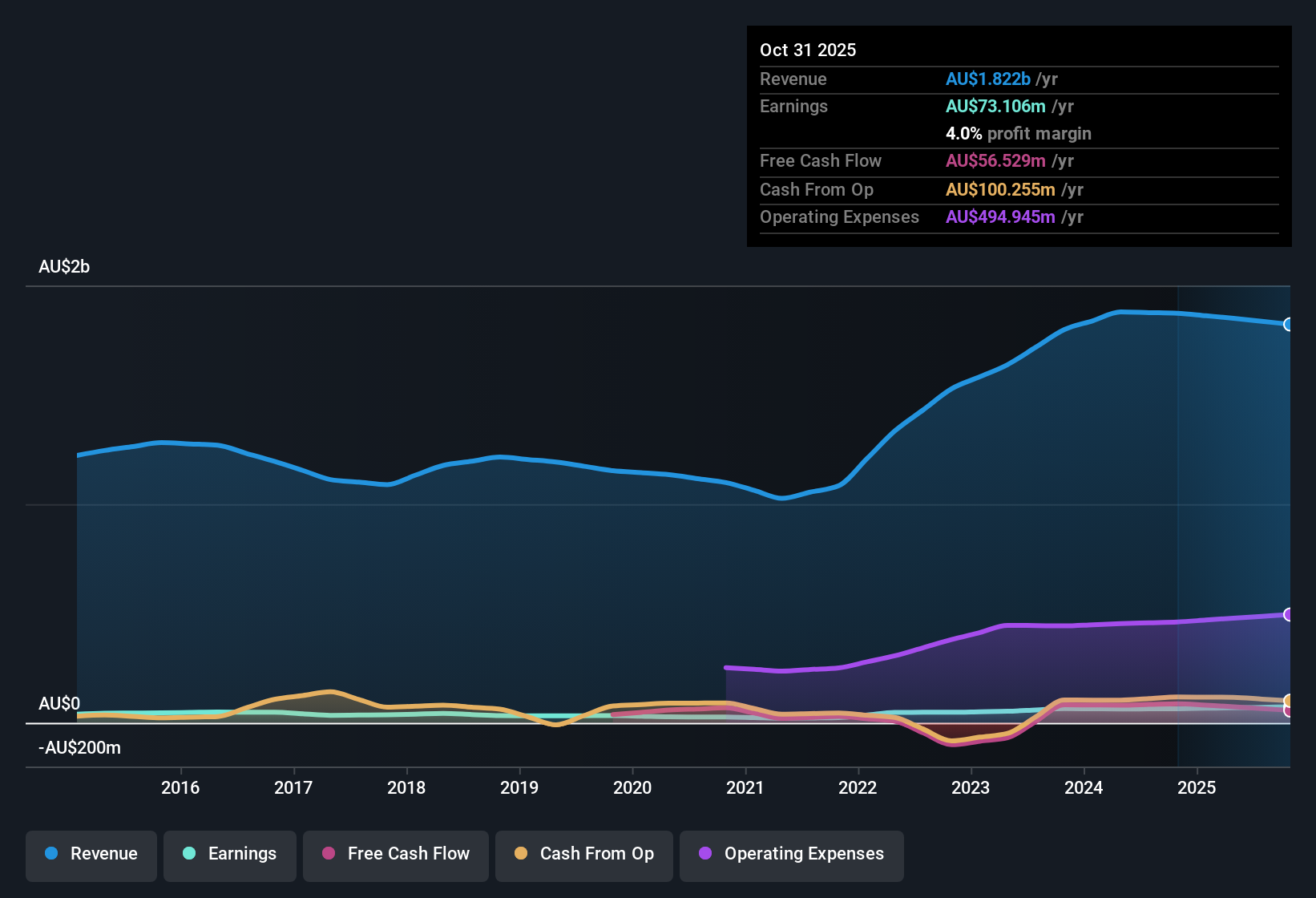

Ricegrowers (ASX:SGLLV) has kicked off H1 2026 with a solid set of headline numbers, anchored by trailing twelve month revenue of A$1.8 billion and EPS of A$1.09, alongside its latest half year print from H2 2025 that saw revenue of A$937.9 million and EPS of A$0.56. The company has seen revenue move from A$960.5 million and EPS of A$0.51 in H2 2024 to A$937.9 million and EPS of A$0.56 in H2 2025, setting up a story where investors will be weighing how this earnings profile and a 4% net profit margin shape the outlook for profitability.

See our full analysis for Ricegrowers.With the numbers on the table, the next step is to line this latest earnings run against the dominant narratives around Ricegrowers to see which stories hold up and which ones the fresh margin picture could put under pressure.

See what the community is saying about Ricegrowers

Margins Edge Higher To 4%

- Trailing twelve month net profit rose to A$73.1 million on A$1.8 billion of revenue, lifting the margin to 4% from 3.4% a year earlier, which means Ricegrowers is keeping more of each sales dollar than it did previously.

- Consensus narrative expects higher margin, branded-led growth, and the recent shift from A$64.4 million to A$73.1 million in trailing net profit supports that bullish angle, yet:

- Revenue over the same trailing windows actually eased from A$1.87 billion to A$1.82 billion, so the margin gain is coming more from efficiency and mix than from top line expansion.

- Forecast revenue growth of about 4.5% per year trails the wider Australian market’s 5.9%, which limits how far margin improvements alone can carry the bullish case.

EPS Growth Slows From Five Year Pace

- Over the last year, trailing EPS climbed from A$0.98 to about A$1.09, which is solid but below the much faster 21.9% per year earnings growth seen over the past five years.

- Analysts’ consensus view projects earnings to reach A$85.6 million and EPS of A$1.30 by around 2028, up from A$68.4 million today, but:

- The implied forward earnings growth rate of roughly 7% per year is a clear step down from the historic 21.9% per year pace, suggesting the business may be maturing.

- With profit margins only expected to move from 3.7% to 4.2% over three years, most of that EPS lift has to come from modest revenue growth rather than a dramatic profitability reset.

Valuation Hinges On Slower Top Line

- At a share price of A$16.10, Ricegrowers trades on about 15 times earnings, slightly above the Oceanic Food industry average of 14.5 times but below the 18.7 times peer average, while a DCF fair value of A$32.68 sits far above where the stock changes hands.

- Consensus narrative highlights expansion into higher growth international markets and more premium products as key drivers, yet the hard numbers leave a mixed picture:

- Revenue is only forecast to grow around 4.5% per year versus 5.9% for the Australian market, which makes the large gap between the A$16.10 price and A$32.68 DCF fair value more sensitive to execution.

- An unstable dividend record adds another layer for income investors to weigh when deciding whether a modestly above industry P/E and the perceived upside are enough compensation for slower expected growth.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Ricegrowers on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers from another angle and think the story points elsewhere, then quickly turn that view into a structured narrative in minutes, Do it your way.

A great starting point for your Ricegrowers research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Ricegrowers’ slower expected revenue growth, modest margin gains, and reliance on execution leave its long term earnings trajectory looking less dynamic than in the past.

If you want businesses where steady expansion is already built into the numbers, use our stable growth stocks screener (2095 results) today to quickly target companies delivering consistent revenue and earnings progress.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com