Dycom Industries (DY): Reassessing Valuation After Four Straight Earnings Beats and Fiber-Driven Growth Momentum

Dycom Industries (DY) is back in focus after another above-consensus quarter, its fourth straight earnings beat, as investors weigh how much of the fiber and data center boom is already priced in.

See our latest analysis for Dycom Industries.

That backdrop helps explain why, even after a 1 day share price return of minus 2.18 percent and some profit taking this week, Dycom still sports a powerful year to date share price return of 92.43 percent and a 1 year total shareholder return above 100 percent. This suggests momentum has cooled at the edges, but the longer term trend remains firmly up as investors price in sustained fiber and data center driven growth.

If Dycom’s run has you thinking about where the next infrastructure beneficiaries might come from, this is a good moment to explore fast growing stocks with high insider ownership and see what other fast moving, owner aligned businesses are emerging.

With the shares trading near peak multiples, yet still sitting below consensus price targets as earnings power marches higher, investors now face a key question: is Dycom still a buy, or is future growth already priced in?

Most Popular Narrative Narrative: 11.8% Undervalued

With Dycom Industries last closing at 340.02 dollars against a narrative fair value of 385.56 dollars, the story points to potential upside supported by structural growth tailwinds and expanding earnings power.

The accelerating buildout of fiber-to-the-home and data center connectivity, driven by surging AI workloads and hyperscaler investments, is creating multi-year, visibility-rich opportunities for Dycom. This is expected to support robust backlog growth and sustained double-digit revenue expansion as these build cycles ramp into 2027 and beyond.

Curious how ambitious revenue ramps, higher margins, and a lower future earnings multiple can still add up to a higher fair value than today? The narrative lays out the full framework behind that conclusion and the specific financial milestones Dycom is expected to reach along the way.

Result: Fair Value of $385.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat narrative could be challenged if key telecom customers curb capital spending, or if regulatory and permitting delays slow large scale fiber projects.

Find out about the key risks to this Dycom Industries narrative.

Another View: Market Multiples Flash a Caution Sign

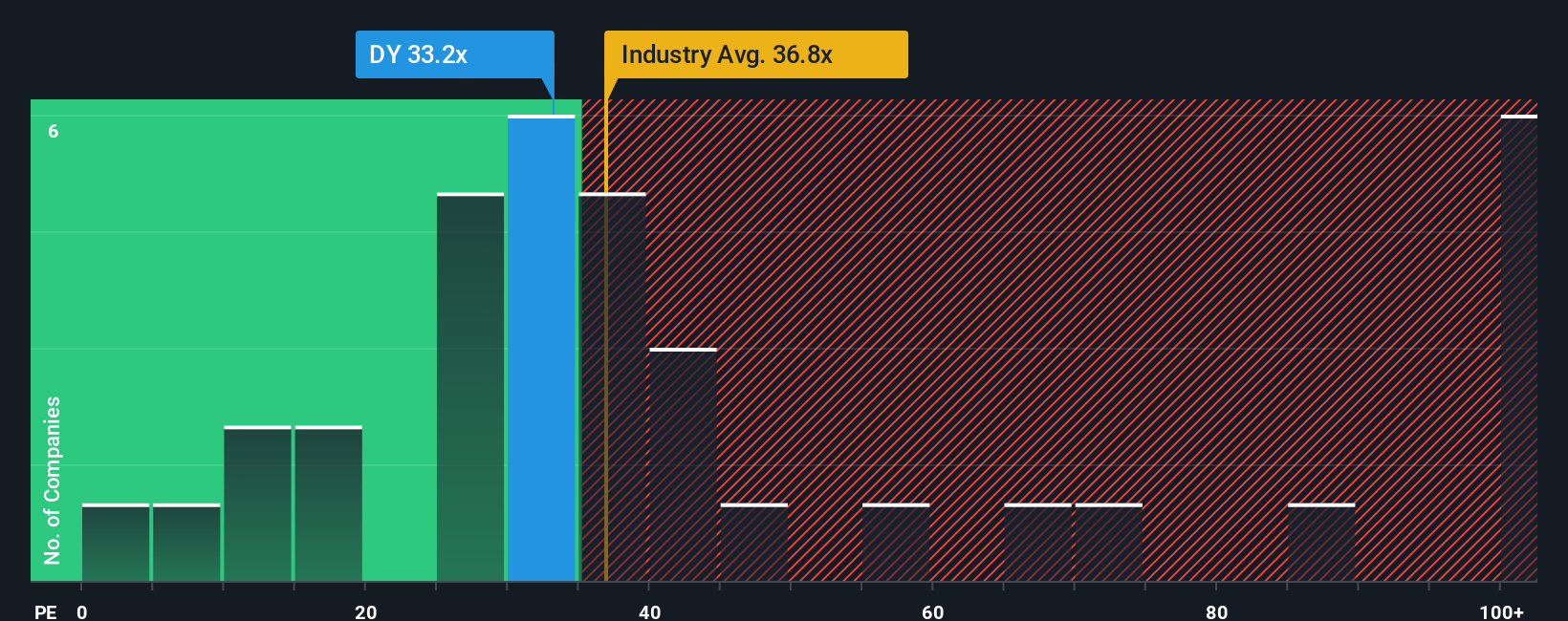

While the narrative fair value suggests upside, the market’s current pricing looks stretched on earnings. Dycom trades on a price to earnings ratio of about 33.1 times, versus 24.4 times for peers, 32.4 times for the broader US construction group, and a fair ratio of 30.3 times.

That premium signals investors are already paying up for growth, leaving less room for error if revenue or margins disappoint. If sentiment cools or sector valuations normalize toward the fair ratio, today’s optimism could quickly turn into valuation risk for late buyers.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Dycom Industries Narrative

If this perspective does not fully align with your own view or research style, you can quickly build and customize your personal Dycom thesis in just a few minutes, Do it your way.

A great starting point for your Dycom Industries research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in an edge by scanning handpicked stock ideas from powerful screeners built to surface opportunities that most investors overlook.

- Target steady income potential by reviewing these 13 dividend stocks with yields > 3% that combine attractive yields with the backing of listed businesses.

- Ride structural technology trends by assessing these 24 AI penny stocks positioned to benefit from the rapid adoption of artificial intelligence.

- Capitalize on valuation gaps by checking these 913 undervalued stocks based on cash flows where market prices lag their underlying cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com