Honeywell (HON): Revisiting Valuation After Positive Evercore Coverage and Ongoing Portfolio Transformation

Honeywell International (HON) has been getting extra attention after Evercore ISI kicked off coverage with an upbeat view, just as the company pushes ahead with major portfolio separations and high profile technology partnerships.

See our latest analysis for Honeywell International.

The upbeat coverage and new partnerships seem to be nudging sentiment in Honeywell’s favour, with a 7 day share price return of 4.08% helping to offset a weaker year to date share price return of 11.36%. The 5 year total shareholder return of 11.88% points to steadier, long term compounding rather than explosive momentum.

If Honeywell’s strategic reshaping has you rethinking the industrials space, this could be a smart moment to explore aerospace and defense stocks for more ideas riding similar long term demand trends.

Yet with Honeywell trading below analyst targets despite modest growth and a multi year transformation ahead, investors face a key question: is this a rare blue chip value opportunity, or is future upside already priced in?

Most Popular Narrative: 16.5% Undervalued

With Honeywell closing at $199.89 and the narrative fair value sitting nearer $239, the story centers on steady upgrades rather than a moonshot rerating.

The company's focus on growing high-growth verticals such as LNG, data centers, and specialty chemicals, coupled with productivity improvements, should drive revenue growth and improve overall segment margins.

Want to see what kind of revenue runway and margin lift justify this gap to fair value, and how much multiple expansion that assumes, without guessing?

Result: Fair Value of $239.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps around the three way breakup, or a deeper global industrial slowdown, could quickly compress margins and challenge the current upside narrative.

Find out about the key risks to this Honeywell International narrative.

Another Lens On Value

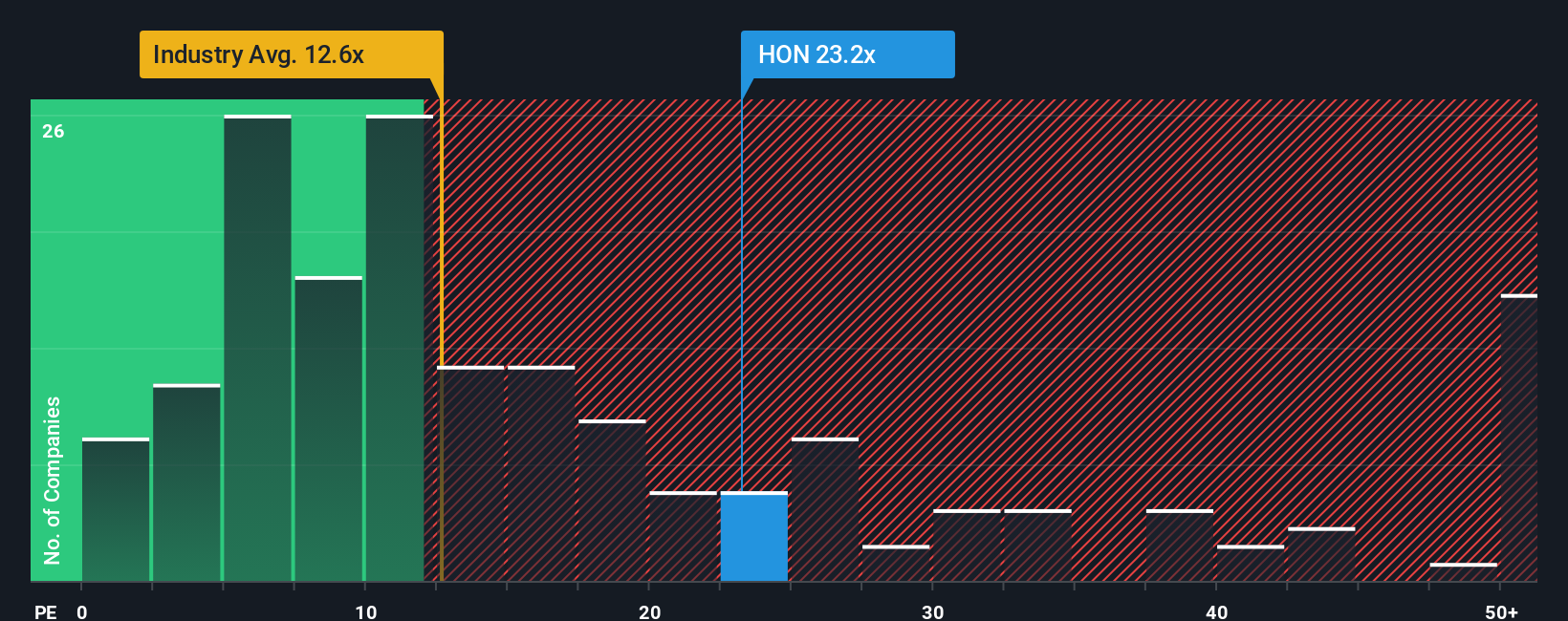

On earnings-based valuation, Honeywell does not appear to be an obvious bargain. It trades on a 20.7x price-to-earnings ratio, above the 12.2x global industrials average but below peers at 28.2x and a fair ratio of 28.3x. This suggests more of a quality premium than a deep value play.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Honeywell International Narrative

If our take does not quite match your view, you can dive into the numbers yourself and craft a personalized narrative in minutes, Do it your way

A great starting point for your Honeywell International research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Do not stop at one opportunity when Simply Wall St can help you quickly pinpoint fresh, data driven stock ideas tailored to your investing style and goals.

- Capture early stage potential by targeting these 3636 penny stocks with strong financials that already show improving fundamentals and room for significant upside.

- Position your portfolio for the AI revolution by focusing on these 24 AI penny stocks where real revenue growth backs the hype.

- Lock in attractive entry points with these 913 undervalued stocks based on cash flows that our models flag as trading below their intrinsic cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com