Thales (ENXTPA:HO) Valuation Check After Launch of Its New AI Security Fabric Platform

Thales (ENXTPA:HO) just rolled out its AI Security Fabric, a platform aimed at shielding Agentic AI and LLM apps from threats like prompt injection and data leakage, and the stock is starting to reflect that shift.

See our latest analysis for Thales.

That launch lands after a strong run, with the latest share price at €231.2 and a year to date share price return of 68.02 percent. The five year total shareholder return of 241.04 percent shows longer term momentum has been firmly building alongside defence and AI wins.

If Thales AI security sounds compelling, it might be worth seeing what else is out there in aerospace and defense stocks for other defence focused names riding similar themes.

With earnings and AI momentum running hot but the shares still trading below analyst and intrinsic estimates, the real question now is whether Thales is undervalued today or if the market is already pricing in that future growth.

Most Popular Narrative: 17.3% Undervalued

With Thales closing at €231.2 against a narrative fair value near €279.7, the valuation case leans on sustained growth and margin expansion across its core franchises.

Strategic capacity expansions and ongoing cost efficiency programs (including supply chain optimization and production site investments) will enable Thales to serve increased demand efficiently, translating to improved net margins and free cash flow conversion over time.

Curious how steady, mid single digit revenue growth can still support a double digit uplift to earnings and valuation multiples? The narrative leans on rising profitability, powerful sector demand and a sizeable earnings step up over the next few years. Want to see exactly how those assumptions stack up to justify this upside?

Result: Fair Value of €279.69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps in Cyber, as well as ongoing volatility in the Space division, could quickly undermine confidence in those growth and margin assumptions.

Find out about the key risks to this Thales narrative.

Another View: Multiples Tell A Tougher Story

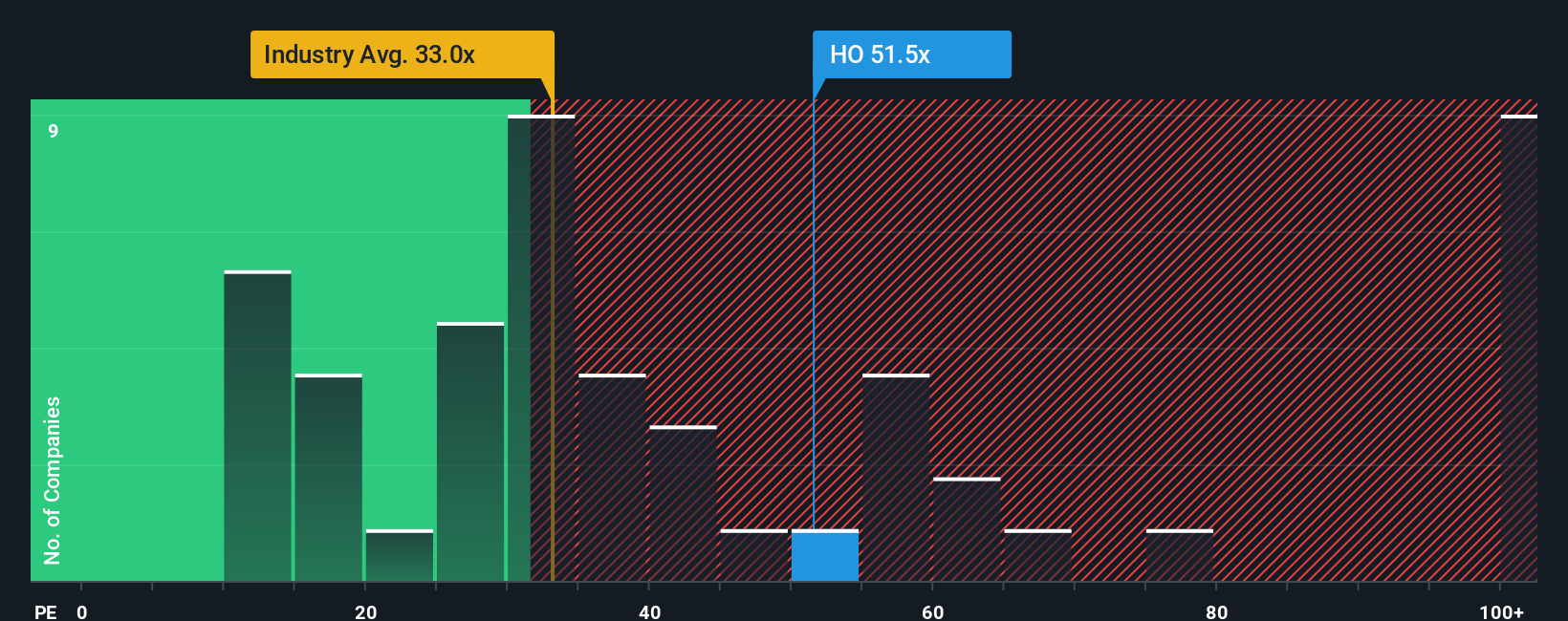

While the narrative fair value and DCF work both point to upside, the earnings multiple paints a sharper picture of what is already priced in. Thales trades on about 45 times earnings, versus roughly 29 times for the European Aerospace and Defense sector and a fair ratio closer to 31 times.

That gap suggests investors are paying a clear premium for execution and AI driven growth today, leaving less room for disappointment if Cyber margins or Space recovery slip. Is this still an undervalued story, or has sentiment already raced ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Thales Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in minutes: Do it your way.

A great starting point for your Thales research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in an edge by scanning fresh opportunities our tools surface every day so you are not relying on just one story.

- Capture potential mispricings early by checking out these 913 undervalued stocks based on cash flows that pair solid fundamentals with attractive cash flow based valuations.

- Tap into powerful secular growth by scanning these 24 AI penny stocks at the forefront of automation, data intelligence and next generation software.

- Strengthen your income strategy by reviewing these 13 dividend stocks with yields > 3% offering reliable yields alongside the potential for capital growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com