Will Brookdale’s (BKD) Seasonal Occupancy Dip Amid Year‑Over‑Year Gains Reshape Its Demand Narrative?

- In December 2025, Brookdale Senior Living Inc. reported that November consolidated weighted average occupancy reached 82.5%, rising 300 basis points year-over-year but slipping 10 basis points from October, with similar patterns in same-community occupancy and an 80 basis point improvement for fourth quarter to date versus the full third quarter of 2025.

- An interesting element for investors is that November’s small sequential occupancy decline was consistent with Brookdale’s typical seasonal pattern, while year-over-year gains signal ongoing progress in filling its communities.

- We’ll now examine how these year-over-year occupancy gains, despite a seasonally usual monthly dip, may influence Brookdale’s broader investment narrative.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Brookdale Senior Living Investment Narrative Recap

To own Brookdale, you need to believe that rising occupancy can eventually offset persistent losses, heavy leverage and high upkeep needs on aging properties. The latest November update reinforces occupancy as the key short term catalyst, with year over year gains supporting that thesis, while not materially changing the central risk that higher staffing and operating costs could absorb much of the benefit.

Brookdale’s third quarter 2025 results, released in early November, put these occupancy figures into financial context by showing how higher census levels are flowing through revenue and margins. When read together, the quarterly earnings and the November occupancy data help frame whether recent operational progress is enough to support the longer term case for margin improvement and better cash generation.

Yet even with improving occupancy, Brookdale’s high leverage and limited cash runway remain factors investors should be aware of as they consider...

Read the full narrative on Brookdale Senior Living (it's free!)

Brookdale Senior Living's narrative projects $3.3 billion revenue and $176.3 million earnings by 2028. This requires 2.3% yearly revenue growth and a $418.9 million earnings increase from -$242.6 million today.

Uncover how Brookdale Senior Living's forecasts yield a $11.44 fair value, a 8% upside to its current price.

Exploring Other Perspectives

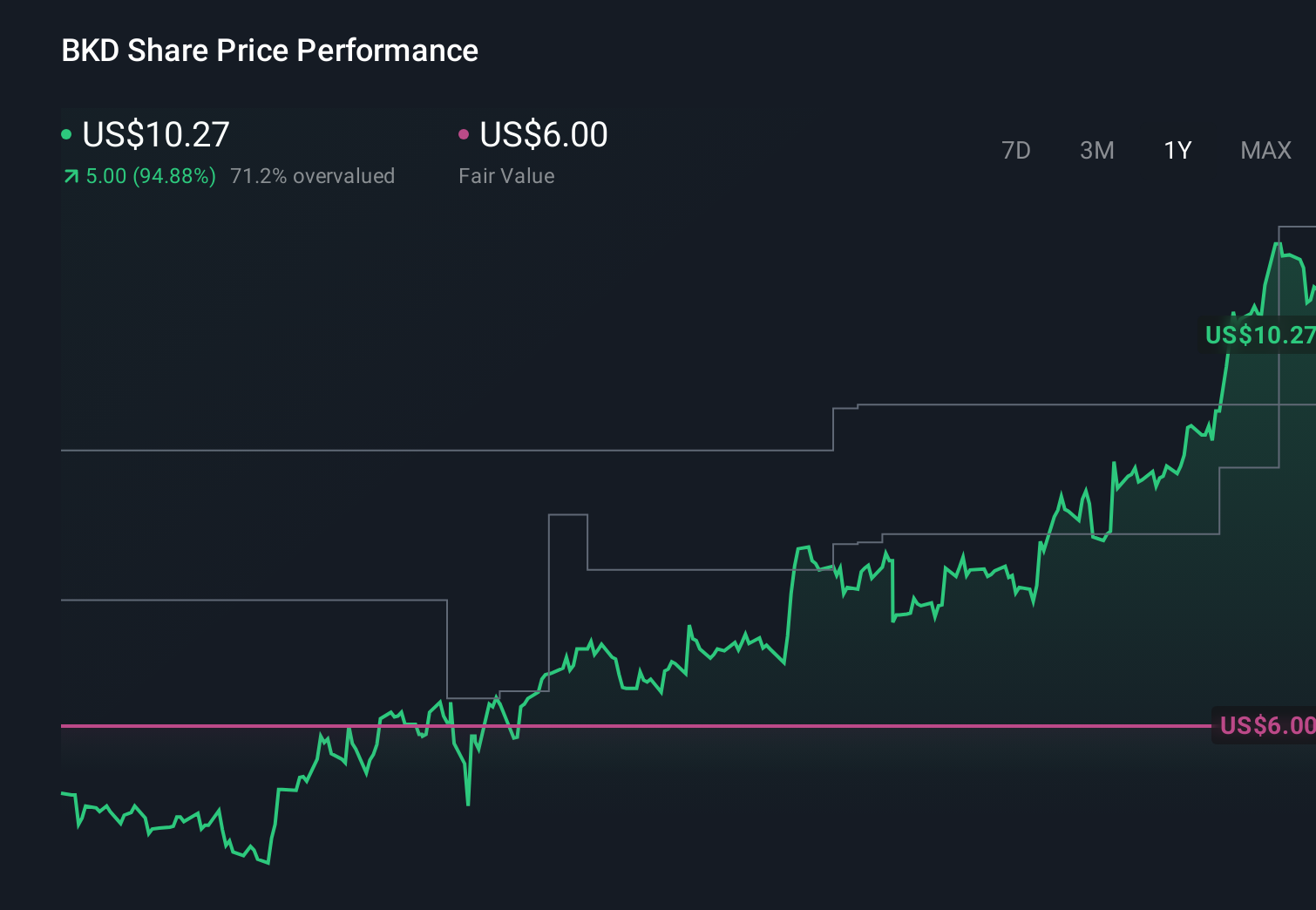

Simply Wall St Community members have only two fair value estimates for Brookdale, ranging from US$6.00 to about US$16.68, underscoring how far apart views can be. You can weigh those against the recent occupancy gains, which highlight how much of Brookdale’s future performance may depend on sustaining higher utilization without letting labor and other operating costs eat up the benefit.

Explore 2 other fair value estimates on Brookdale Senior Living - why the stock might be worth as much as 58% more than the current price!

Build Your Own Brookdale Senior Living Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brookdale Senior Living research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Brookdale Senior Living research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brookdale Senior Living's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com