Atmos Energy (ATO): Reassessing Valuation After a 27% One-Year Share Price Climb

Atmos Energy (ATO) shares have quietly climbed over the past year, with the stock up about 27% and roughly 22% year to date, prompting a closer look at what is driving the move.

See our latest analysis for Atmos Energy.

With the share price now around $169.17 and a strong year to date share price return, that 1 year total shareholder return near 27% suggests investors are steadily repricing Atmos for dependable growth rather than treating it as a sleepy utility.

If this steady climb in a defensive name has you rethinking where resilience and growth can mix, it may be worth exploring fast growing stocks with high insider ownership for other under the radar opportunities.

Yet with the stock hovering just below analyst targets and trading at a premium to some peers, the key question is whether Atmos remains undervalued or if the market is already factoring in years of future growth.

Most Popular Narrative: 3.5% Undervalued

Compared with the last close around $169.17, the most popular narrative pegs Atmos Energy's fair value slightly higher, implying modest upside if its growth path holds.

Major multiyear capital investment programs focused on modernizing and expanding pipeline infrastructure, combined with favorable regulatory mechanisms and frequent rate filings, underpin ongoing rate base growth, translating to stable and predictable long-term earnings and cash flow.

Want to see what is hiding behind that steady growth story? The narrative quietly leans on rising margins, accelerating earnings, and a richer future valuation multiple.

Result: Fair Value of $175.27 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising capital spending needs and heavy reliance on favorable Texas regulation could squeeze free cash flow and derail the current earnings and valuation trajectory.

Find out about the key risks to this Atmos Energy narrative.

Another Angle on Valuation

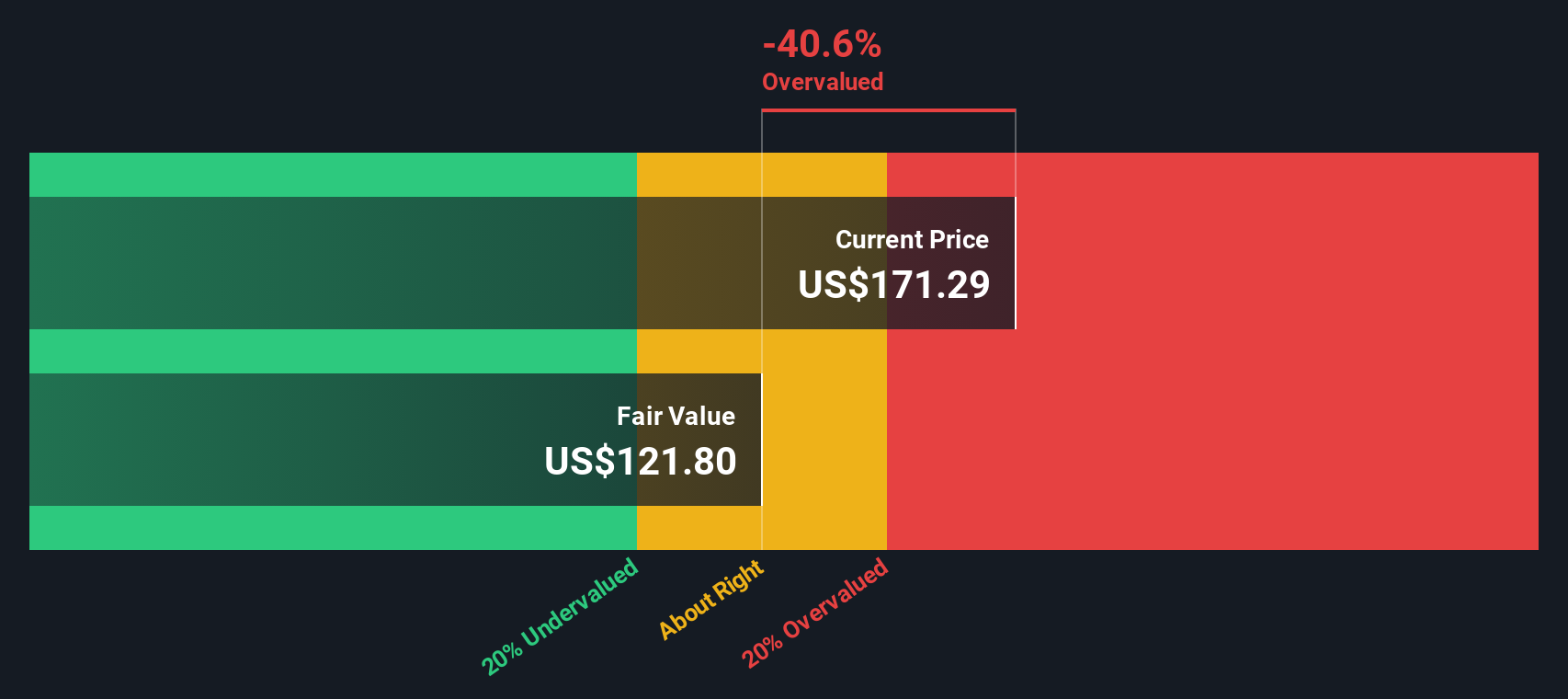

While the narrative suggests Atmos is modestly undervalued, our DCF model presents a stricter view, with fair value closer to $121.96. From that perspective, today’s price looks rich rather than cheap and raises the question: are investors overpaying for stability and regulated growth?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Atmos Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 915 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Atmos Energy Narrative

If you see the story differently or want to dig into the numbers yourself, you can shape a custom view in minutes: Do it your way.

A great starting point for your Atmos Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

- Capture potential bargains early by scanning these 915 undervalued stocks based on cash flows that the market may be mispricing based on their future cash flows.

- Position yourself for the next wave of innovation by targeting these 24 AI penny stocks shaping how businesses use artificial intelligence.

- Strengthen your income stream by zeroing in on these 13 dividend stocks with yields > 3% that aim to reward shareholders with steady cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com